Views and Analysis

Type:

Author:

Sort:

Jan 22, 2026

The Economic Logic of Large Language Models

Nov 5, 2025

Navigating the Green Tightrope

Oct 9, 2025

A Transparent Alternative to Neural Networks

Feb 19, 2026

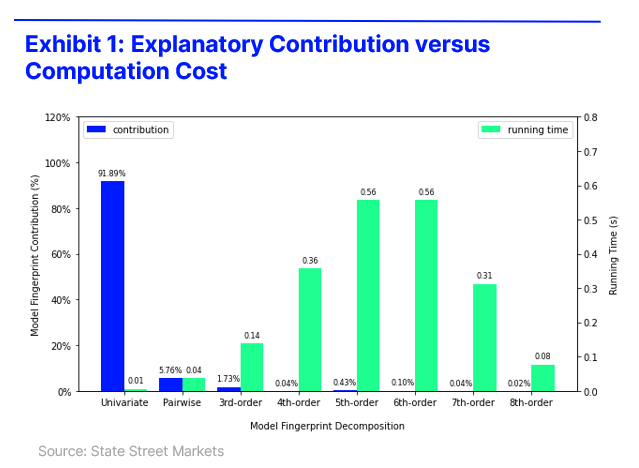

Model Fingerprint

In this paper, we propose a novel model interpretability framework named Model Fingerprint. It is a bottom‑up approach to explaining machine learning models that shifts the focus from assigning feature importance to uncovering the logical structure that drives predictions. While attribution methods such as SHAP faithfully quantify how important each feature is, importance alone is a limited set of lens – much like trying to understand a movie by listing how significant each character is without ...

Nov 12, 2025

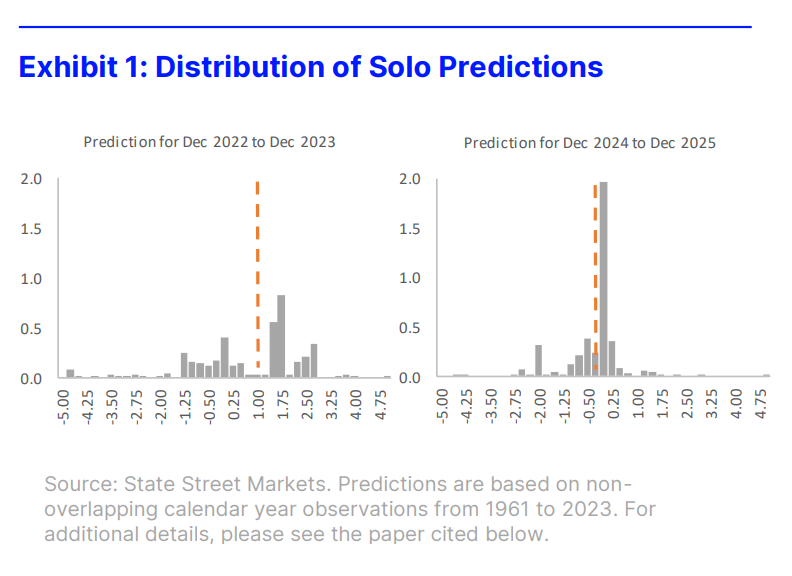

Confidence Revisited: The Distribution of Information

By Megan Czasonis, Mark Kritzman, Fangzhong Liu, and David Turkington Relevance-Based Prediction can assess a prediction’s reliability from the consistency of the information that forms it, providing a novel perspective that complements conventional measures of confidence. Prediction is like a voting process. Each datapoint casts a “vote” for the unknown outcome, and the final forecast averages these diverse views. But to know how confident we should be in the average, we need transparency into ...

Oct 14, 2025

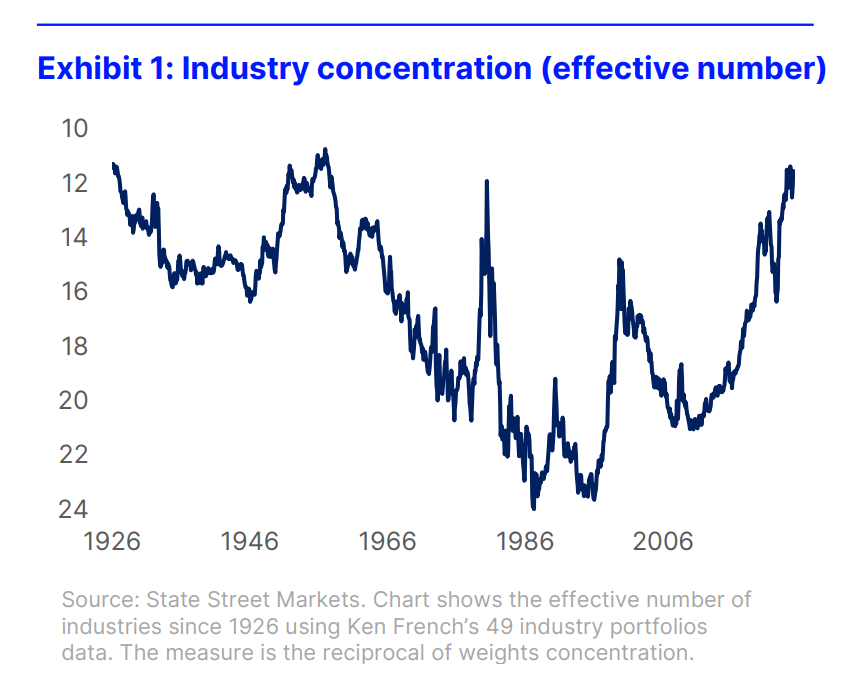

The Fallacy of Concentration

By Mark Kritzman, and David Turkington Evidence shows that concentrated market capitalization weights do not make an index riskier, because larger stocks are inherently more diversified and their increased weights are offset by their lower volatility compared to small stocks. The dominance of large tech firms in market-cap-weighted indices has sparked recent concern about concentration risk, but historical data and empirical analysis suggest these fears may be unfounded. A review of nearly 90 ...

Feb 25, 2026

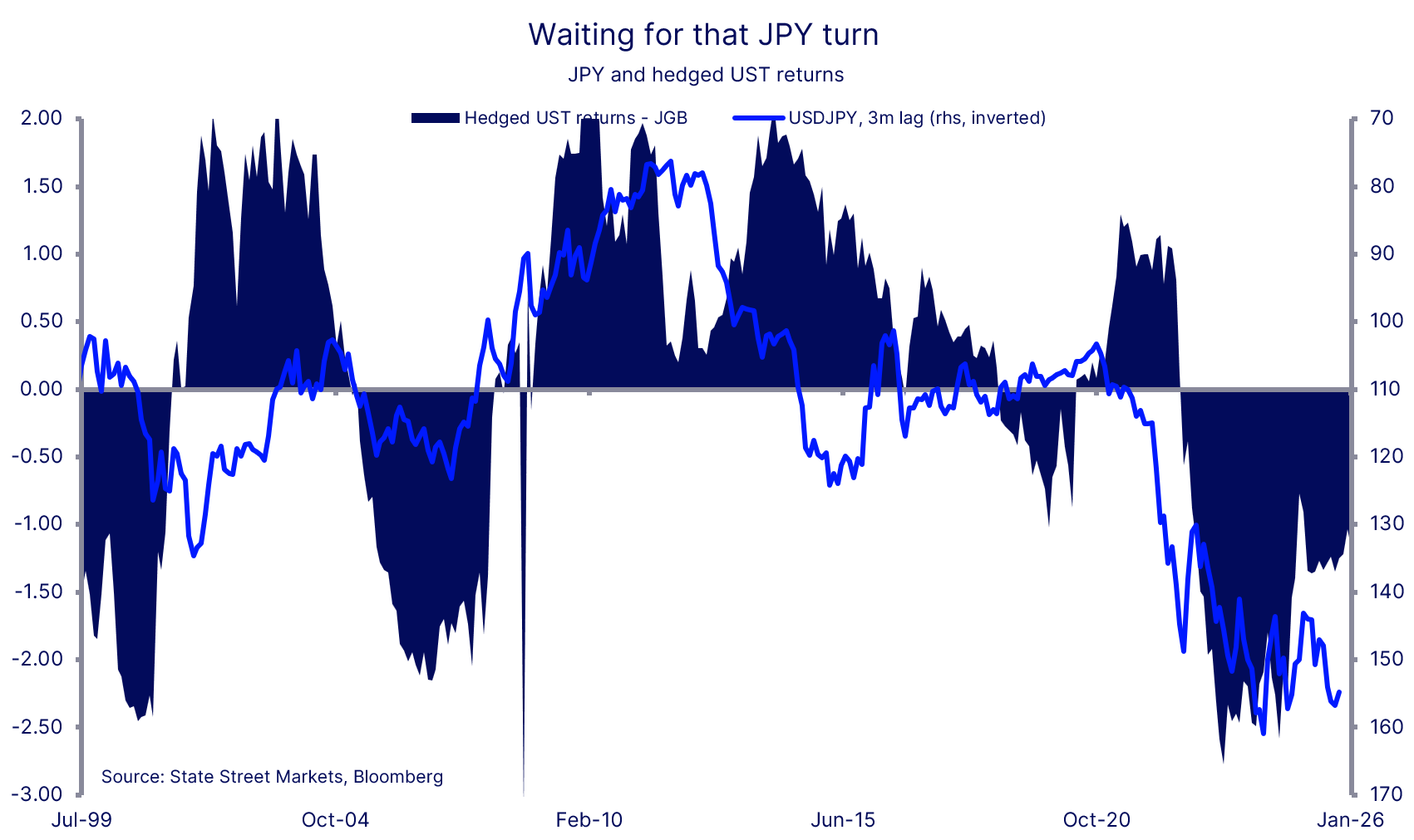

Waiting for that JPY turn

Trying to pick a top in USDJPY has become the new widow maker trade but the conditions for a more extensive JPY rally may be appearing on the horizon. The performance of USDJPY is very much influenced by the ability, or otherwise, of Japanese investors to hedge their purchases of US Treasuries and still outperform JGB yields. Here we look at relative 10-yr yields after adjusting for the cost of a 3m hedge. It is still prohibitive for Japanese investors to buy USTs hedged relative to JGBs, but the ...

Feb 9, 2026

The rotation into EM

The MCSI EM’s relative performance to EAFE in daily price changes since the beginning of 2025 is a tale of time periods. EM underperformed up to and beyond the announcement on “Liberation Day”. However, subsequent price action underscores the significance of the push into EM, rather than Europe and Japan, since Q3 2025. This divergence has become even more pronounced through January.

Feb 2, 2026

Inflation Threat

Chair Powell characterized the current inflation situation as being distorted by the inflationary impact of new tariffs, while expressing confidence that the Fed will bring inflation back to the 2% goal. It may be the case of Lucy pulling the football away. The graph shows the average z-score of copper, aluminium, lead, tin and nickel. Based on a long history, the surging z-score suggests upside risk to US 5-year breakeven rates. There is an old adage that states when the Fed becomes more complacent ...

Feb 2026

Trading the Policy Whiplash

Market volatility continued to climb in February, with a landmark Supreme Court ruling on US tariffs last week upending US trade policy in an afternoon. Questions now circle as to whether last year's trade-induced USD weakness that was expected to continue into 2026 is now at risk of reversal. Meanwhile, the yen's tumble under Takaichi-nomics has resumed, equities and gold remain choppy and many long-dormant correlation relationships are starting to reassert themselves. Managing risk remains a constant ...

Feb 2026

Year of the Fire Horse: China in Focus

In celebration of Lunar New Year, we take a deep dive into China’s political economy. Despite trade tensions, a weak consumer and a halting post‑COVID recovery, a powerful export boom kept China on track last year—and could do so again in 2026. Fresh off a two-week fact-finding trip across the country, Ning Sun, senior EM strategist at State Street Markets, joins us to unpack what she saw on the ground and the challenges facing the world’s biggest exporter.

Feb 2026

AI, Labor Disruptions and the Future of the Fed

The changing of the guard at the top of the Federal Reserve comes at a crucial time for policymakers and markets. It is far from certain whether the promise of artificial intelligence heralds an era of stronger trend growth, or if the displacement in labor markets that might result will prove more damaging. Kevin Warsh’s term as Chairman will surely be defined as much by this question as his stated desire to reorient Fed policies and its mission. To discuss all of this, we are thrilled to welcome ...

Feb 2026

A step on the brakes

Holdings Institutional portfolios stayed strongly tilted towards equities, with stock allocations at their highest since 2007 and bond allocations at their lowest since 2008, while the US remained a clear regional overweight. Risk Appetite Risk appetite eased back to neutral after a mid month lift, as Fed uncertainty and liquidity concerns encouraged a more cautious mix, with selective risk still expressed in emerging market bonds and FX and high yield versus investment grade.

Dec 2025

Investors neutral amidst data uncertainty

Holdings Institutional portfolios remain heavily overweight in US equities and technology, favouring quality, growth and large caps, with stock allocations at an eighteen‑year high and bonds and cash still out of favour. Risk Appetite Risk appetite has eased to neutral as investors rotate out of cyclicals and commodities into defensives and the US dollar, while still taking selective risk in high yield credit and technology rather than retreating from equities.

Nov 2025

One Step Forward, One Step Back

Holdings Institutional portfolios remain heavily overweight in US, Tech, and growth oriented styles, with stock allocations at an 18-year high. Risk Appetite The risk appetite index has dropped to neutral as investors rotate out of cyclicals and commodities into defensives and the US dollar.

1. Peter L. Bernstein Award for Best Article in an Institutional Investor Journal in 2013; Bernstein-Fabozzi/Jacobs-Levy Award for Outstanding Article in the Journal of Portfolio Management in 2006, 2009, 2011, 2013 (2), 2014, 2015, 2016, 2021; Graham & Dodd Scroll Award for article in the Financial Analysts Journal in 2002 and 2010. Roger F. Murray First Prize for Research Presented at the Q Group Conference in 2012, 2021, 2023. Harry M. Markowitz Award for Best Paper in the Journal of Investment Management in 2022, 2023. Doriot Award for Best Private Equity Research Paper in 2022.