Type:

Author:

Sort:

Articles

Feb 25, 2026

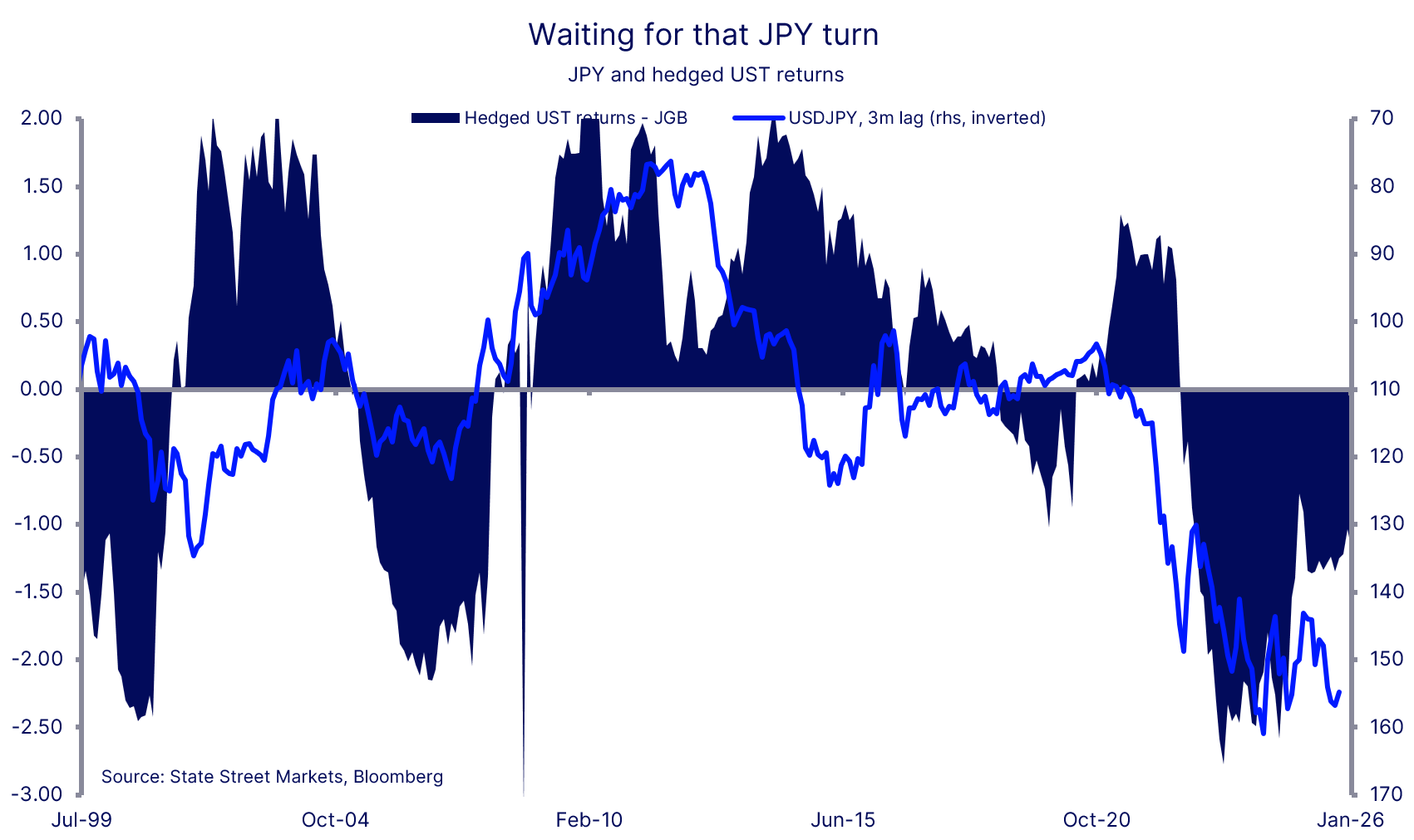

Waiting for that JPY turn

Trying to pick a top in USDJPY has become the new widow maker trade but the conditions for a more extensive JPY rally may be appearing on the horizon. The performance of USDJPY is very much influenced by the ability, or otherwise, of Japanese investors to hedge their purchases of US Treasuries and still outperform JGB yields. Here we look at relative 10-yr yields after adjusting for the cost of a 3m hedge. It is still prohibitive for Japanese investors to buy USTs hedged relative to JGBs, but the ...

Feb 9, 2026

The rotation into EM

The MCSI EM’s relative performance to EAFE in daily price changes since the beginning of 2025 is a tale of time periods. EM underperformed up to and beyond the announcement on “Liberation Day”. However, subsequent price action underscores the significance of the push into EM, rather than Europe and Japan, since Q3 2025. This divergence has become even more pronounced through January.

Feb 2, 2026

Inflation Threat

Chair Powell characterized the current inflation situation as being distorted by the inflationary impact of new tariffs, while expressing confidence that the Fed will bring inflation back to the 2% goal. It may be the case of Lucy pulling the football away. The graph shows the average z-score of copper, aluminium, lead, tin and nickel. Based on a long history, the surging z-score suggests upside risk to US 5-year breakeven rates. There is an old adage that states when the Fed becomes more complacent ...

Jan 23, 2026

Crisis averted?

The dramatic turnaround over the course of the week in the US pursuit for the control of Greenland has seen markets recover their losses from Tuesday and the threat of fresh trade tariffs on a number of European countries has now been removed. But how significant was the mini-crisis? Our FX political risk index produced by GeoQuant helps us to quantify the extent of the concern. The latest week has seen a dramatic increase in the US political risk index, with the size of the jump the largest we ...

Jan 20, 2026

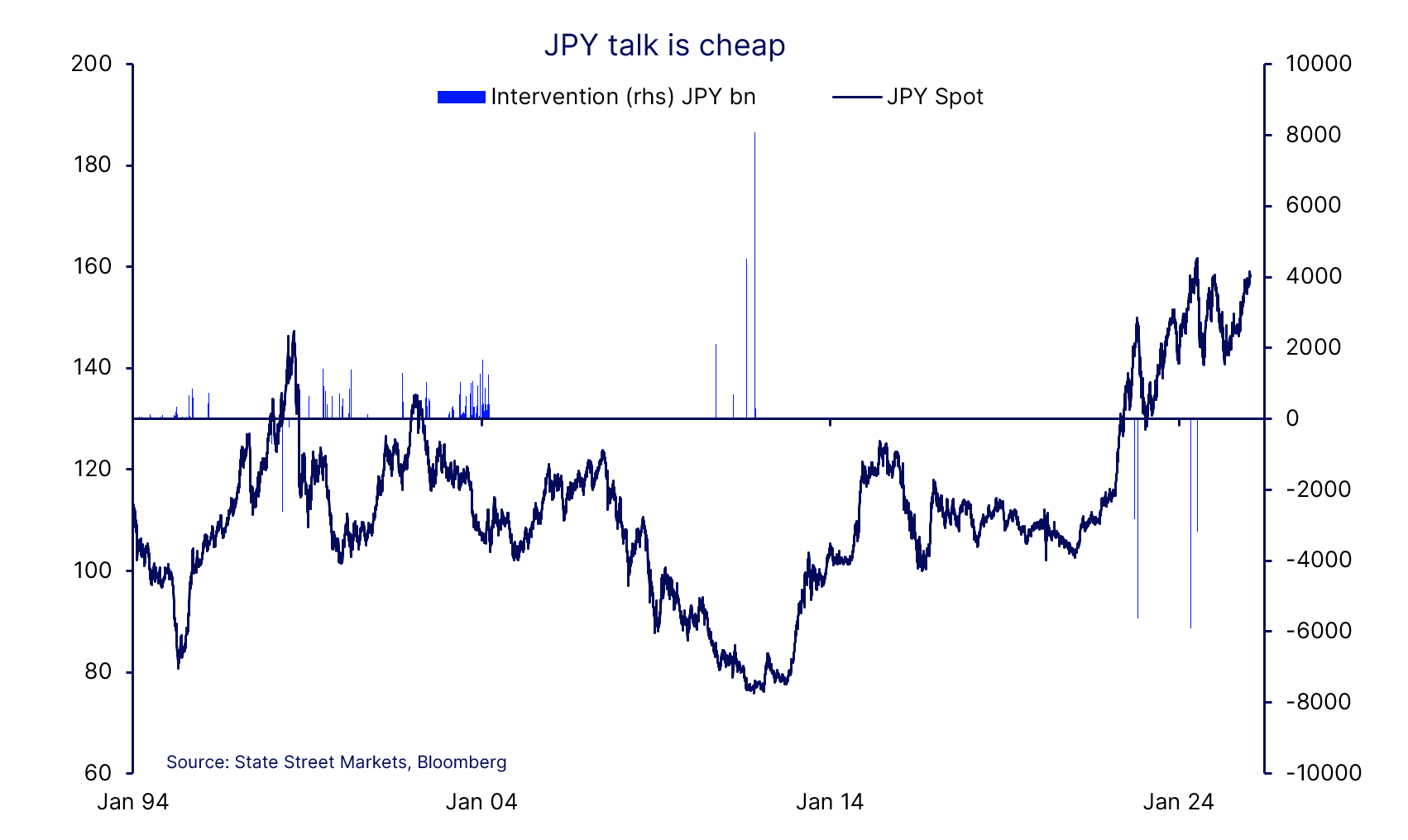

JPY talk is cheap

The continued weakness of the JPY is testing the rhetoric of Japanese officials who argue the currency is not reflecting fundamentals. With the JPY diverging from rate differentials and still more than 40% undervalued by our PPP metrics, this point is not really up for debate. The challenge is the perception that the Takaichi govt’s policy mix will favour a weak currency. Perceptions, and indeed policy, can, and of course, do change; but ultimately with the decision rights for intervention in ...

Jan 13, 2026

Market Signals and Shifts: What to watch in 2026

Our second annual State Street Markets outlook, Market signals and shifts: What to watch in 2026, examines the dominant forces shaping the year ahead through a lens that challenges consensus thinking.

Jan 5, 2026

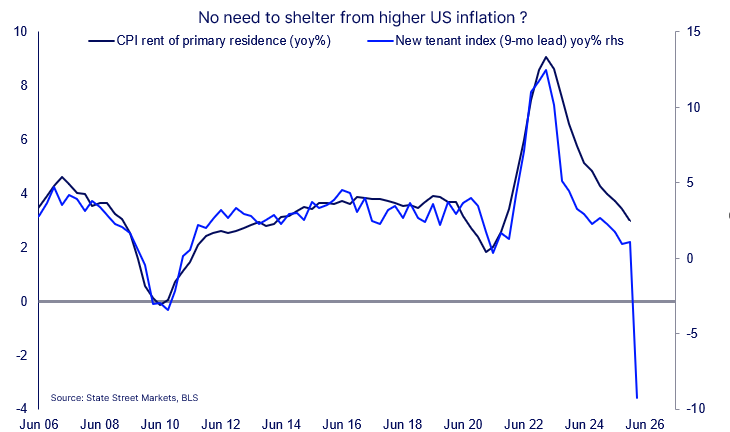

No need to shelter from higher US inflation ?

November’s two-for-the-price-of-one inflation print beat expectations even more than we estimated. This was partly due to a much sharper than expected easing in inflation from rents, which has been the persistent reason for the stickiness of inflation above the 2% target. Data on newly rented properties (most recently from Q2) has been warning of much softer shelter inflation for some time. So perhaps the distorted collection process has led to a greater weight of new rentals this time around. ...

Dec 8, 2025

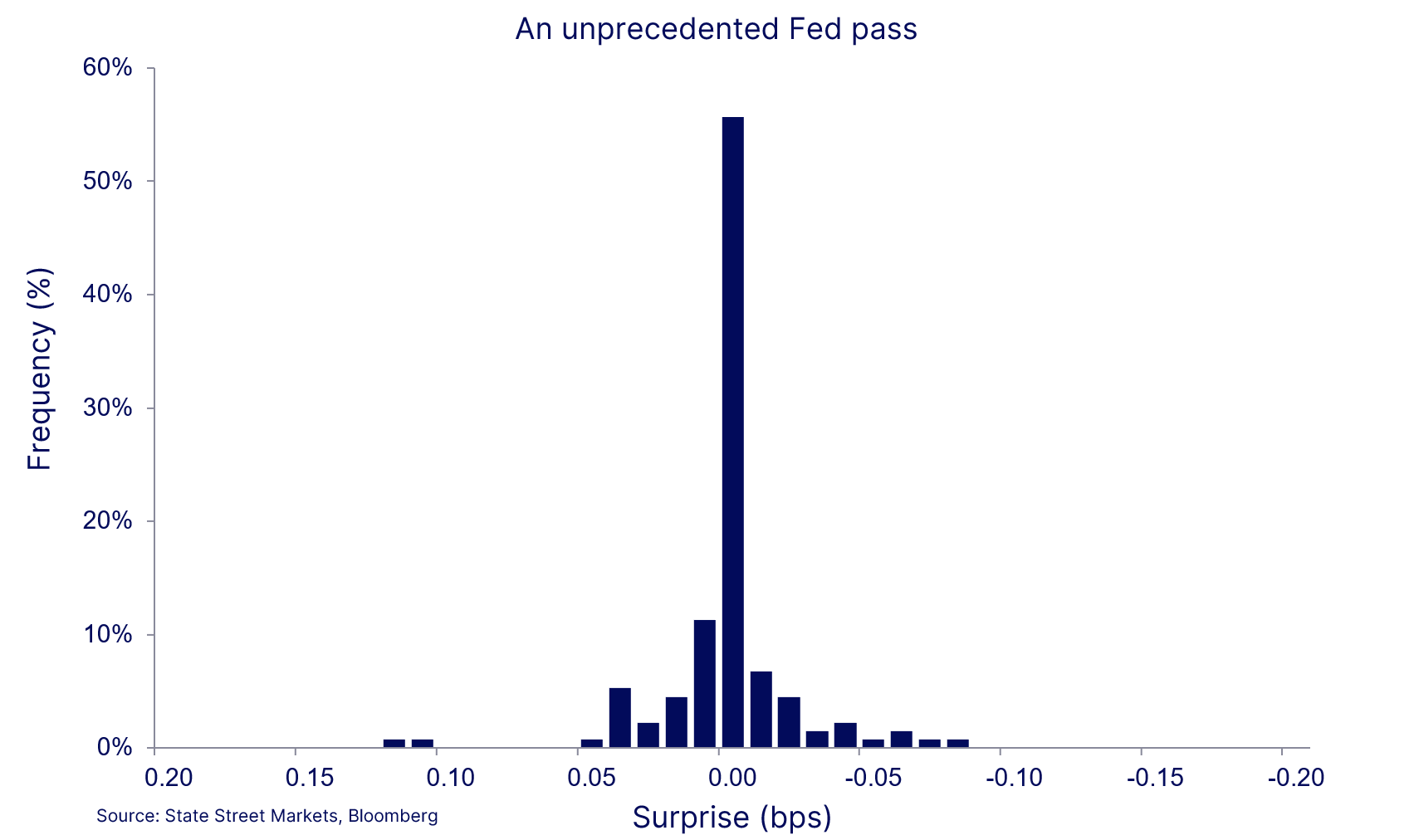

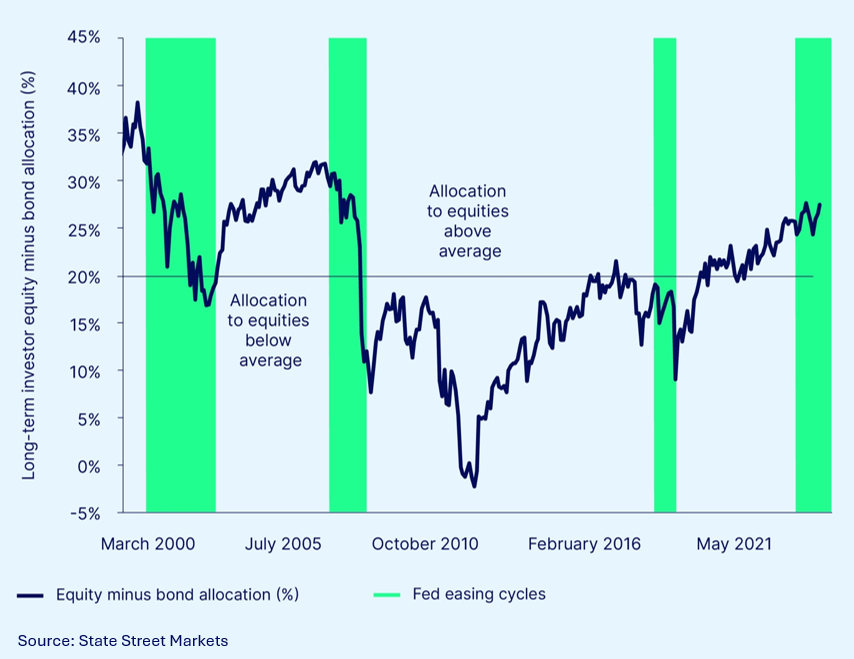

An unprecedented Fed pass

For all the volatility in the macro environment, disagreement across the FOMC and public criticism of the central bank, the Fed in theory is still very predictable. So, with Fed fund futures discounting 23bps of easing at the December meeting it is highly unlikely that the Fed will not deliver. Looking back to 1994 at all the Fed meetings where rates were left on hold, there are no instances of market discounting such a sizeable move, in either direction. In short not delivering a cut this week ...

Nov 26, 2025

Market Signals and Shifts: An end-of-year assessment

In our January 2025 look-ahead report, we pinpointed several critical fault lines and promising updrafts for financial markets. Among the questions we sought to answer during the year were: Will United States’ exceptionalism continue to dominate market consensus, or are we on the brink of a significant shift away from the US? Where does the US dollar go from here? Will Treasuries get some traction? With less than two months remaining in 2025, we assess key developments on these topics and more, ...

Nov 24, 2025

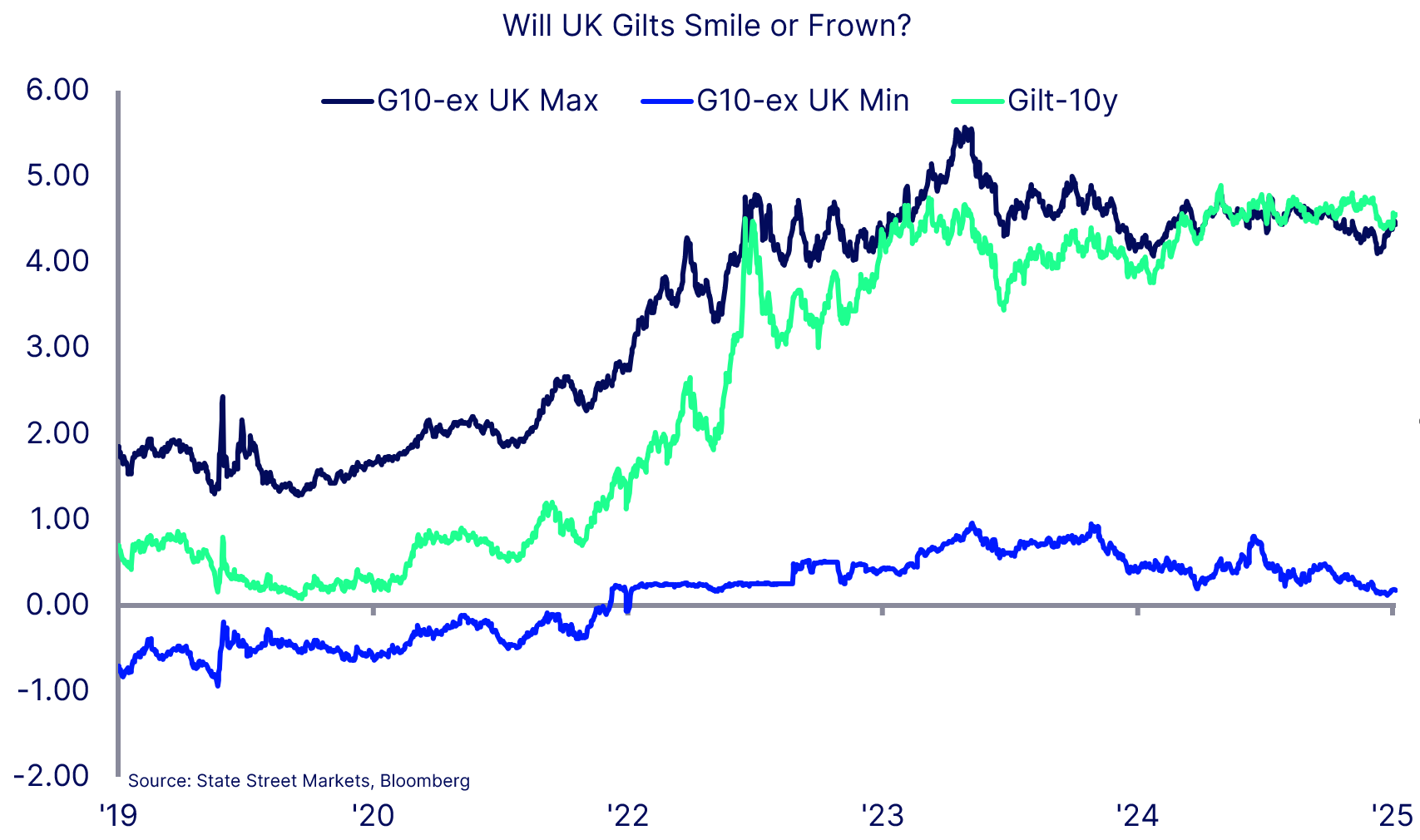

Will UK Gilts Smile or Frown?

The UK Government is set to release the next Budget on 26 November, the day before the US Thanksgiving holiday. The run-up to the announcement is full of ‘pitch-rolls’ and odd briefings. The OBR forecasts, particularly the productivity downgrade, compelled the Labour government to find ways to create 30bn of fiscal headroom. At the same time as the Labour government is cobbling together what the FT calls is a hotchpotch plan; and there are worries about whether a leadership challenge is in the offing. ...

Nov 12, 2025

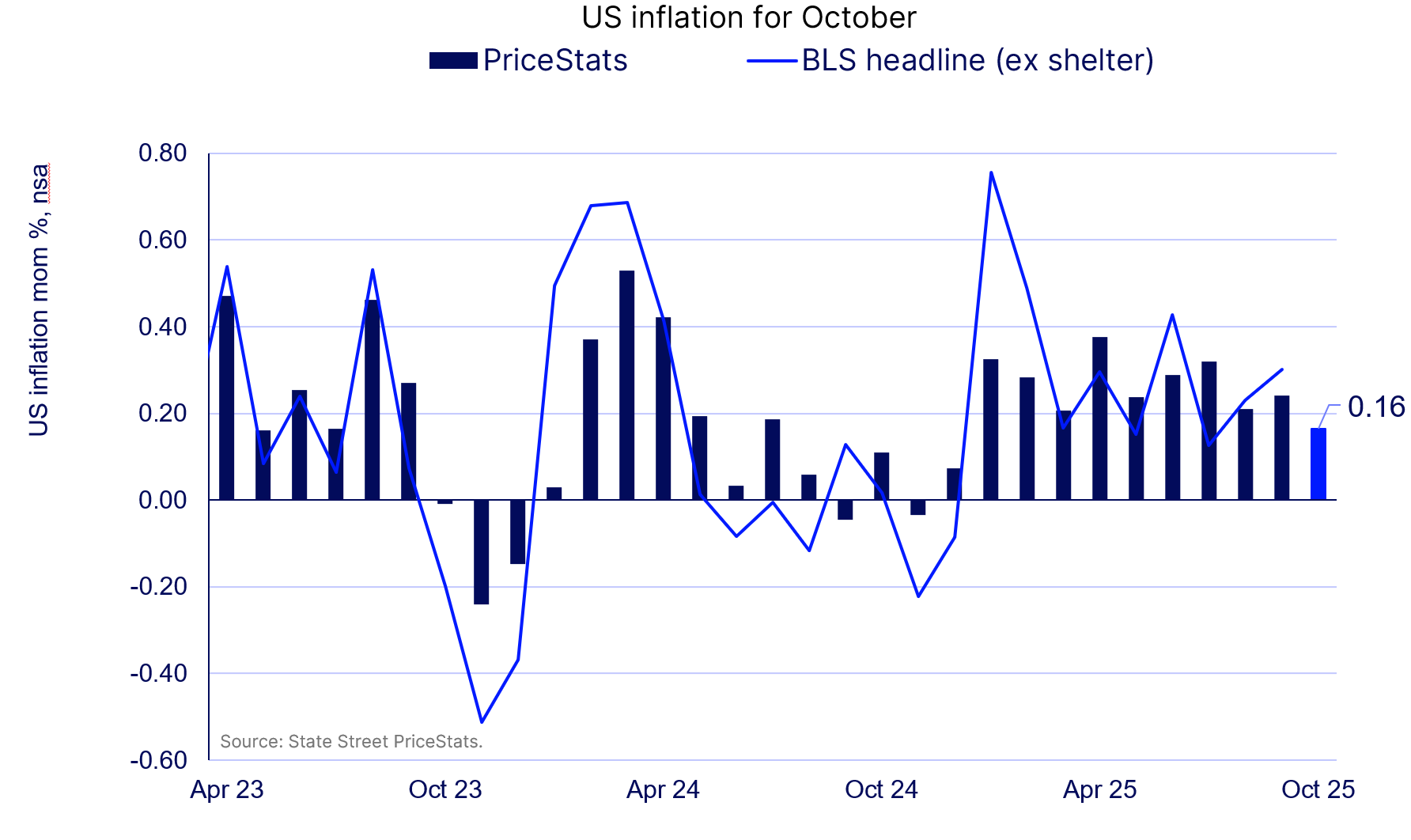

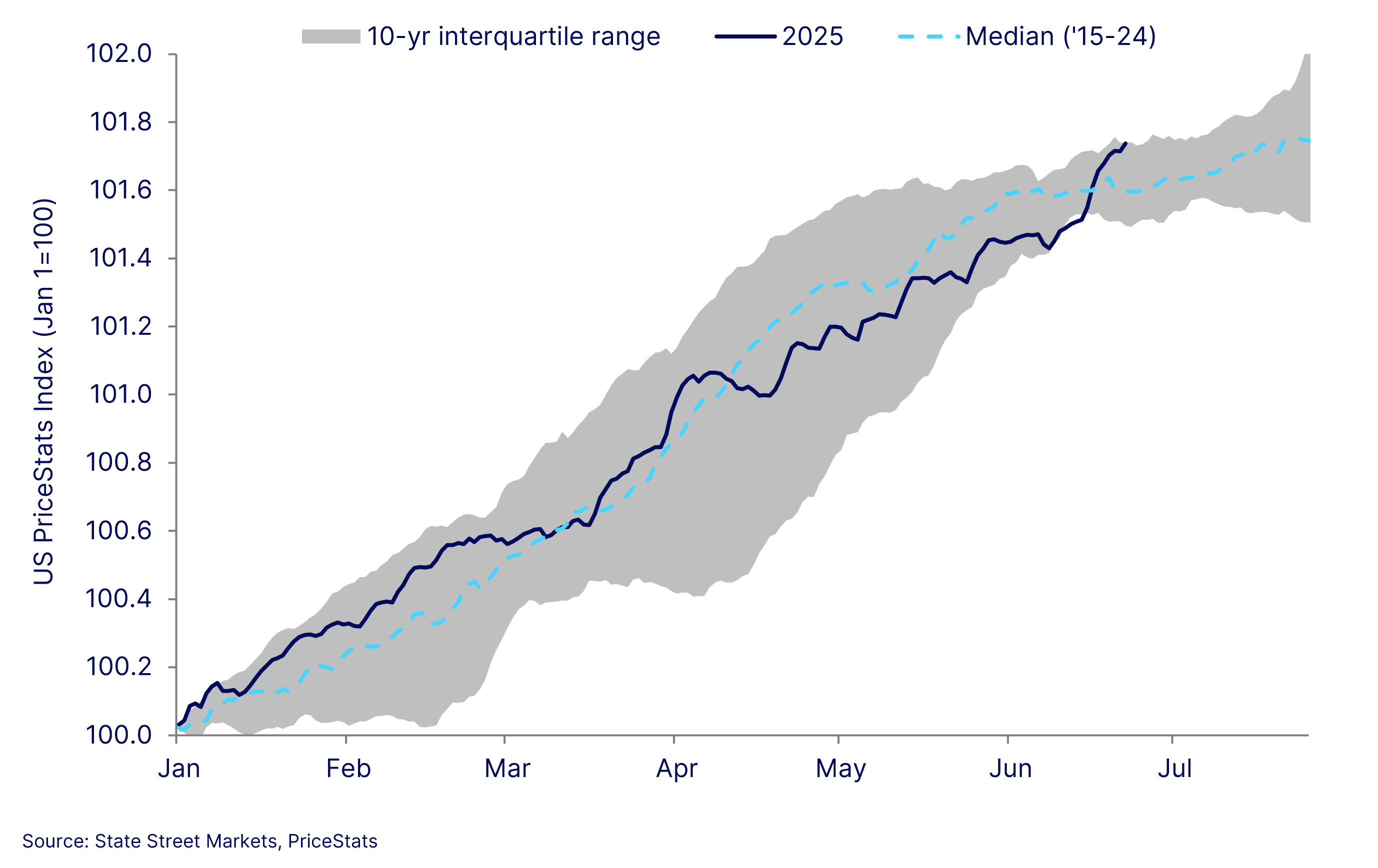

US inflation for October

PriceStats closely matched the delayed official CPI release for September, but we will not have an official number for October this week. However, PriceStats tells us that the inflation trend moderated somewhat in October. A 0.16%mom rise (nsa) is close to the average for the month over the past decade and approximates the 2024 reading. After rising consistently since June, this leaves the PriceStats annual inflation rate almost unchanged in October, albeit remaining at a two-year high. This suggests ...

Nov 5, 2025

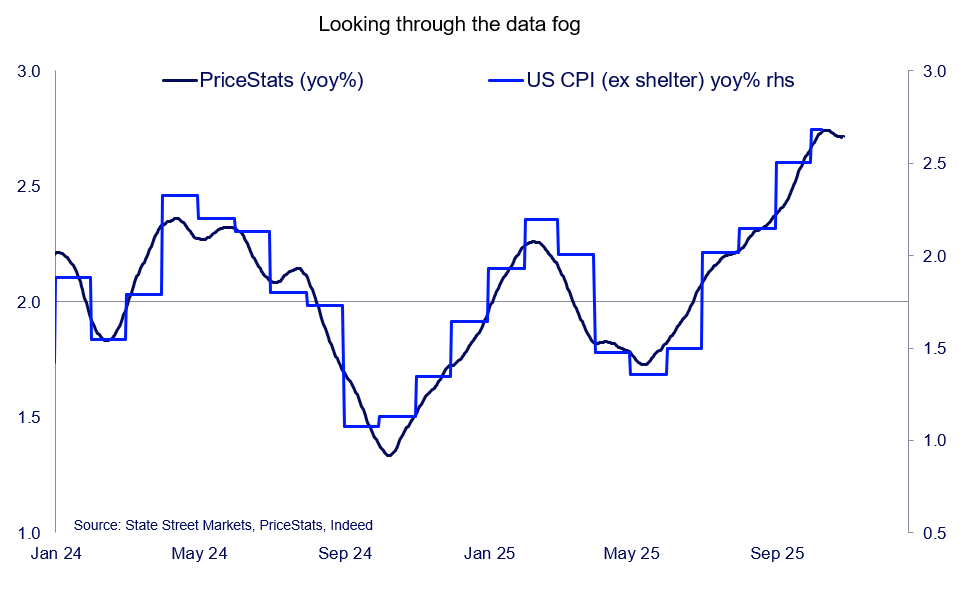

Looking through the data fog

In a year when policy uncertainty has been a watchword, interest rate markets were always a little too confident in a third consecutive easing in December, especially given the current data fog clouding the outlook. For now, alternative data for October is pointing in a similar direction. As we detail in Not so scary heading into Halloween, the uptrend in PriceStats annual inflation rate has levelled out over the month. The downtrend in labour demand captured by Indeed job postings has continued. ...

Oct 28, 2025

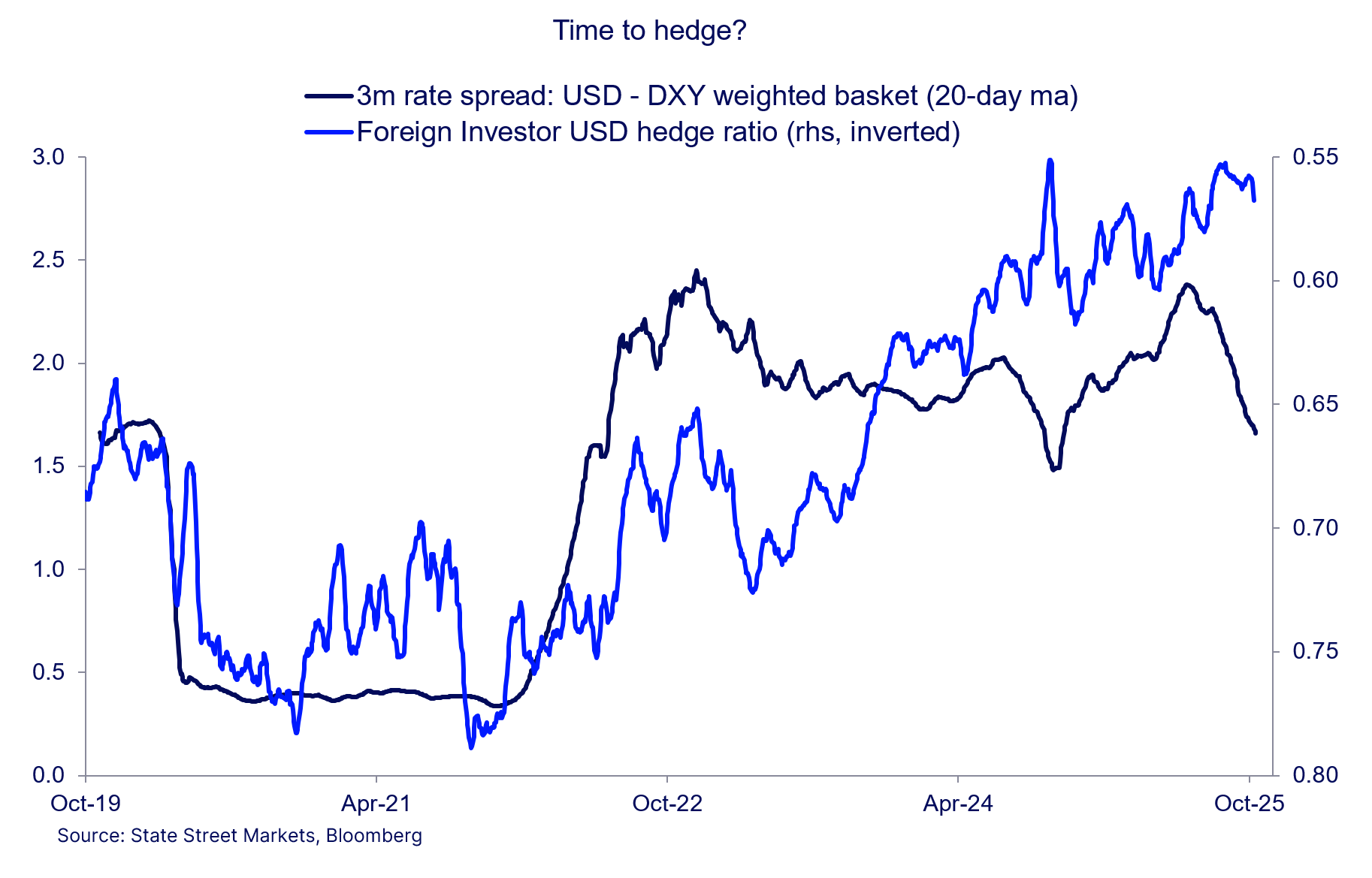

Time to hedge?

One misunderstood element of the Q1 USD sell-off was the idea that this was driven by overseas investors increasing hedge ratios on their USD assets. In fact, our investor sentiment data showed that foreign investor hedge ratios on US assets have barely moved. Why foreign investor not increase hedges on their USD exposure? Simply because it is expensive to do so and USD foreign hedge ratios show a strong relationship with relative rates. This may spell further bad news for the USD. As the Fed ...

Oct 22, 2025

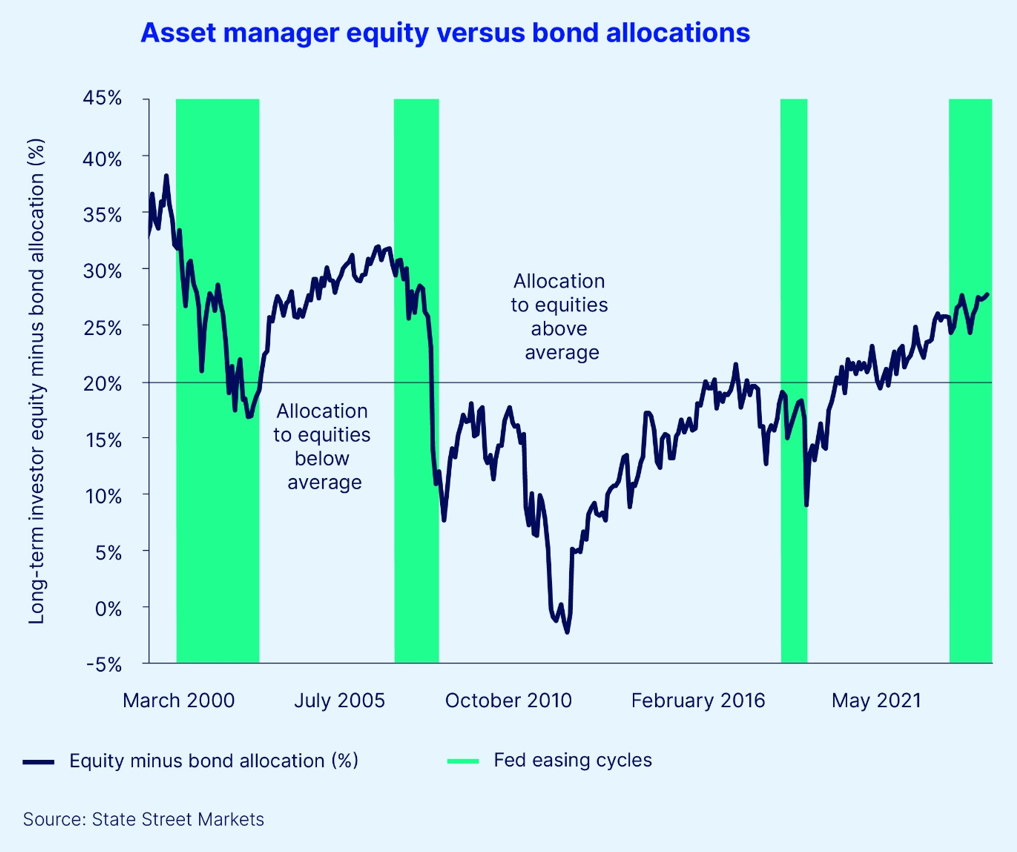

Look at what they do, not what they say

US Banks have kicked off a strong start of 3Q25 earnings season. They exceeded analysts’ profit forecasts with managements lauding pick-up in M&A activity and rising fee income from higher equity valuations. Despite all that, management teams warned about a potential bubble. Fortunately, their own loan departments seemingly missed the memo – lending growth has finally overtaken investments, while loan loss provisions have not increased.

Oct 13, 2025

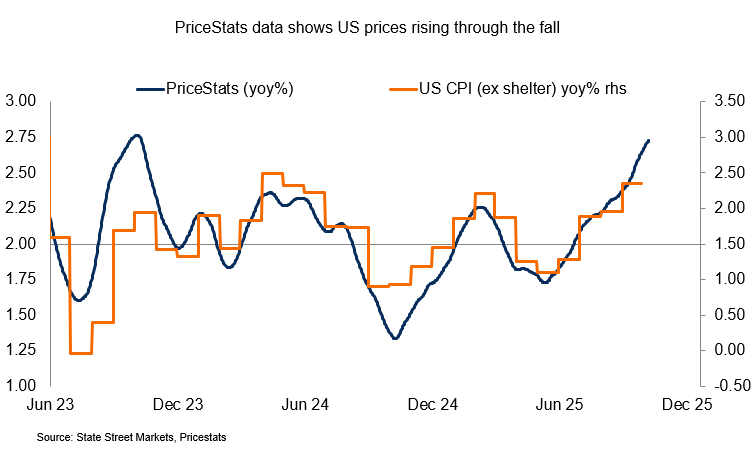

PriceStats data shows US prices rising through the fall

US inflation remained firm in September, though not alarming. A 0.24 percent increase is notable for September, as it is typically a month of modest price gains. This rise pushed PriceStats’ annual inflation to its highest level this year. Much of the unusual seasonal inflation strength came from household equipment and furniture prices, which include a higher share of imported goods than other sectors. According to PriceStats, the annual inflation rate in this segment has now risen above five percent ...

Aug 28, 2025

Exceptions to US exceptionalism

Entering 2025, we pinpointed several critical fault lines and promising updrafts for financial markets. The year has been a rollercoaster, and it's no surprise that both challenges and opportunities have emerged, leaving us with an outlook that's equally optimistic and cautious. The key questions we posed at the start of the year remain as relevant as ever. And just as we did in our mid-April update, we revisit those questions here, leveraging the latest readings of State Street’s investor behavior ...

Aug 26, 2025

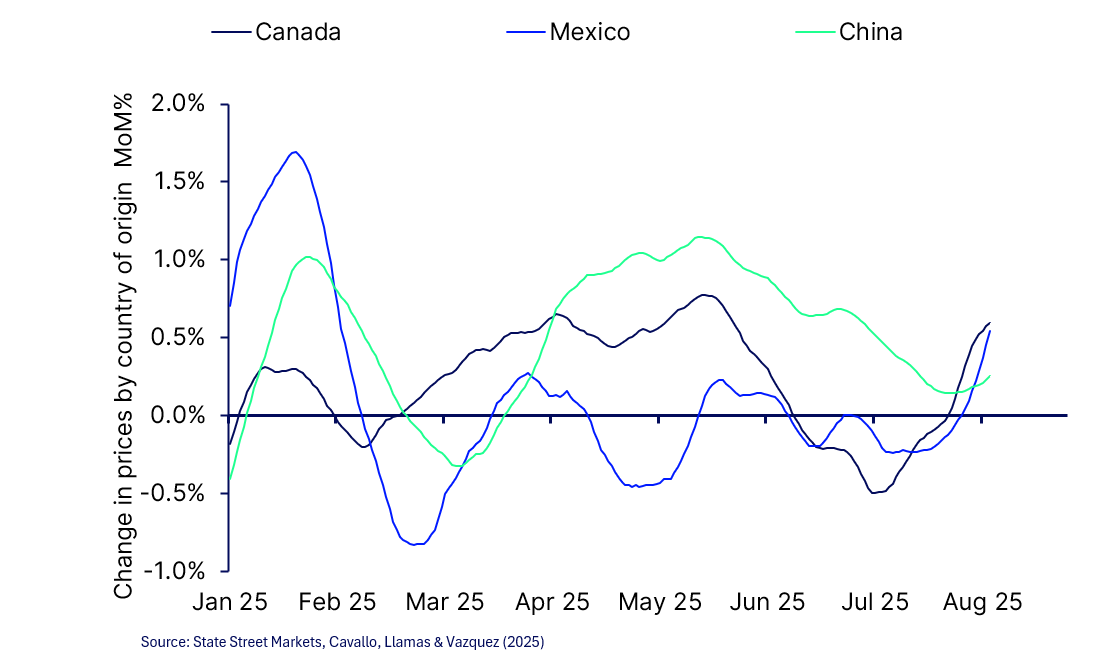

US import prices neither shocking nor one-offs

As our regular updates on PriceStats this year have demonstrated, the pass-through of tariffs into consumer prices has, like the tariff implementation itself, been complicated. Alberto Cavallo’s more granular look at a subset of PriceStats data where country of origin is available shows that just as inflation on goods coming from China appeared to fade in August, the price of goods coming from Mexican and Canada has re-accelerated once again. So, while overall pass-through so far has been modest ...

Aug 1, 2025

The Great US Macro Vol Collapse

A measure of US macro growth volatility is constructed for U3 unemployment rate and ISM. It is based on 3m rolling averages and the 3y range of those averages. A Z-score for each is constructed. The result shows a remarkable level of stability. Quite worryingly, you must go back to Q4 2007 to find an example of where the average of these two series was so low. Of course, that was just ahead of the NBER recession that began in Dec-2007. Other examples include late 1999, 1979 and 1970. Recessions ...

Jul 25, 2025

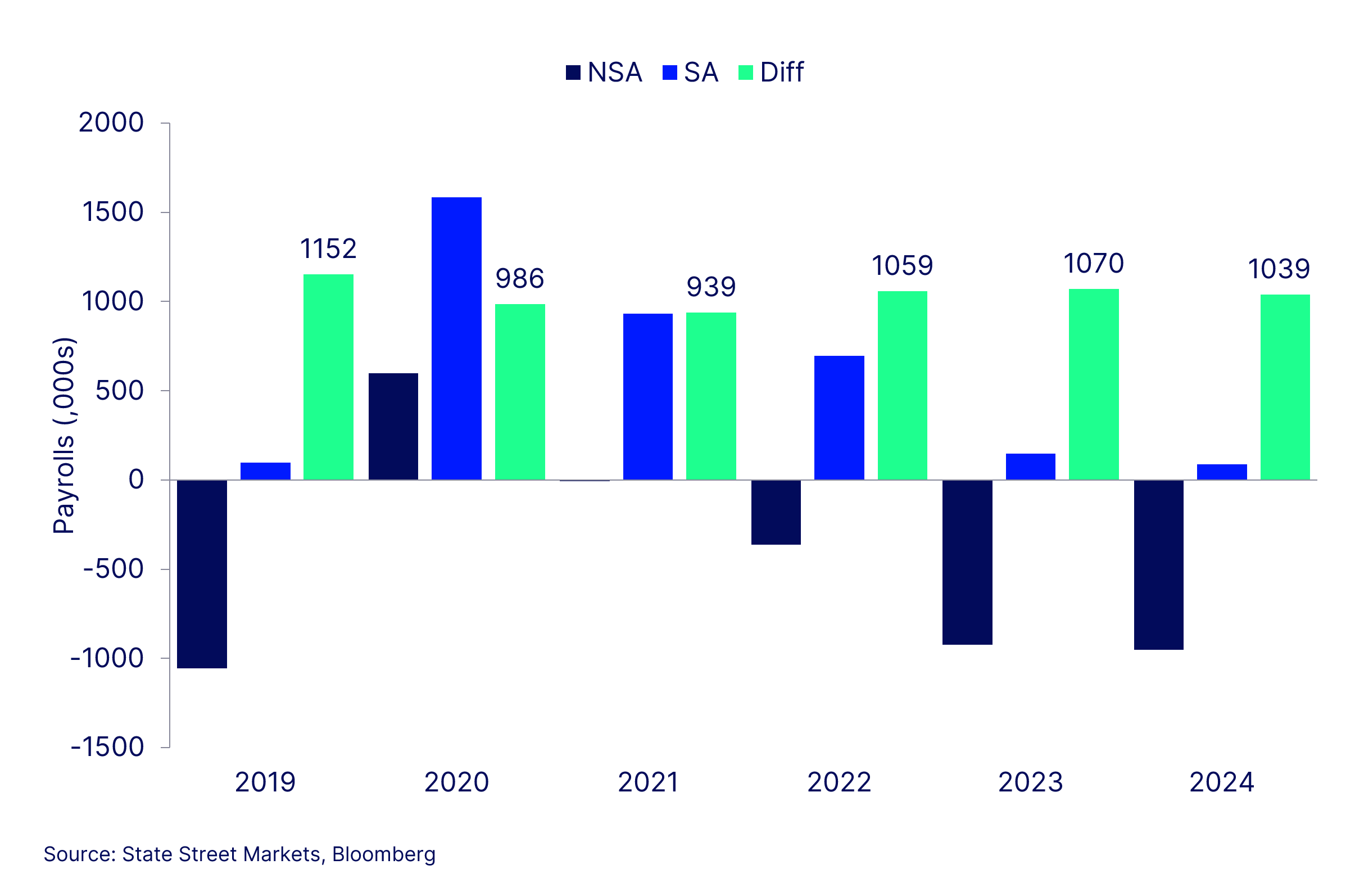

July NFP data fog

There are two months of the year in which the deviation between Nonfarm Payrolls (NFP) seasonally adjusted and the non-seasonally adjusted numbers are quite large. Those are January and July. The chart shows the recent years where the seasonal adjustment has averaged 1,040,000 jobs. If the seasonally adjusted NFP beats or misses, some will want to blame the seasonal adjustment. It is not an easy job and is one of those dark arts from statisticians.

Jul 17, 2025

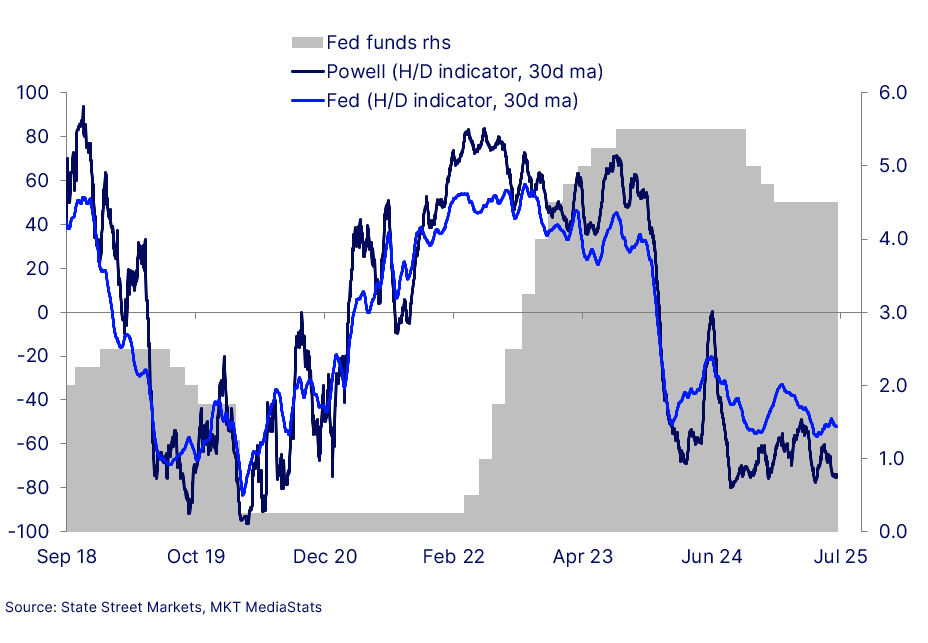

Powell and Fed tone changes

Fed funds may remain on hold, but the media tone of commentary on the Fed remains dovish. Ironically given speculation on his tenure, the tone of media articles on Chair Powell are on average still more dovish than the Fed as a whole. At key pivot points in September 2021 and again mid-2024, the tone of Powell’s commentary appeared to move before the rest of the committee. But so far in 2025 Powell’s more dovish tone is yet to influence the rest of the committee, who remain more cautious.

Jul 10, 2025

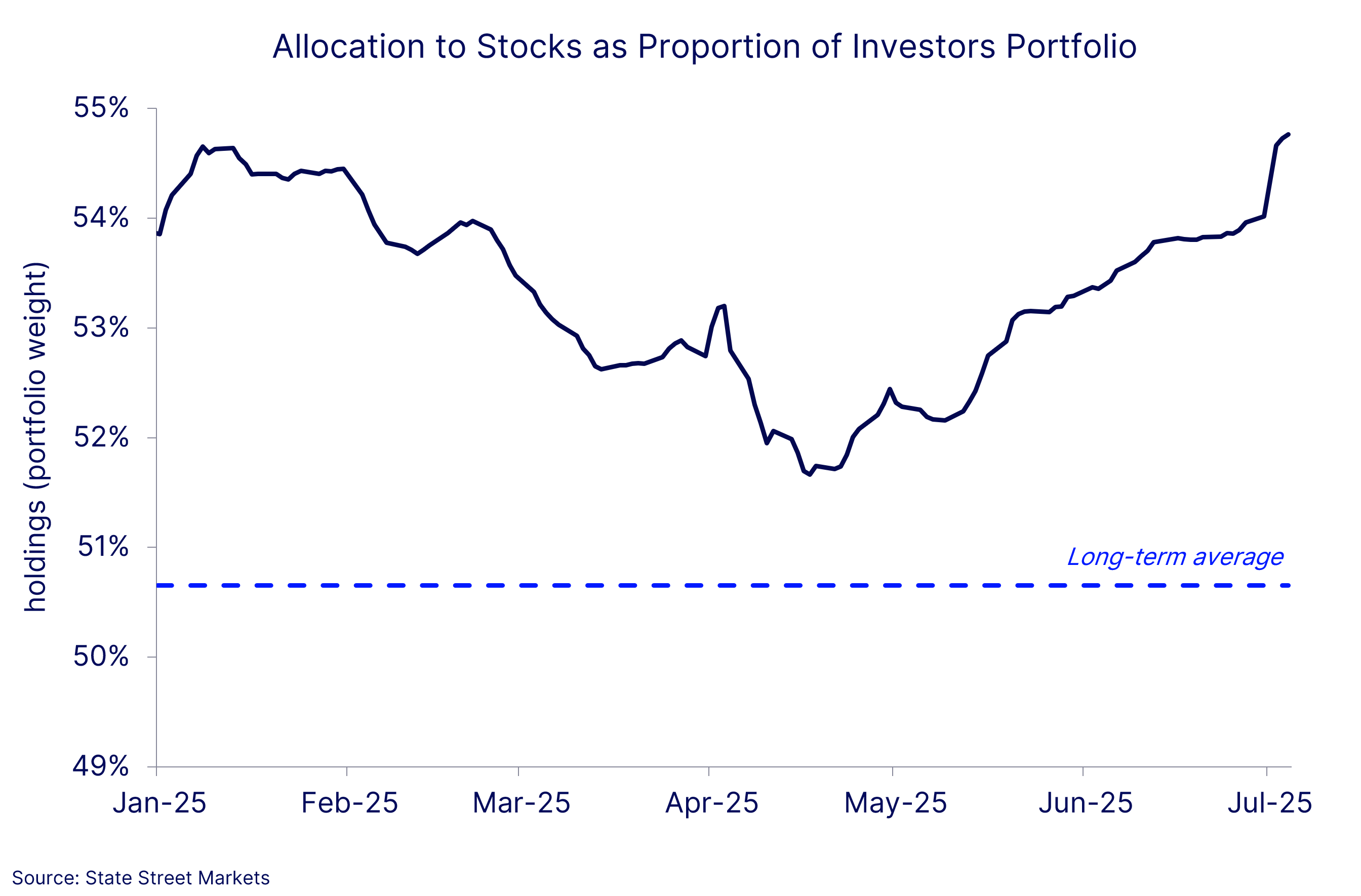

Risk? What Risk?

The first half of the year was nothing but high drama for financial markets (indeed we are all looking forward to quiet summer days). However, institutional investors have taken this palaver in their stride and kept adding risk to their portfolios. Indeed, their allocation to stocks has now gone above the level at the start of the year.

Jul 8, 2025

2025 Foundations of Investing Seminar Series

It is now our annual custom to share insights on the ever-evolving fundamentals of finance and investing. Please join us for our 5th annual State Street Foundations of Investing Seminar Series, where we feature back-to-basics presentations from our renowned academic partners and the deep expertise of our research team in State Street Markets. Connecting theory to practice, our presenters will cover topics ranging from macro policy and investment strategy design to risk management and beyond. You ...

Jul 3, 2025

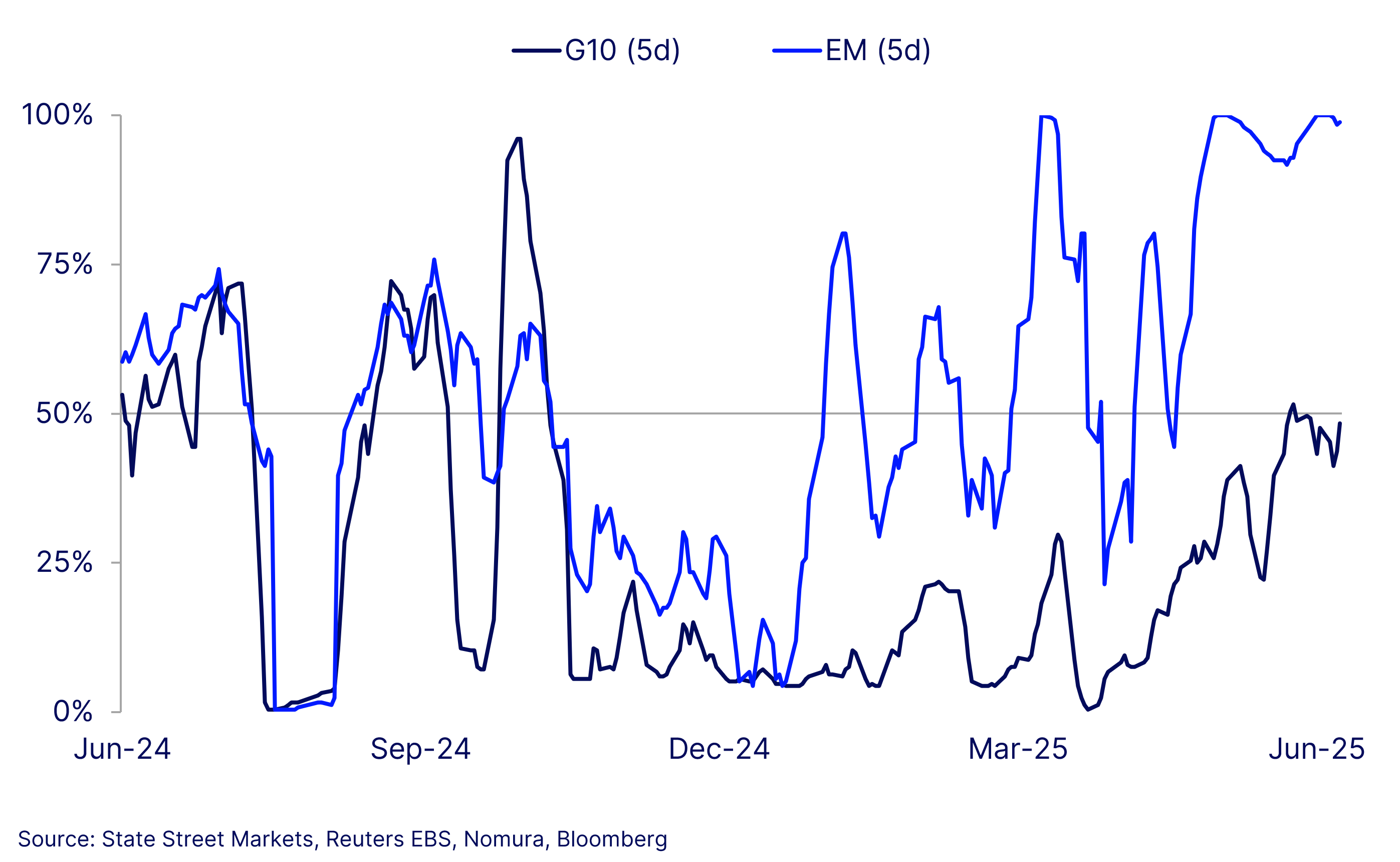

FX market liquidity sees no ill effects from geopolitics

In keeping with a more subdued tone to volatility and more buoyant risk conditions, FX market liquidity continues to improve. This chart plots a rolling weekly measure of the size of order books for aggregates of the most liquid G10 and EM currency pairs. Despite significant uncertainty and geopolitical risk, the depth of book in EM is at the strongest levels of the last year, with each individual pair also reading above its median.

Jun 27, 2025

Summer inflation focus heats up

Chair Powell’s comment that the Fed expects tariffs to feed through to inflation in June/July will focus even more market attention on incoming inflation. Having correctly anticipated softer inflation prints in the past two-months, the pressure in import sensitive sectors alongside the spike in gas prices has seen the price level jump in the first twenty-three days of June, especially in the past week. It is still too early to call what this means for core CPI, but the headline inflation trend ...

Jun 20, 2025

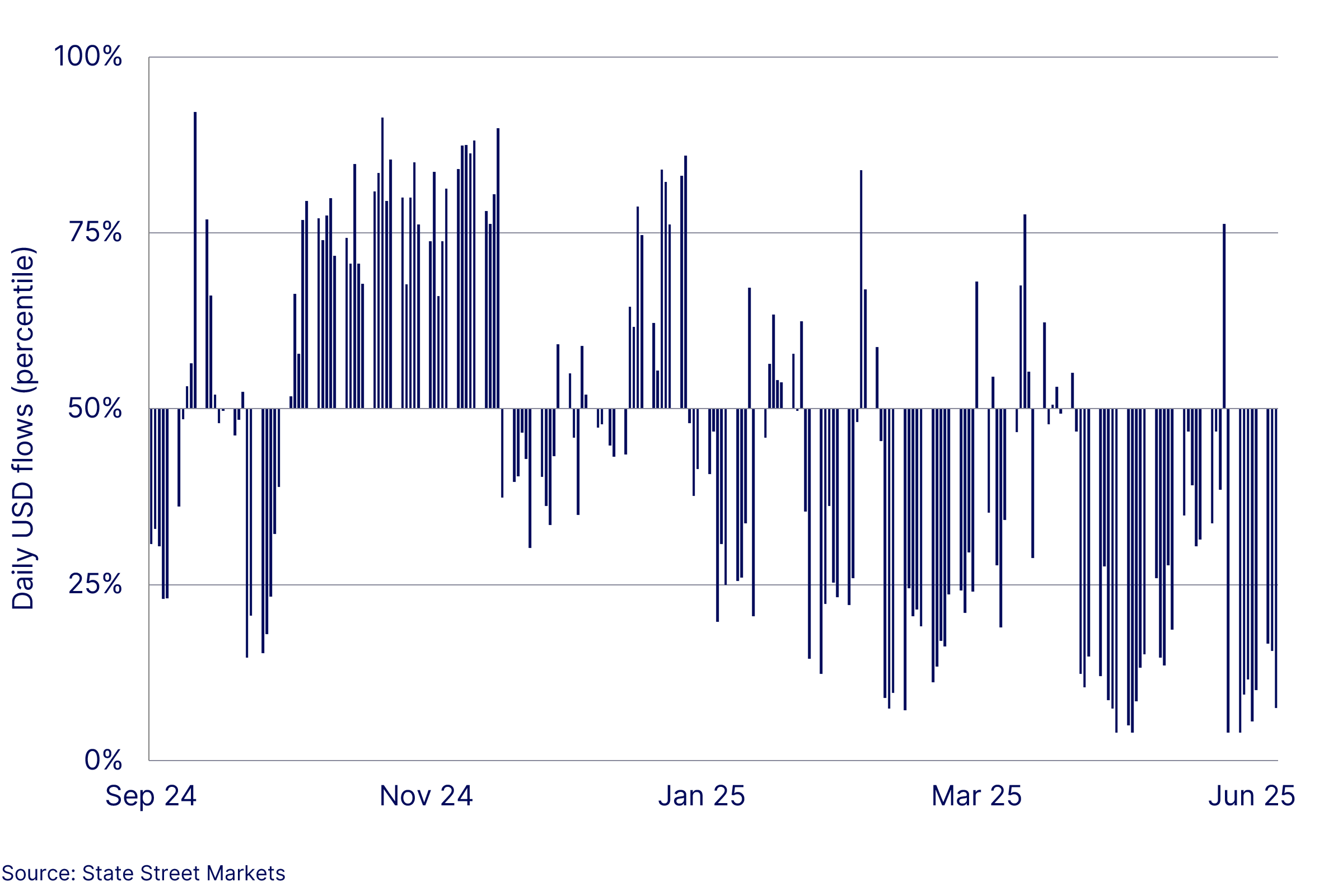

The curious absence of asset manager demand for the USD

The forward sales of the USD by asset managers in Q1 were understandable. Investors began 2025 with a significant USD overweight and were reducing risk in the face of uncertainty. In Q2, after sustained USD sales, both domestic and foreign investors are now underweight, but the appetite to sell the USD appears undiminished. Even in the face of rising geopolitical uncertainty and the outperformance of US stocks, we have observed only one day of USD buying in the past six weeks. The appetite to ...

Jun 12, 2025

HIBOR breaks away from SOFR

The Hong Kong interbank rate (HIBOR) should trade close to the US SOFR rate under normal circumstances due to HKD’s peg to the USD. But since the steep appreciation of TWD in May, HIBOR has decoupled from SOFR. The yield differential with the US is already quite substantial and the interest rate arbitrage of buying higher-yielding USD funded by lower-yielding HKD has not been able to close the interest rate gap for more than a month now, perhaps reflecting the very strong desire to sell the dollar ...

Jun 5, 2025

2025 State Street Summer Sessions

Save the Date: 2025 State Street Summer Sessions Webinar Series It is now our annual custom to take time in the summer months to share insights on the ever-evolving fundamentals of finance and investing. Please join us for our 5th annual State Street Summer Sessions, where we feature back-to-basics presentations from our renowned academic partners and the deep expertise of our research team in State Street Markets. Connecting theory to practice, our presenters will cover topics ranging from ...

Jun 5, 2025

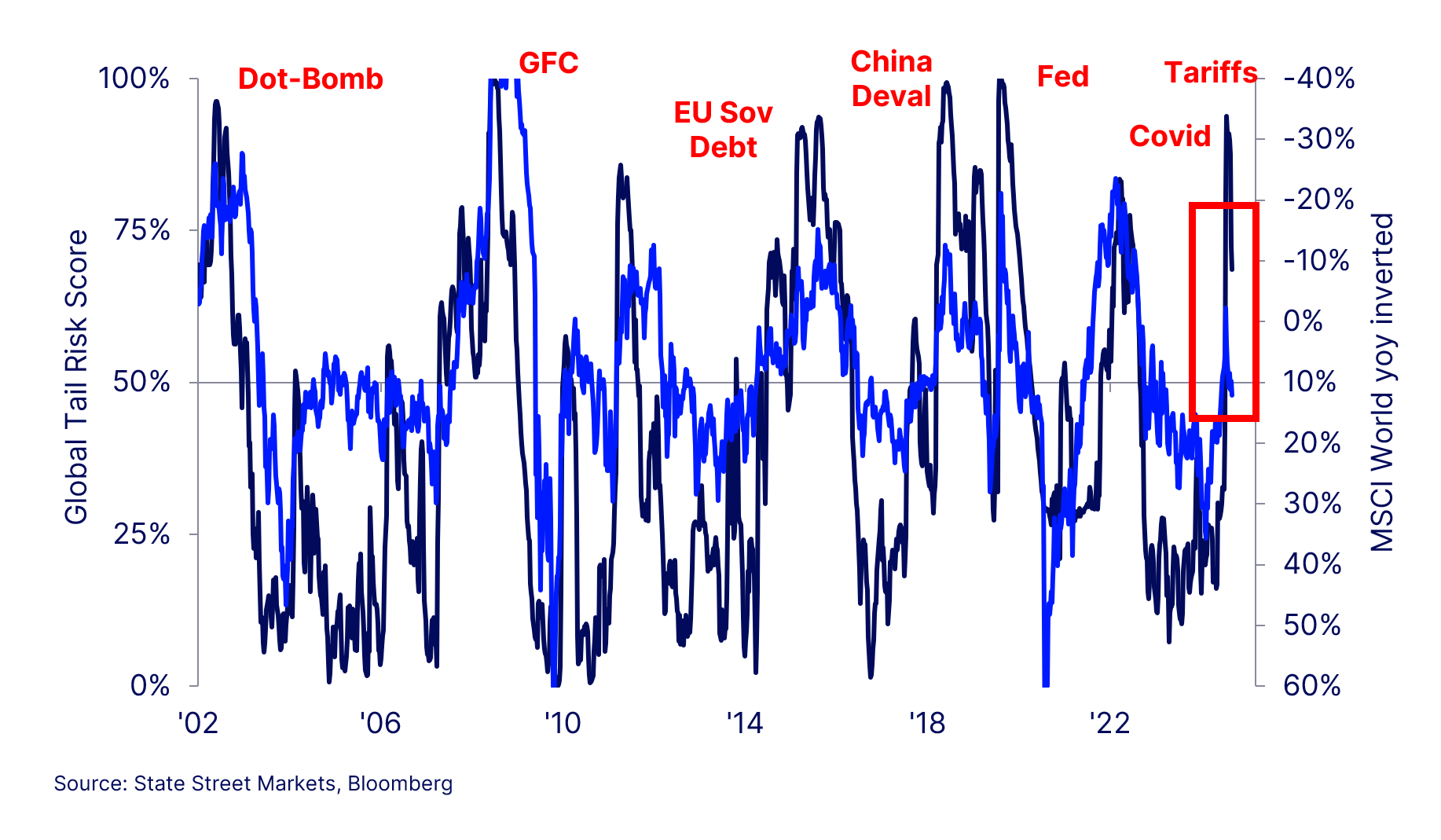

Global Tail Risk Score

The Global Tail Risk score uses the Pythagorean theorem to convert State Street’s Systemic Risk Index and Turbulence Index into a single metric. President Donald Trump’s chaotic rollout of tariffs caused a spike in this metric, which has only partially corrected. Movements tend to be echoed in the annual change of the MSCI World equity index. What is interesting to observe is the current disconnect. The Global Tail Risk score is still an elevated 68% even as the MSCI World y/y% shows a 12% gain. ...

May 30, 2025

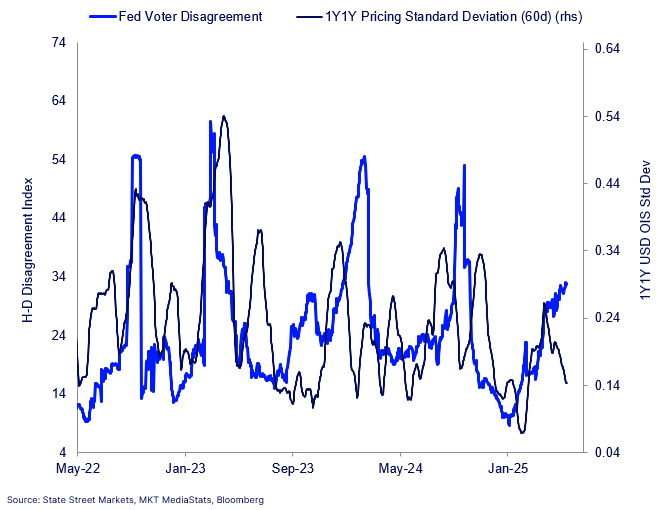

Agree to disagree

May’s FOMC minutes emphasized the “unusually elevated uncertainty” surrounding policymakers’ economic outlooks. Such uncertainty is also reflected in voter disagreement as measured by the dispersion in individual Fed members’ media tone, which has been consistently on the rise since the start of the year. Indeed, while volatility in market Fed pricing has ebbed since the more immediate aftermath of April’s tariff announcements, voter disagreement continues to edge higher as the Fed grapples with ...

May 23, 2025

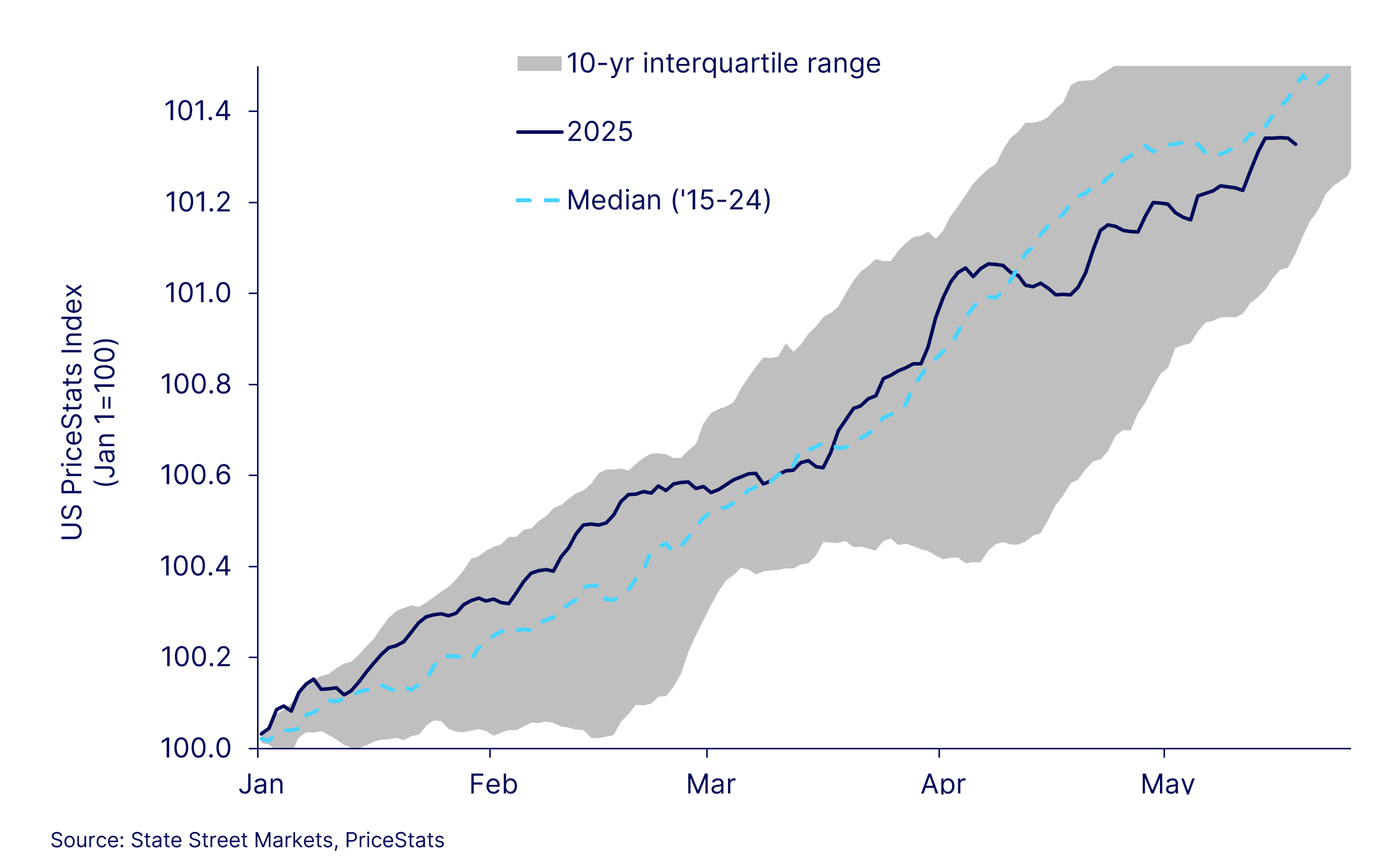

US inflation, first third is normal

We are now more than a third of the way through 2025 and so far, the trend in the US price level remains surprisingly normal. More granular data shows the prices of imported goods from China are already up more than 2% since March. But the aggregate price level as of mid-May remains on a fairly average, if a little bumpy, track. With expectations for core inflation in the high threes this could simply reflect the variable and uncertain lags that complicate most economic variables, but at this ...

1. Peter L. Bernstein Award for Best Article in an Institutional Investor Journal in 2013; Bernstein-Fabozzi/Jacobs-Levy Award for Outstanding Article in the Journal of Portfolio Management in 2006, 2009, 2011, 2013 (2), 2014, 2015, 2016, 2021; Graham & Dodd Scroll Award for article in the Financial Analysts Journal in 2002 and 2010. Roger F. Murray First Prize for Research Presented at the Q Group Conference in 2012, 2021, 2023. Harry M. Markowitz Award for Best Paper in the Journal of Investment Management in 2022, 2023. Doriot Award for Best Private Equity Research Paper in 2022.