Type:

Author:

Sort:

Working Papers

Feb 19, 2026

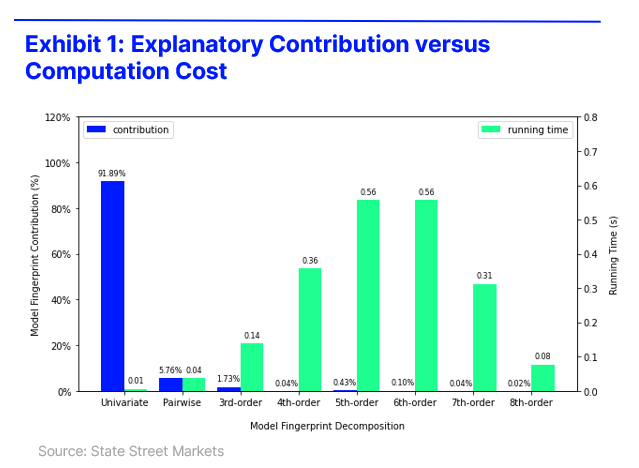

Model Fingerprint

In this paper, we propose a novel model interpretability framework named Model Fingerprint. It is a bottom‑up approach to explaining machine learning models that shifts the focus from assigning feature importance to uncovering the logical structure that drives predictions. While attribution methods such as SHAP faithfully quantify how important each feature is, importance alone is a limited set of lens – much like trying to understand a movie by listing how significant each character is without ...

Nov 12, 2025

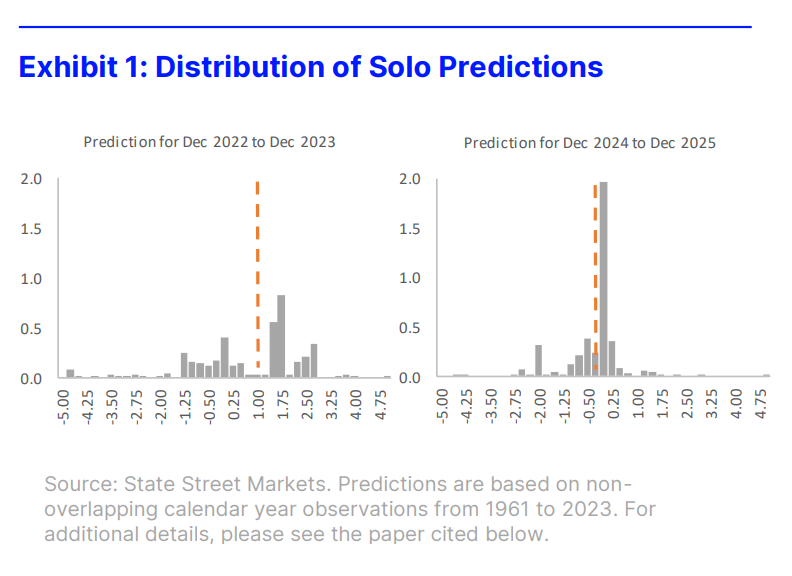

Confidence Revisited: The Distribution of Information

By Megan Czasonis, Mark Kritzman, Fangzhong Liu, and David Turkington Relevance-Based Prediction can assess a prediction’s reliability from the consistency of the information that forms it, providing a novel perspective that complements conventional measures of confidence. Prediction is like a voting process. Each datapoint casts a “vote” for the unknown outcome, and the final forecast averages these diverse views. But to know how confident we should be in the average, we need transparency into ...

Oct 14, 2025

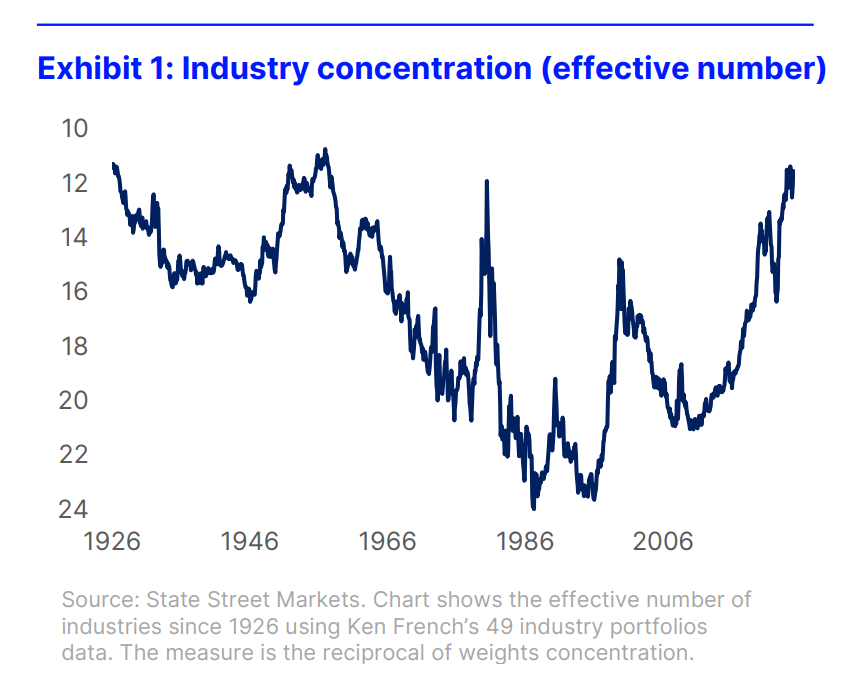

The Fallacy of Concentration

By Mark Kritzman, and David Turkington Evidence shows that concentrated market capitalization weights do not make an index riskier, because larger stocks are inherently more diversified and their increased weights are offset by their lower volatility compared to small stocks. The dominance of large tech firms in market-cap-weighted indices has sparked recent concern about concentration risk, but historical data and empirical analysis suggest these fears may be unfounded. A review of nearly 90 ...

Sep 23, 2025

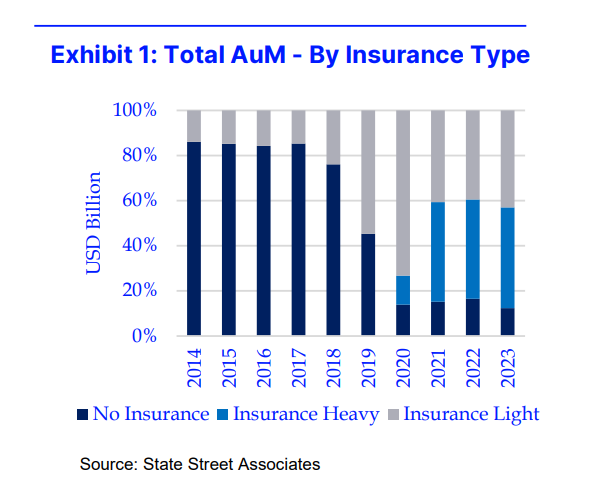

Permanent Capital Meets Private Markets

By Alexander Cheema-Fox, Megan Czasonis, Piyush Kontu and George Serafeim We analyse the transformative impact of life insurance platform integration on the business models, financial profiles, and market valuations of prominent alternative asset managers (AAMs). Relying on episodic fundraising through closed-end funds has long defined the growth and operating model of alternative asset managers (AAMs). Many firms have depended on periodic capital commitments from institutional investors, which, ...

Sep 9, 2025

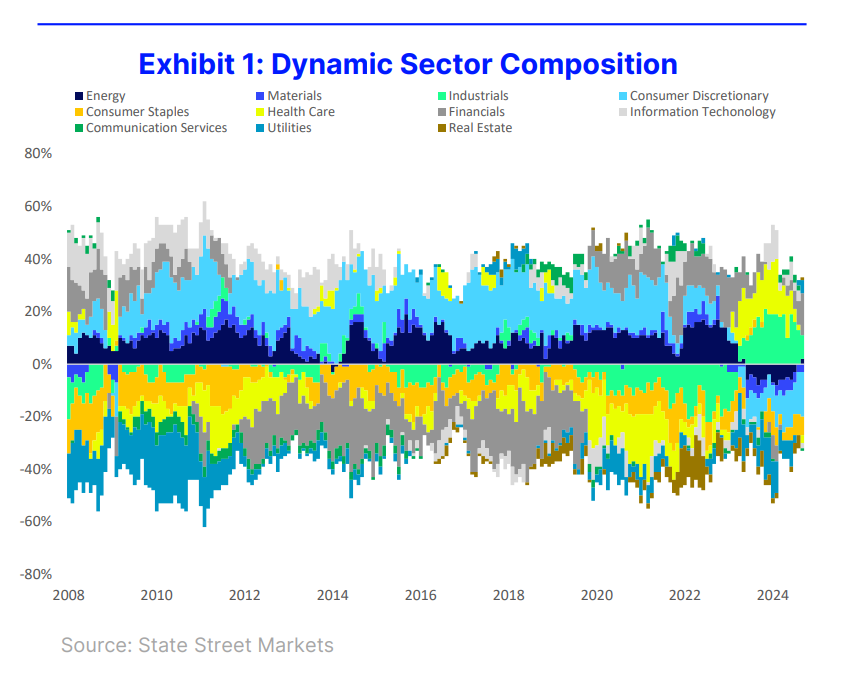

Stocks for Inflation Shocks

By Megan Czasonis, Ding Li, Grace (TianTian) Qiu, Huili Song, and David Turkington We present an adaptive method for constructing an inflation robustness equity factor which outperforms attribute- and sector-based strategies during 65 inflation events from 2008 to 2025. We introduce a novel framework to identify which equities will prove robust and which will falter during episodes of inflationary stress. By analyzing firm-level attributes and comparing them to historical performance during ...

Aug 22, 2025

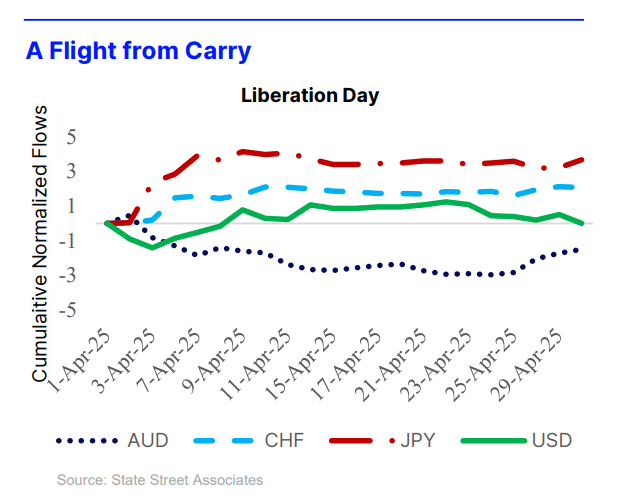

Flight to Safety or Flight from Carry?

By Alexander Cheema-Fox, Edward S.Cuipa III, and Robin Greenwood Institutional investor flows can help distinguish between flights to safety and flights from carry, revealing that the CHF, JPY, and USD play distinct roles depending on interest rate differentials and whether market stress is driven by macroeconomic uncertainty or funding pressure in currency markets. We examine the roles of safe-haven and funding currencies during market stress by analyzing how institutional investors reallocate ...

May 7, 2025

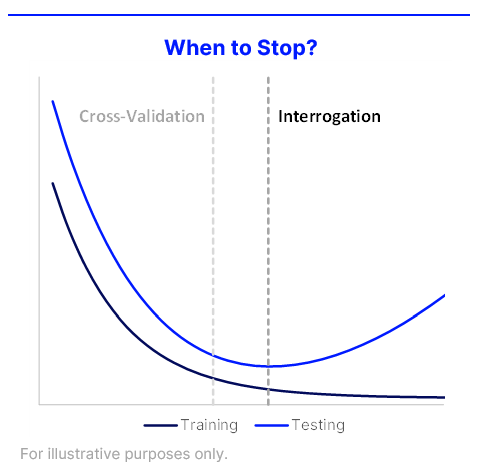

Replacing Cross-Validation with Interrogation

By Megan Czasonis, Yin Li, Huili Song, and David Turkington Our innovative "interrogation" method detects unreliable machine learning predictions in advance, overcoming limitations of the traditional cross-validation method. We introduce a new method called "interrogation" to warn when a machine learning model has underfit or overfit a data sample, offering a more efficient alternative to traditional cross-validation. Unlike cross-validation, which can be cumbersome and computationally expensive, ...

Nov 18, 2024

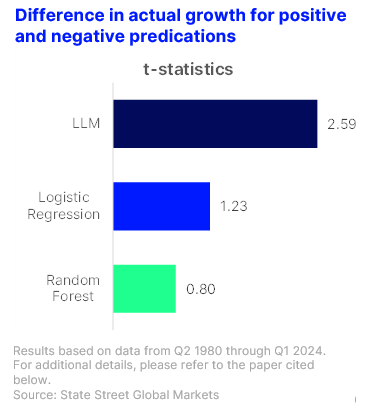

The Economic Logic of Large Language Models

By Megan Czasonis, Huili Song, and David Turkington We show that LLMs can effectively extrapolate from disparate domains of knowledge to reason through economic relationships, and that this may have advantages over narrower statistical models. Fundamentally, large language models (LLMs) and numerical models both learn patterns in training data. However, while traditional models rely on narrowly curated datasets, LLMs can extrapolate patterns across disparate domains of knowledge. In new research, ...

Oct 21, 2024

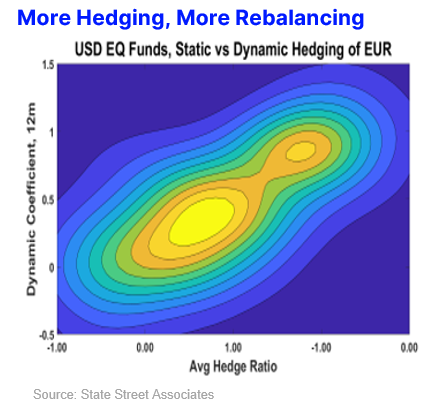

How do Global Portfolio Investors Hedge Currency Risk?

By Alexander Cheema-Fox and Robin Greenwood Using a uniquely deep proprietary dataset, we detail how global investors across regions and asset classes hedge their currency risk, stick to their hedges, and adjust their hedging targets over time. Currency risk is a key component of global investor returns, but different categories of investor approach these exposures differently. Using State Street’s proprietary custodial data, we have a uniquely precise view into how investors actually choose ...

Oct 7, 2024

State Street 2024 Summer Sessions

2024 State Street Summer Sessions Webinar Series This summer we reviewed the fundamentals of finance and investing! Even the most sophisticated investors can benefit from an occasional tune-up. For our fourth annual State Street Summer Sessions, our team of academic and industry experts went back to basics, covering the core principles of modern investing. Connecting theory to practice, our Global Markets research experts and academic partners covered topics such as inflation, liquidity, private ...

Oct 7, 2024

State Street 2024 Foundations of Investing Seminar Series

Join us for the 2024 State Street Foundations of Investing Seminar Series This year we reviewed the fundamentals of finance and investing! Even the most sophisticated investors can benefit from an occasional tune-up. For our fourth annual State Street Foundations of Investing Seminar Series, our team of academic and industry experts went back to basics, covering the core principles of modern investing. Connecting theory to practice, our Global Markets research experts and academic partners covered ...

Sep 24, 2024

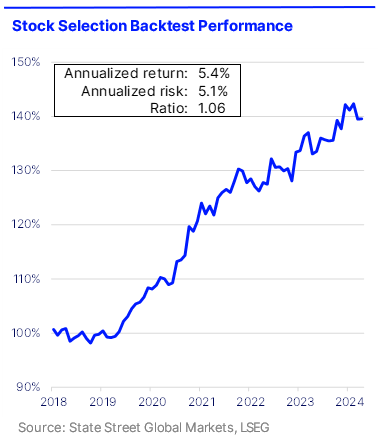

Machine Learning Stock Selection Model

State Street Global Markets’ Machine Learning Stock Selection Model uses a data-driven approach and machine learning techniques to predict sector-relative performance of U.S. large cap stocks. Our model: • Incorporates State Street’s proprietary indicators of media sentiment and behavioral trends • Uses our Model Fingerprint framework to offer insights into the key drivers of stock returns • Shows strong efficacy in predicting sector-relative stocks returns in an out-of-sample ...

Jun 28, 2023

State Street 2023 Foundations of Investing Seminar Series

2023 State Street Foundations of Investing Seminar Series This year we reviewed the fundamentals of finance and investing! Even the most sophisticated investors can benefit from an occasional tune-up. For our third annual State Street Foundations of Investing Seminar Series, our team of academic and industry experts went back to basics, covering the core principles of modern investing. Connecting theory to practice, our Global Markets research experts and academic partners covered topics such ...

Jun 2, 2023

State Street 2023 Summer Sessions

2023 State Street Summer Sessions Webinar Series This summer we reviewed the fundamentals of finance and investing! Even the most sophisticated investors can benefit from an occasional tune-up. For our third annual State Street Summer Sessions, our team of academic and industry experts went back to basics, covering the core principles of modern investing. Connecting theory to practice, our Global Markets research experts and academic partners covered topics such as inflation, liquidity, private ...

Nov 7, 2022

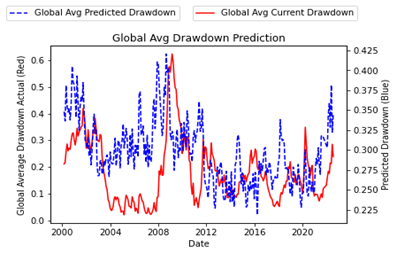

Measuring Market Froth

We define equity markets and sectors to be “frothy” when the probability of a future drawdown in prices is high. Using simple panel regressions, we analyze data across 80 countries and 400 country-sectors to identify and evaluate which factors--including issuance, volatility, the price path, and flow-based factors-- are most predictive of future sector-level drawdowns. We translate our predictive model into indicators for sector- and market-level froth.

Sep 15, 2022

State Street 2022 Summer Sessions

Time to review the fundamentals of finance and investing! Even the most sophisticated investors can benefit from an occasional tune up. Watch replays from the 2022 State Street Summer Sessions webinar series, where our team of academic and industry experts went back to basics and covered the core principles of modern investing. Connecting theory to practice, our presenters put trends like inflation, cryptocurrencies and ESG investing into context. How Media Narratives Drive Markets Ronnie ...

Aug 11, 2022

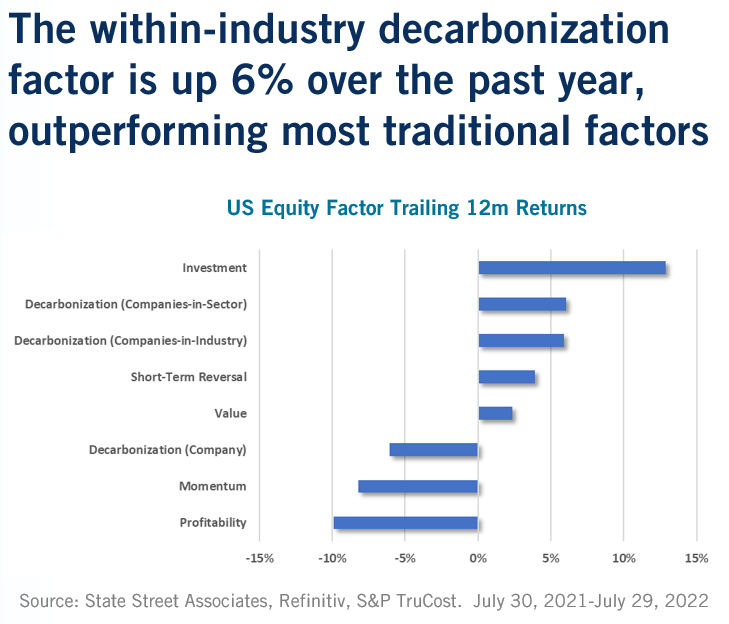

Decarbonization Demonized

By Alexander Cheema-Fox and George Serafeim Despite strong energy sector performance over the past year, best-in-industry decarbonization and climate solutions investments have exhibited strong returns.

Dec 17, 2021

State Street Live Research Retreat: Replays

On Wednesday November 17th, 2021 we held our State Street LIVE Virtual Research Retreat. Below you will find summaries and replays of all presentations, plus links to related materials. Please reach out to us if you would like to discuss any of this research in more detail. Links below will require account log in to our research platform, Insights. If you do not yet have an account and are interested in hearing more from this year’s presenters and exploring our research, indicators, publications, ...

Oct 28, 2021

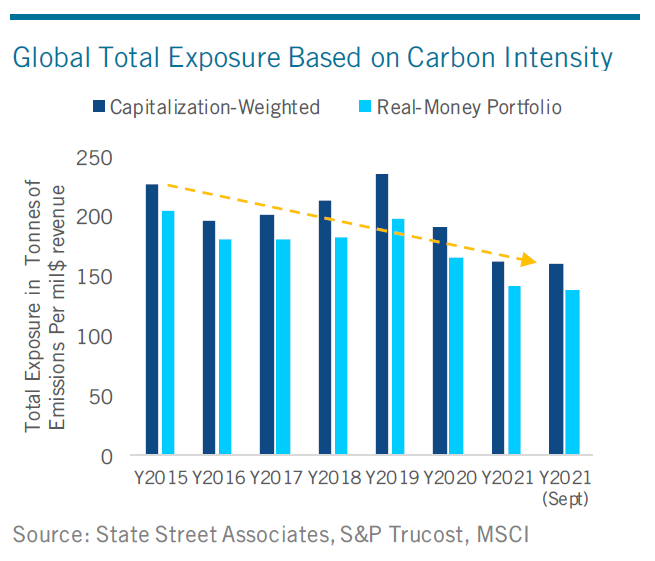

We’ll Always Have Paris: How Institutional Exposures to Carbon Emissions Have Evolved Since 2015

By Alexander Cheema-Fox, George Serafeim and Hui (Stacie) Wang.Institutions have decarbonized since 2019: we break down the where and how.2015 Paris Agreement marked a milestone in that all nations agreed to work together to tackle climate. Responding to this changing landscape and taxonomy in climate change, investors are increasingly paying attention to the carbon exposure of their portfolios. Fast track to 2021, almost six years later, we ask: where are we standing now? Have institutional investor ...

Oct 1, 2021

State Street Summer Sessions: Replays and Notes

Review the fundamentals of modern finance by catching up on the Summer Sessions hosted by State Street Associates’ team of academic and industry experts. Go back to the basics connecting theory to practice with trends like inflation, cryptocurrencies and ESG investing. To view a short overview video of the Summer Sessions, click here. Replays are available on our research platform, Insights, in the Experts’ Corner, the exclusive home of our Summer Sessions recordings. To read comprehensive notes ...

Jul 21, 2021

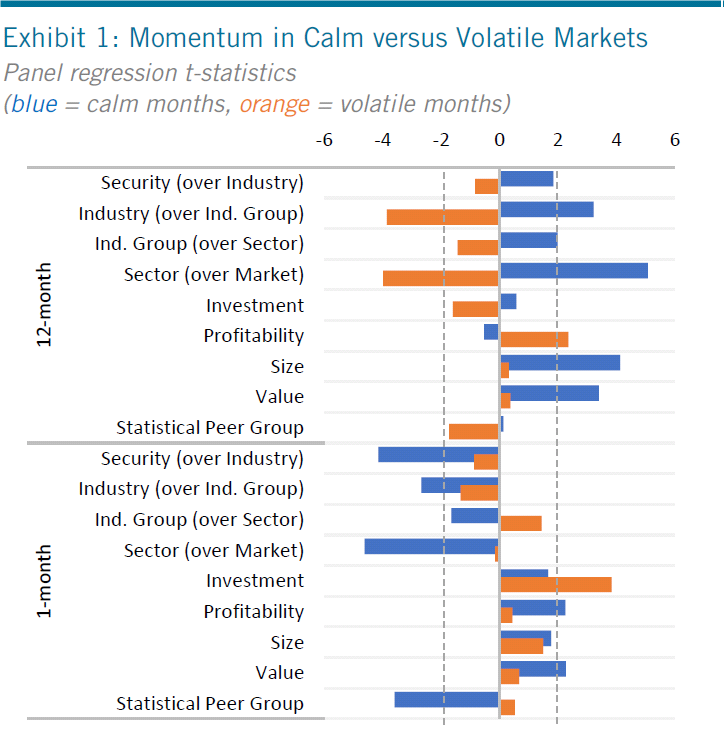

Mapping Out Momentum

By Yimou Li and David TurkingtonIs it better to focus on single-stock, industry or factor trends? And how does market risk and time horizon affect them? We use a unified framework to map out the distinct sources of momentum and reversal in the stock market.A variety of stock momentum and reversal effects have been documented in financial literature, but it’s hard to unify these often disparate findings. We disentangle the overlapping effects of momentum and reversal to show where the most durable ...

Oct 29, 2020

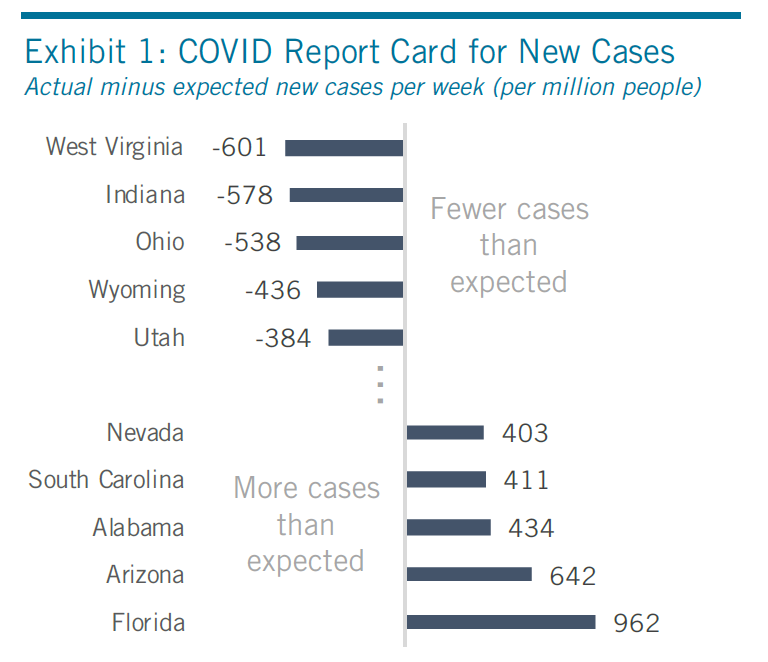

The COVID Report Card

By Megan Czasonis, Mark Kritzman, Baykan Pamir, and David Turkington. We evaluate how well US states and countries responded to the COVID-19 crisis by attributing their outcomes to demographic circumstances outside of their control versus discretionary actions. When the pandemic hit, some US states were better positioned than others, owing to demographic factors beyond their immediate control. These factors — education level, median age, political affiliation of the governor, and population density ...

1. Peter L. Bernstein Award for Best Article in an Institutional Investor Journal in 2013; Bernstein-Fabozzi/Jacobs-Levy Award for Outstanding Article in the Journal of Portfolio Management in 2006, 2009, 2011, 2013 (2), 2014, 2015, 2016, 2021; Graham & Dodd Scroll Award for article in the Financial Analysts Journal in 2002 and 2010. Roger F. Murray First Prize for Research Presented at the Q Group Conference in 2012, 2021, 2023. Harry M. Markowitz Award for Best Paper in the Journal of Investment Management in 2022, 2023. Doriot Award for Best Private Equity Research Paper in 2022.