We offer an intuitive and interactive way to engage with State Street Global Markets'® research. With Insights, you can read market commentary from our team of macro strategists and explore the most interesting trends in our daily indicators of investor behavior, risk, inflation and sentiment based on award-winning research.1

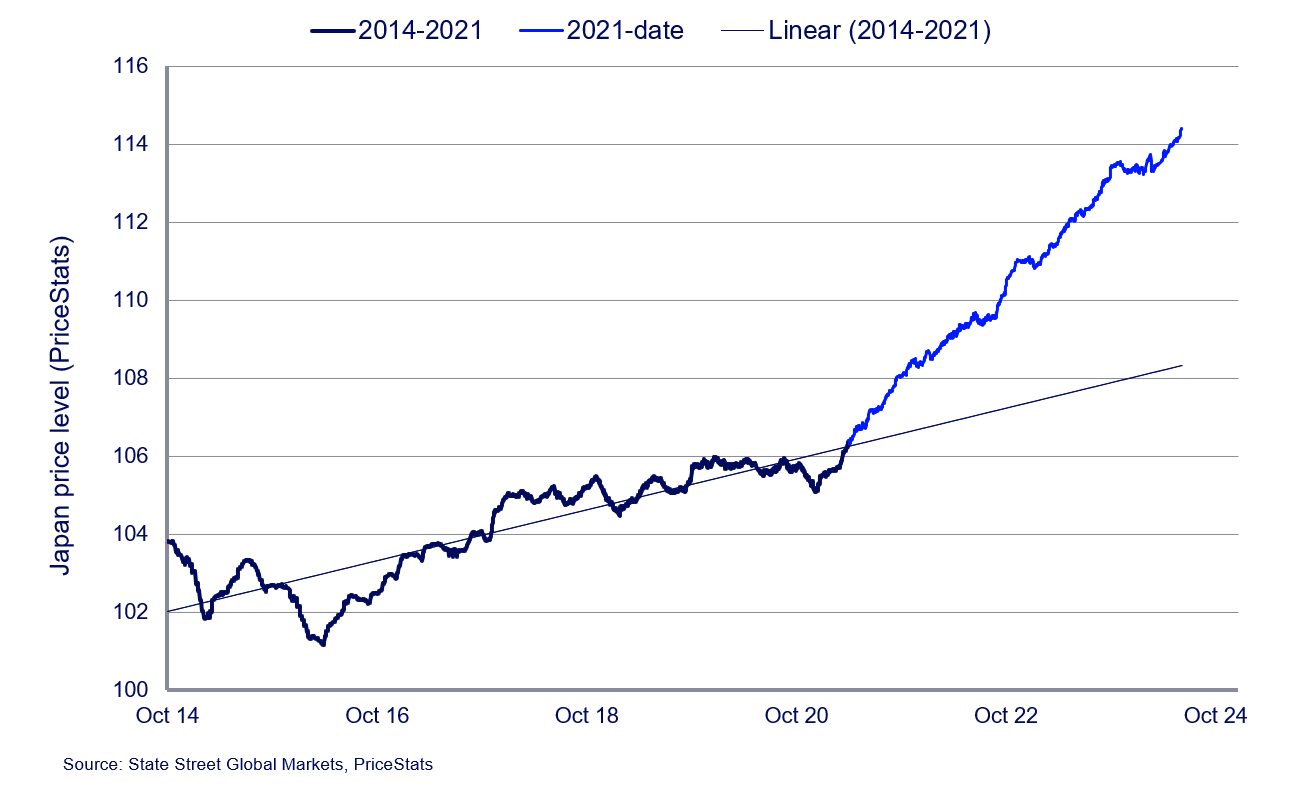

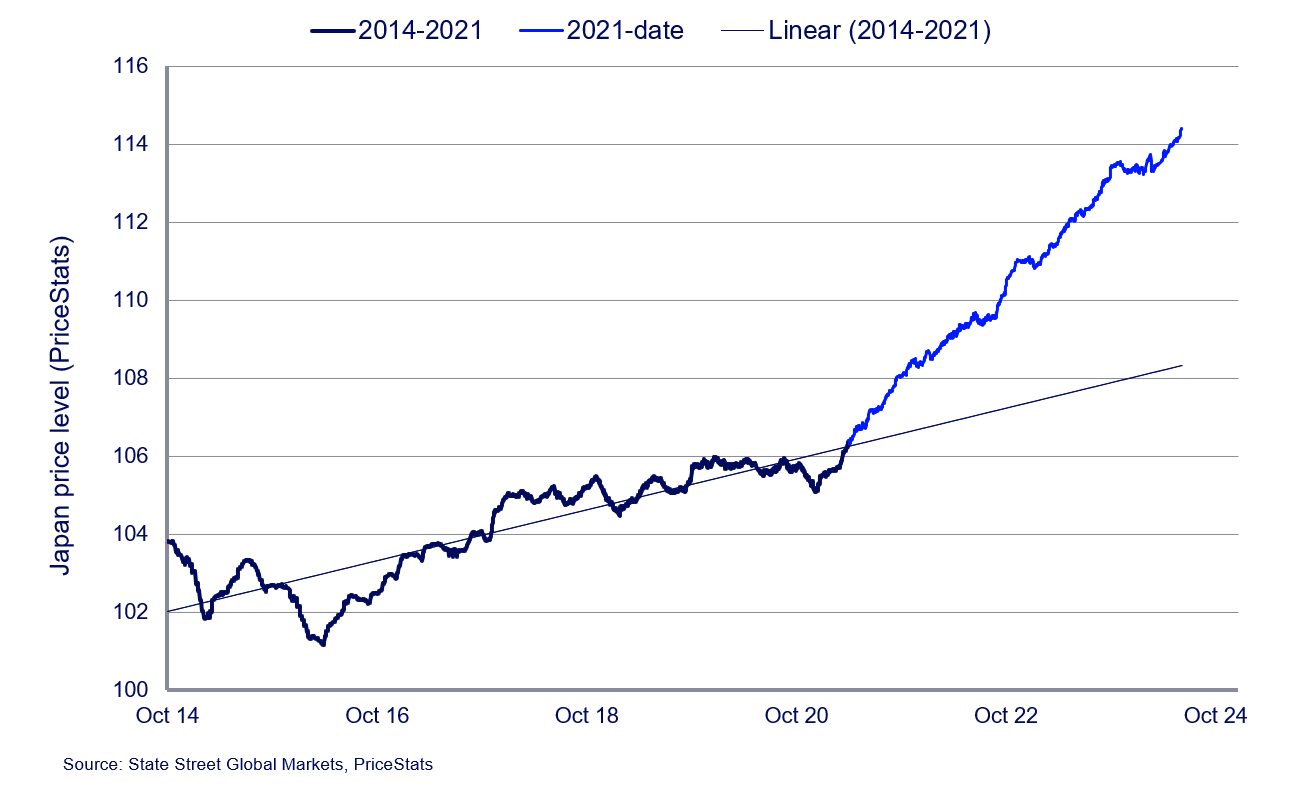

Prior to the pandemic Japan struggled to generate a sustainable inflation trend.

The annualised rise in the price level as captured by PriceStats was only 0.4% yoy; a level low enough to be peppered with bouts of outright deflation.

Since 2021, however, there has been a clear structural break. A clear inflation mindset has returned. The trend growth in the Japanese price level since this point has been comfortably above 2%, and if anything is currently showing signs of accelerating not fading.

The implication is that Japan’s inflation trend has shown a lasting change, but monetary policy settings have barely moved from the deflationary era, yet.

Holdings

- The State Street Holdings Indicators showed that long-term investor allocations to equities rose 33bps to 53.7%.

- Cash holdings well a further 0.4 percentage points to 18.4%, this is the first time in tenth months that cash holdings are below their long-term average.

- Fixed income holdings were left largely unchanged after their sharp rise last month.

RiskAppetite

- The State Street Risk Appetite Index bounced back to 0.09 in May revealing a modest risk on bias across the month.

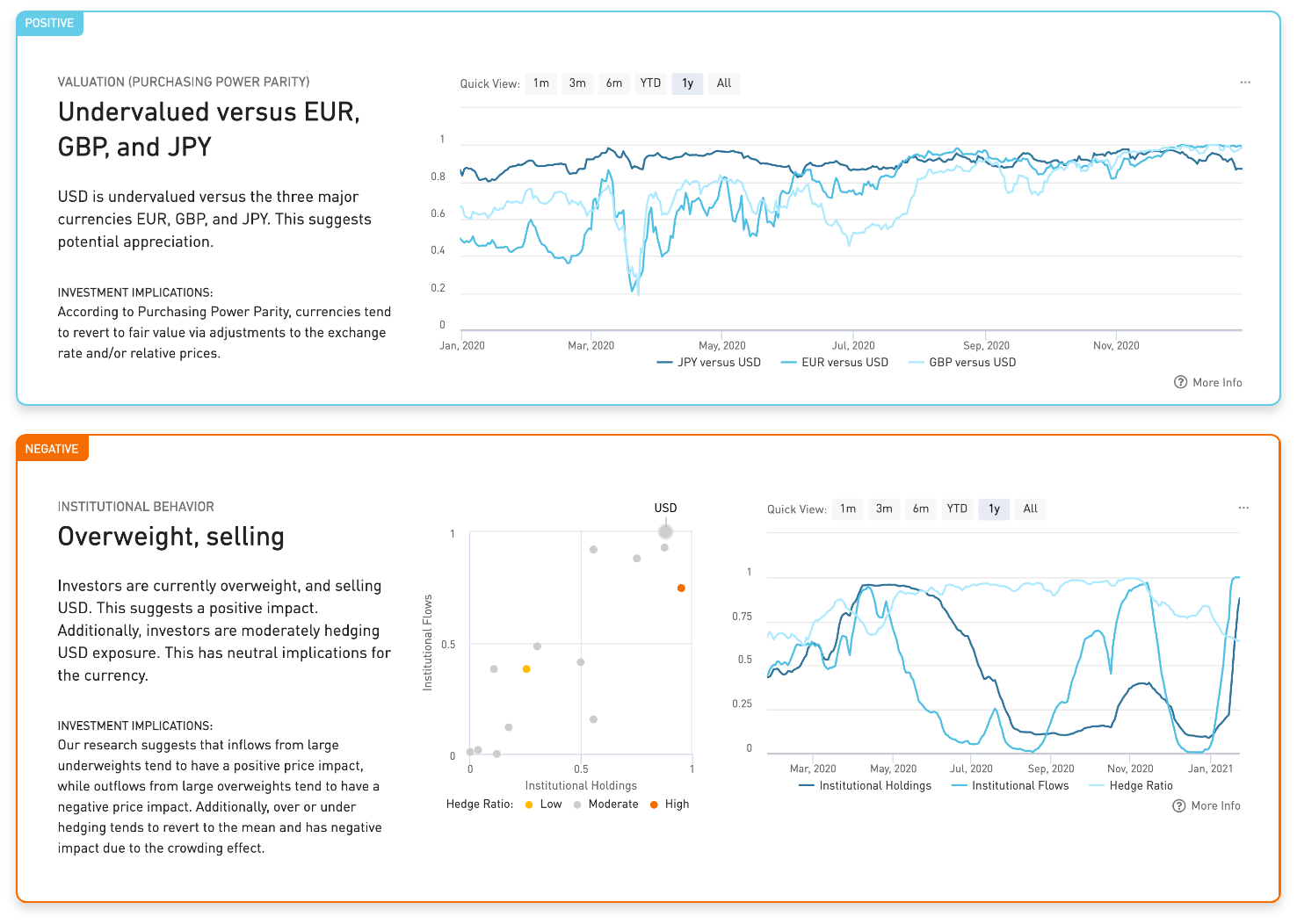

- Within this moderate risk on environment long-term investors began to reassess their USD overweight once again.

- Long-term investors rediscovered their appetite for higher yielding FX and fixed income instruments in May.

The State Street Global Markets® Insights app provides you with instant access to our cutting-edge research, data-driven indicators and timely expert commentary on global macro trends, multi-asset strategy, investor behavior, daily inflation, media sentiment, risk regimes, liquidity, currencies, portfolio construction and more.

Powered by our longstanding partnerships with renowned academics and unique proprietary data sources, Global Markets Research provides an essential perspective on markets that is not available anywhere else.

We offer intuitive and interactive ways to engage with State Street Global Markets' research.

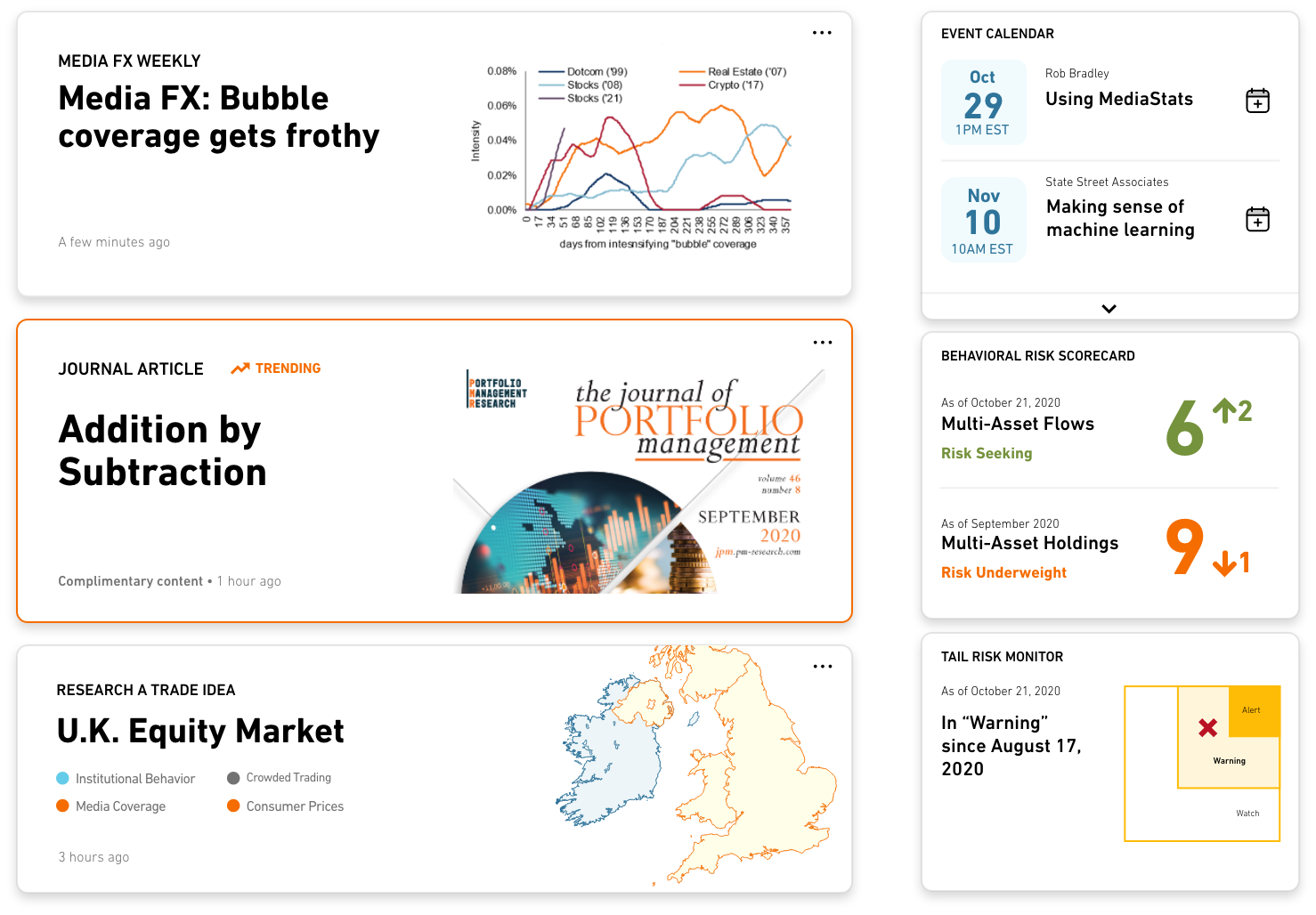

Our home section is at the core of Insights and is the starting point for exploring our research. We curate a feed of the most relevant and exciting content that is of greatest interest to you, based on your research preferences, saved views, and our Insights AI engine.

In Research, explore our catalogue of research by filtering on publication type, author, or theme. Once you’re satisfied with your search, sort the results by the latest or most popular research meeting your criteria and subscribe to future publications or authors.

Choose how you want to engage with our indicators. Browse our Indicator section to analyze trends across market segments and through time.

In Research a Trade Idea, look across flagship indicator pairings in investor behavior, risk, inflation and sentiment to get a feel for the investment environment in the market segment of your choosing.

Or, if you’re looking for a more hands-on approach, visit our Signal Studio and craft your own indicator combinations.

Our expansive suite of investment indicators provides investors with an information edge. We provide measures of:

- Investor Behavior

- Risk Regimes

- Media Sentiment

- Consumer Prices

Our team of macro strategists produce regular commentary on equity, fixed income, and currency markets around the world. We offer a differentiated view on global market trends, risk, and opportunities.

Access our white papers and peer-reviewed research articles related to macro / multi-asset investor behavior, hedging, risk regimes, liquidity risk, private assets, portfolio construction, and more.

Join us for the 2024 State Street Foundations of Investing Seminar Series

Time to review the fundamentals of finance and investing! Even the most sophisticated investors can benefit from an occasional tune-up. Join us for our fourth annual State Street Foundations of Investing Seminar Series, where our team of academic and industry experts will go back to basics, covering the core principles of modern investing.

Connecting theory to practice, our Global Markets research experts and academic partners will cover topics such as inflation, liquidity, private markets, and much more. We have plenty of new sessions this year, in addition to the most popular sessions from last year. Register for specific seminars or join them all. So close your email, silence your phone, and prepare some tough questions. We’ll see you there!

Thursday, July 18, 2024

9am HK

The Limits of Diversification

Will Kinlaw, Senior Managing Director, Head of Global Markets Research, State Street Global Markets | REGISTER NOW

To diversify is one of the fundamental tenets of investing. Yet what seems straightforward in theory is complex in practice. Correlations can be asymmetric and unstable through time. Moreover, correlations measured over shorter intervals do not necessarily extrapolate to longer intervals. This presentation will synthesize more than 10 years of published research into these questions, analyze the challenge from a new perspective, and propose actionable solutions to help investors construct more resilient portfolios.

Thursday, August 1, 2024

9am HK

Understanding Chinese Policies and Cross Asset Implications

Ben Luk and Yuting Shao, State Street Global Markets Research | REGISTER NOW

China’s increasing importance not only in emerging markets but also globally means investors are closely following every move out of Beijing. Meanwhile, with China’s post-Covid pent-up demand start to run out of steam, continued weak prices and property sector slump underpin concerns on whether China is able to turn the macro economy around. What’s more, the 3rd Plenum and upcoming US general elections add another layer of policy and geopolitical uncertainty. In this summer session, Ben Luk and Yuting Shao take a deep dive into China’s macro economy and asset classes to try to understand the dynamics of underlying drivers and implications for emerging markets and broader global economy.

Thursday, August 8, 2024

9am HK

Quant Strategies and Backtests: Building Blocks and Best Practices

Andrew Li and Alex Cheema-Fox, State Street Associates| REGISTER NOW

We explore the philosophy, mechanisms, and logistics of quantitative strategies and backtesting. This includes how and why to formulate a backtest, modes of testing (e.g. cross-sectional relative value vs market timing), signal construction (simple linear vs machine learning), data wrangling considerations (e.g. ensuring data are point-in-time), and performance evaluation (e.g. risk-adjusted returns, turnover). Illustrative examples from various asset classes are presented.

Thursday, August 15, 2024

9am HK

Machine Learning Interpretation and Model Fingerprint

David Turkington and Huili Song, State Street Associates| REGISTER NOW

Machine learning brings exciting opportunities to investing by utilizing advanced models capable of processing complex nonlinearity and interaction patterns that are powerful for statistical predictions. However, applying machine learning to investing also faces challenges that differ from other disciplines where machine learning has excelled. The primary challenge is the black box problem – the lack of trust and transparency in understanding the models. In this summer session, we will discuss both the opportunities and challenges of applying machine learning to investing, and presenting our solutions that help human users comprehend how a machine learning model arrives at a prediction.

Thursday, August 22, 2024

9am HK

Geopolitics and Markets

Daniel Drezner, Tufts University’s Fletcher School of Law and Diplomacy, State Street Associates Academic Partner | REGISTER NOW

The past few years have highlighted a sea change in how governments approach their own economies and the global economy, adding an additional layer of uncertainty to markets. Geopolitical hotspots have the potential to generate significant economic fallouts. The year of elections is only half over, and the biggest votes are coming soon. Political analyst Daniel Drezner dissects the role that politics will be playing in the months to come.

Thursday, August 29, 2024

9am HK

Theory and Practice of Sentiment Analysis Using AI

Gideon Ozik, CFA, PhD, MKT MediaStats, State Street Associates Academic Partner | REGISTER NOW

Analysis of textual information pertaining to stocks, bonds, and currencies can provide investors with valuable insights into market trends and investor behaviors, as well as improve their ability to predict future fluctuations of asset prices.

In this session, we will cover various textual analysis methodologies, review advancements in AI and Large Language Models (LLM), and demonstrate practical applications such as prediction of stock returns using LLMs applied to media coverage, short squeezes using social media, treasury yields using media coverage of monetary policy, and introduce analysis of local media to forecast election outcomes.

Join us for the 2024 State Street Summer Sessions Webinar Series

Time to review the fundamentals of finance and investing! Even the most sophisticated investors can benefit from an occasional tune up. Join us for our 4th annual State Street Summer Sessions, where our team of academic and industry experts will go back to basics and cover the core principles of modern investing.

Connecting theory to practice, our presenters will cover topics including inflation, liquidity, and private markets into context. We have plenty of new sessions this year, in addition to the most popular sessions from last year. You can register for specific seminars or join us for them all. So close your email, silence your phone, and prepare some good questions. We’ll see you there!

Thursday June 27, 2024

9am EST

Geopolitics and Markets

Daniel Drezner, Tufts University’s Fletcher School of Law and Diplomacy, State Street Associates Academic Partner | Replay Coming Soon

The past few years have highlighted a sea change in how governments approach their own economies and the global economy, adding an additional layer of uncertainty to markets. Geopolitical hotspots have the potential to generate significant economic fallouts. The year of elections is only half over, and the biggest votes are coming soon. Political analyst Daniel Drezner dissects the role that politics will be playing in the months to come.

Tuesday, July 9, 2024

11am EST

Generative AI, Climate Solutions and Investment Implications

George Serafeim, Harvard Business School, State Street Associates Academic Partner| Replay Coming Soon

Presenting an application of Generative AI to identify climate technologies and innovation and the implications for growth, risk and valuation across different sectors of the economy.

Thursday, July 11, 2024

9am EST

How Central Banking Relates to Markets and Economies

Robin Greenwood, Harvard Business School, State Street Associates Academic Partner| Replay Coming Soon

In an increasingly interconnected world, it is impossible to succeed as an investor without a firm grasp on economic fundamentals and policy levers. In this session, Robin Greenwood ꟷ the George Gund Professor of Finance ꟷ will review the fundamental tenets of central banking with a focus on the main questions global investors should be thinking about in 2024.

Tuesday, July 16, 2024

10am EST

The Limits of Diversification

Will Kinlaw, Senior Managing Director, Head of Global Markets Research, State Street Global Markets | Replay Coming Soon

To diversify is one of the fundamental tenets of investing. Yet what seems straightforward in theory is complex in practice. Correlations can be asymmetric and unstable through time. Moreover, correlations measured over shorter intervals do not necessarily extrapolate to longer intervals. This presentation will synthesize more than 10 years of published research into these questions, analyze the challenge from a new perspective, and propose actionable solutions to help investors construct more resilient portfolios.

Thursday, July 18, 2024

10am EST

Inflation Explained: Measurement, Causes, and Latest Trends

Alberto Cavallo, Harvard Business School, State Street Associates Academic Partner| REGISTER NOW

The recent trends indicate that the inflation crisis is ending. However, central banks and investors remain vigilant and cautious about the potential future trajectory, reflecting the persistent uncertainties in the economic landscape. In this session, Alberto Cavallo ꟷ the Thomas S. Murphy Professor of Business Administration at Harvard Business School, co-founder of PriceStats, and member of the Technical Advisory Committee of the U.S. Bureau of Labor Statistics (BLS) ꟷ will discuss the fundamentals of how inflation is measured, what drives it, and how to think about the risk to investors in 2025

Tuesday, July 23, 2024

9am EST

Investing in Private Markets

Josh Lerner, Harvard Business School, State Street Associates Academic Partner| REGISTER NOW

Throughout 2023 and the first half of 2024, private equity faced enormous challenges, navigating lower capital inflow, slower exit activity, decreased valuations and higher capital costs. In this lecture, Harvard Business School professor Josh Lerner will discuss the major factors to consider when investing in today's market conditions.

Professor Lerner will provide insight into the drivers of the historic private equity (PE) boom, current trends that are impacting the direction of the market, and secular shifts that will influence the long-term outlook of PE. The content will draw from a combination of academic research, industry data, and expert insights to provide a 360-degree view of the market landscape. From this lecture, investors will gain a foundation for positioning themselves for success amidst present and future market dynamics.

Thursday July 25, 2024

10am EST

Theory and Practice of Sentiment Analysis Using AI

Gideon Ozik, CFA, PhD, MKT MediaStats, State Street Associates Academic Partner | REGISTER NOW

Analysis of textual information pertaining to stocks, bonds, and currencies can provide investors with valuable insights into market trends and investor behaviors, as well as improve their ability to predict future fluctuations of asset prices.

In this session, we will cover various textual analysis methodologies, review advancements in AI and Large Language Models (LLM), and demonstrate practical applications such as prediction of stock returns using LLMs applied to media coverage, short squeezes using social media, treasury yields using media coverage of monetary policy, and introduce analysis of local media to forecast election outcomes.

Tuesday, July 30, 2024

9am EST

Understanding Chinese Policies and Cross Asset Implications

Ben Luk and Yuting Shao, State Street Global Markets Research | REGISTER NOW

China’s increasing importance not only in emerging markets but also globally means investors are closely following every move out of Beijing. Meanwhile, with China’s post-Covid pent-up demand start to run out of steam, continued weak prices and property sector slump underpin concerns on whether China is able to turn the macro economy around. What’s more, the 3rd Plenum and upcoming US general elections add another layer of policy and geopolitical uncertainty. In this summer session, Ben Luk and Yuting Shao take a deep dive into China’s macro economy and asset classes to try to understand the dynamics of underlying drivers and implications for emerging markets and broader global economy.

Thursday, August 1, 2024

9am EST

Relevance-Based Prediction: A Transparent and Adaptive Alternative to Machine learning

Mark Kritzman, Founding Partner, State Street Associates, State Street Global Markets Founding Partner, CEO, Windham Capital Management, LLC, Chairman, Windham’s Investment Committee | REGISTER NOW

Relevance-based prediction is a model-free approach to prediction that forms predictions as relevance-weighted averages of observed outcomes. The relevance weights are composed of similarity and informativeness, which are both measured as Mahalanobis distances. This prediction method deals with complexities that are beyond the reach of conventional prediction techniques such as linear regression analysis, and it does so in a way that is more transparent, more adaptive, and more theoretically justified than widely used machine learning algorithms.

Tuesday August 6, 2024

9am EST

Quant Strategies and Backtests: Building Blocks and Best Practices

Andrew Li and Alex Cheema-Fox, State Street Associates| REGISTER NOW

We explore the philosophy, mechanisms, and logistics of quantitative strategies and backtesting. This includes how and why to formulate a backtest, modes of testing (e.g. cross-sectional relative value vs market timing), signal construction (simple linear vs machine learning), data wrangling considerations (e.g. ensuring data are point-in-time), and performance evaluation (e.g. risk-adjusted returns, turnover). Illustrative examples from various asset classes are presented.

Thursday, August 8, 2024

9am EST

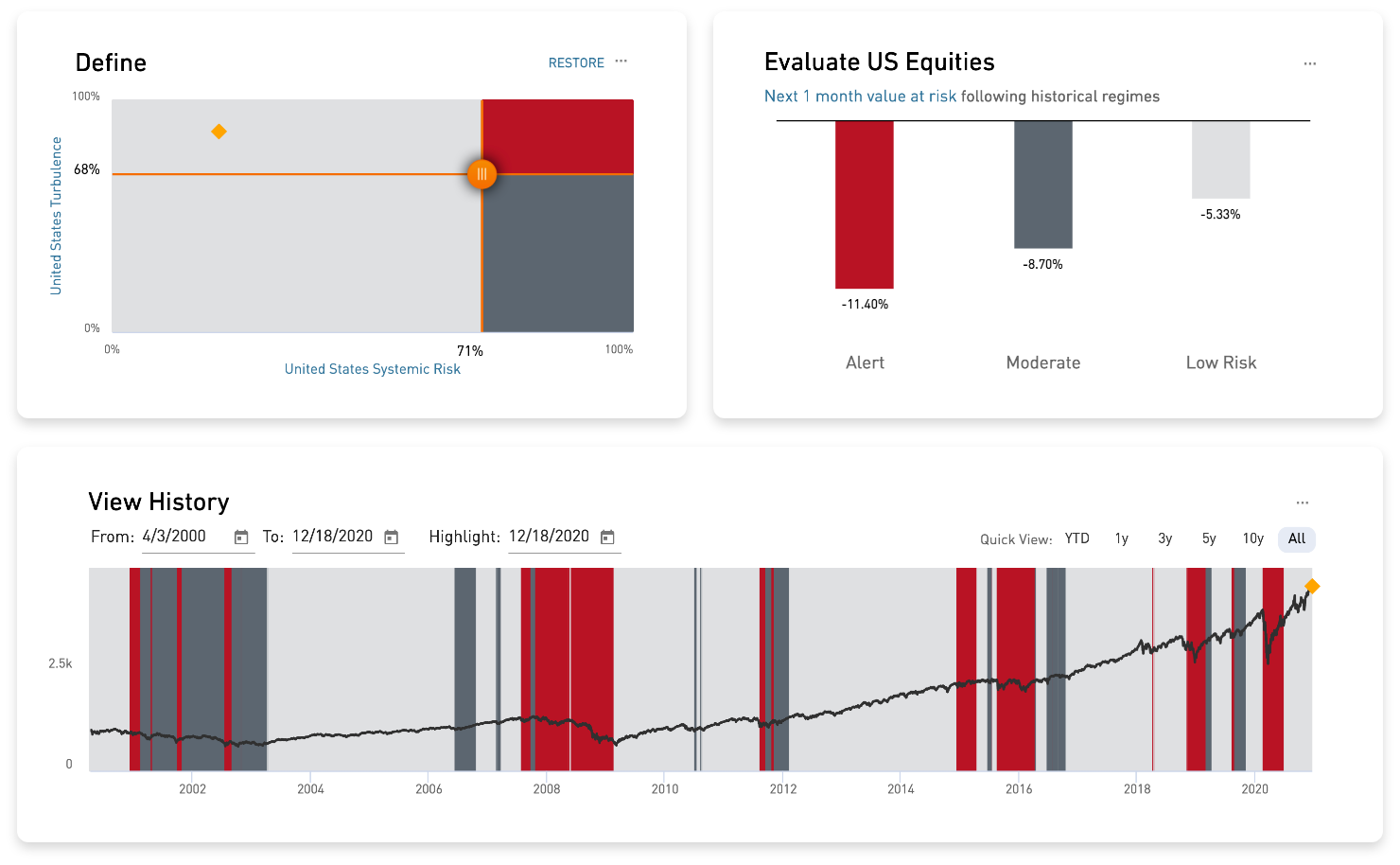

Addressing Portfolio Risk and Regimes

Meg Czasonis, State Street Associates | REGISTER NOW

Investing always entails risk, and it must be managed. But risk is a multidimensional concept which makes it challenging to measure, and even more challenging to control. In this presentation, Megan Czasonis, head of Portfolio Management Research at State Street Associates, will discuss the benefits and limitations to a range of statistical risk measures—from conventional notions of volatility and value-at-risk to more intricate measurement of losses—as well as conducing regime-specific stress tests and managing portfolio risk.

Tuesday August 13, 2024

10am EST

Machine Learning Interpretation and Model Fingerprint

David Turkington and Huili Song, State Street Associates| REGISTER NOW

Machine learning brings exciting opportunities to investing by utilizing advanced models capable of processing complex nonlinearity and interaction patterns that are powerful for statistical predictions. However, applying machine learning to investing also faces challenges that differ from other disciplines where machine learning has excelled. The primary challenge is the black box problem – the lack of trust and transparency in understanding the models. In this summer session, we will discuss both the opportunities and challenges of applying machine learning to investing, and presenting our solutions that help human users comprehend how a machine learning model arrives at a prediction.

Tuesday, August 20, 2024

11am EST

The Evolution of Crypto Markets

Antoinette Schoar, MIT Sloan School of Management, State Street Associates Academic Partner | REGISTER NOW

Recent developments in the crypto market saw an increasing entry of traditional financial institutions and an expanding role for centralized exchanges. We explore the implications of these trends for systemic risk, data privacy and transparency, as well as consumer financial protection.

Tuesday August 27, 2024

10am EST

Understanding Market Liquidity

Ronnie Sadka, Boston College Carroll School of Management, State Street Associates Academic Partner | REGISTER NOW

Despite having been a key determinant of asset prices for decades, liquidity is still a difficult concept to define and properly understand. In this session, we shall review the theoretical economic underpinnings of market liquidity, and discuss its multi-faceted role in determining market prices and investment strategies. Alternative measures will be introduced as well as practical applications. Further attention will be devoted to the impact of recent market trends, such as retail trading and social media on market liquidity.

By Mark Kritzman, Huili Song, and David Turkington.

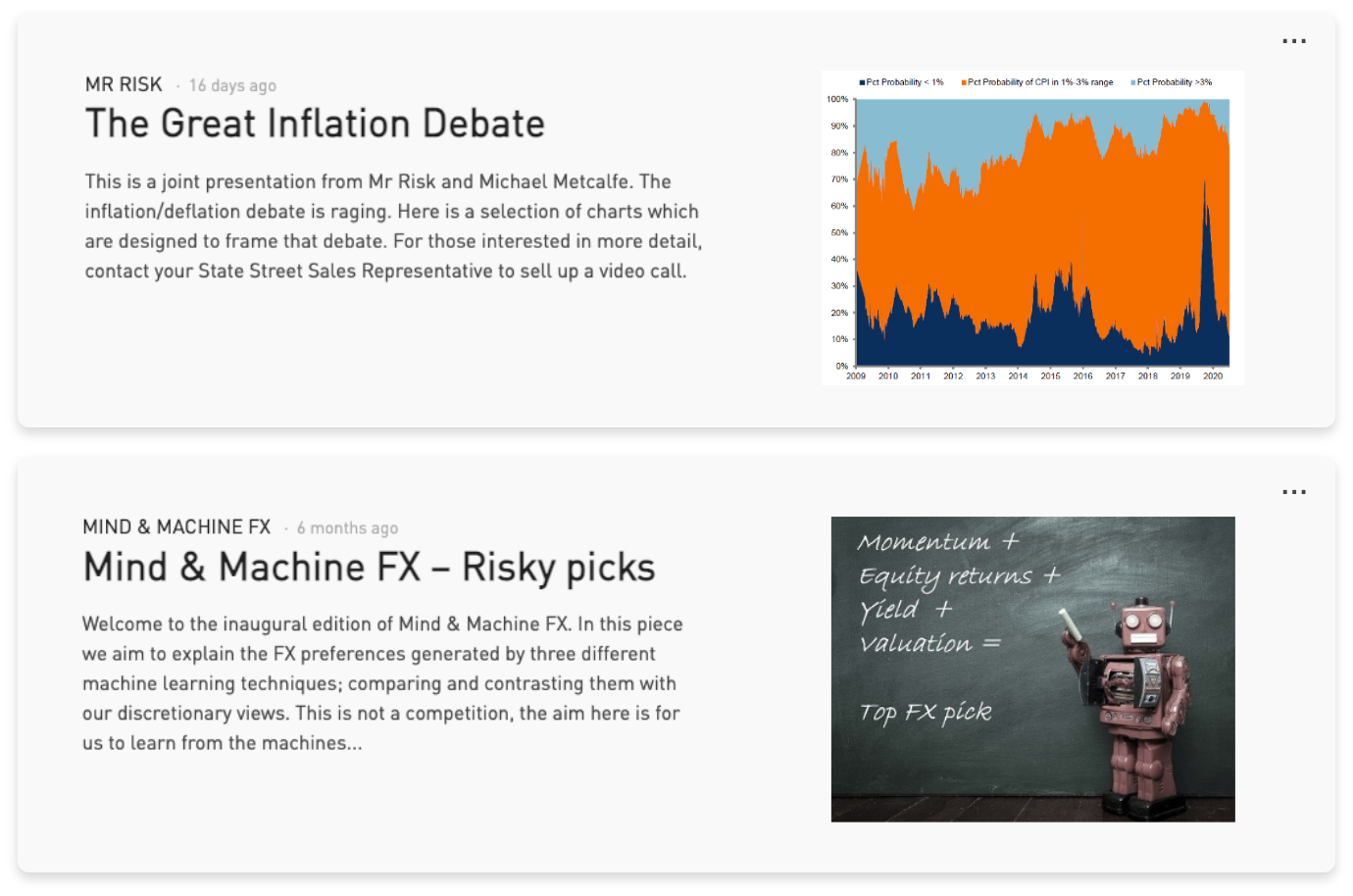

We show how warping time renders stock price bubbles comparable, revealing common patterns that investors can use to detect new bubbles and time exposure to their rise and fall.

Can history offer a guide to understanding future stock-price bubbles? The answer is yes, but we have to learn how to bend time. Thankfully, a method called dynamic time warping offers the solution. Previous bubbles occur at different paces: some rise fast and others slowly, some crash after weeks while others persist for years. By stretching and shrinking the timeline of thousands of bubble events, we systematically place them side by side and find more commonalities in their attributes' patterns than a calendar view suggests. We then use various attributes collectively to assess the likelihood of a developing bubble and identify its lifecycle stage, from inception to peak to conclusion. A simple trading rule seeking to invest in bubble run-ups and post-crash over reactions, while avoiding the peak, generates compelling performance in out-of-sample backtests.

By Alexander Cheema-Fox, Megan Czasonis, Piyush Kontu and George Serafeim

We explore the world’s first set of financial accounting data on firms’ sustainable activities.

Though sustainable investing has grown in popularity over the past decade, measuring sustainability remains a key challenge. Investors often rely on environmental criteria—such as analyst ratings and carbon emissions—that are insufficient or rely on qualitative analysis. However, for the first time, with the advent of the EU’s Taxonomy for Sustainable Activities, investors have access to financial accounting data that follows standardized and transparent criteria for quantifying the percentage of a firm’s revenues and expenditures that align with sustainable activities. In a recent paper, we explore this novel dataset for a cross-section of large European firms, documenting patterns and analysing how firms’ aligned activities relate to fundamentals and environment ratings. We find that the EU Taxonomy data provide information that is distinct from existing sources and offers insights that can help investors and regulators, alike.

By Megan Czasonis, Mark Kritzman, and David Turkington.

We propose a new currency hedging technique called full-scale hedging, which accounts for the complexities of diversification.

Diversification is nuanced and summary statistics, such as correlation, fail to capture complexities that lie below the surface. For investors, these complexities matter—accounting for them can make the difference between an effective, or ineffective, hedging strategy. In the case of currencies, investors often determine risk-minimizing hedge ratios based on the portfolio’s betas to those currencies or with mean-variance optimization. In both cases, the optimal solution depends crucially on the correlation between the currencies and assets in the portfolio. But correlation is an unreliable estimate of the diversification investors actually care about: the co-occurrences of the cumulative returns of the portfolio and currencies over the investment horizon. We propose a new currency hedging technique called full-scale hedging, which addresses these challenges by considering the full distribution of co-occurrences between currencies and the portfolio.

By Mark Kritzman, Cel Kulasekaran, and David Turkington.

We introduce a more flexible way to forecast risk and return based on the most relevant historical periods.

As economic regimes shift, investors who choose to adapt must build portfolios that match their evolving view of the future. Forecasts of asset risk and return should account for regime-specific trends. The question is how to implement this idea in practice. Typically, an analyst will find every time an economic indicator like inflation or growth was above (or below) a fixed threshold, and she will pay equal attention to every data point that qualifies. While this approach seems sensible, it also has dramatic limitations. Ideally, we should recognize that the regime labels of past events are not simple yes/no answers; they are ambiguous. We should pay more attention to some past events than others, based on their relevance. We should weigh the impact of many variables rather than just one. And we should accept that some events are relevant to more than one regime. A statistical measure of relevance, based on the Mahalanobis distance, empowers investors to analyze these nuances of regimes with rigor. We show how to estimate expected risk and return as weighted averages of the relevant past, and how these forecasts of asset performance lead to intuitive portfolios optimized for a range of possible regimes.

By Alberto Cavallo, Megan Czasonis, William Kinlaw, and David Turkington

We show how unstructured price data from online retailers can anticipate inflation shifts and enable investors to hedge inflation risk dynamically.

Investors and academics have been studying inflation, and how it affects asset prices, for more than four decades. Their findings are discouraging: there just aren’t many assets that offer a reliable hedge against inflation. Treasury Inflation Protected Securities (TIPS), introduced in 1997, represent the only U.S. asset class whose returns are linked explicitly to inflation, but they have drawbacks. For one, their yields are lower than normal treasury bonds during most periods, when inflation is low. In an ideal world, investors would capture the higher yield of treasuries when inflation is benign and shift into TIPS to capture their price appreciation when inflation expectations rise. To do this, they need a good leading indicator of the market’s collective inflation expectations. In this paper, we show how unstructured price data from online retailers, spanning millions of products captured by PriceStats®, can be used to forecast the relative performance of TIPS and treasuries.

By Musa Amadeus, Rajeev Bhargava, Michael Guidi, Marvin Loh, Gideon Ozik, and Ronnie Sadka

Read between the lines: The measurement of Fed members’ monetary tones facilitates an understanding of the dynamics of the individual monetary policy stances underlying aggregated, consensus (top-down) Fed tones.

Amadeus et al. (2022) observe that aggregated, consensus (top-down) central bank monetary tones in media contain predictive information pertaining to future weekly yield fluctuations. This article elucidates the more granular, stratified (bottom-up) dynamics underlying these relations. The predictive relationships between Fed consensus tones and yields are primarily driven by an underreaction of yields to the Fed Board of Governors’ tones between monetary policy meetings. Over short-term horizons, Treasury yields appear to price voting FOMC members’ (Board of Governors’ and Regional Bank Presidents’) tones while relatively longer-term horizon yields appear to reflect both voting and non-voting tones. Fed Regional Bank Presidents’ monetary tones are more responsive to regional inflation fluctuations than to unemployment. The analysis of the heterogeneous impacts of Fed members’ tones over distinct yield horizons provides insights pertaining to the pricing of voting and non-voting Fed members’ tones in Treasury markets.

By Megan Czasonis, Mark Kritzman, and David Turkington

Relevance-based prediction is a new approach to data-driven forecasting that serves as a favorable alternative to both linear regression analysis and machine learning. It follows from two seminal scientific innovations: Prasanta Mahalanobis’ distance measure and Claude Shannon’s information theory. Relevance-based prediction rests on three key tenets:

1) relevance, which measures the importance of an observation to a prediction;

2) fit, which measures the reliability of each individual prediction task;

3) codependence, which holds that the choice of observations and predictive variables should be determined jointly for each individual prediction task

By William Kinlaw, Mark Kritzman, and David Turkington

Conventional statistics hide important realities that investors need to know.

The correlation coefficient often fails to capture what really matters to investors. There are two reasons for this. First, investors often measure correlations using monthly data and assume that they also hold over one-year, five-year or ten-year periods. Unfortunately, in the real world, they often don’t. The second reason has to do with a fundamental misconception about diversification. The fact is, investors don’t always want it. Sure, they want it on the downside, in order to offset the poor performance of one or more assets. But on the upside they prefer all assets to rise in unison, which is the opposite of diversification. Put differently, they’d be happy to place their eggs, conveniently, in a single basket provided nobody steals it. Our research shows that correlations can vary through time based on a range of conditions including the level of interest rates, the degree of turbulence in financial markets, and the performance of major equity markets. Overall, our findings challenge the notion that returns evolve as a simple “random walk,” a critical pre-condition without which we must interpret the correlation coefficient distrustfully. To address these issues, we introduce the notion of co-occurrence and offer a new perspective on how investors should diversify portfolios.

2023 State Street Foundations of Investing Seminar Series

This year we reviewed the fundamentals of finance and investing! Even the most sophisticated investors can benefit from an occasional tune-up. For our third annual State Street Foundations of Investing Seminar Series, our team of academic and industry experts went back to basics, covering the core principles of modern investing.

Connecting theory to practice, our Global Markets research experts and academic partners covered topics such as inflation, liquidity, private markets, and much more. Check back here for the replay videos when they become available.

Thursday, June 29th 2023 at 9:00am HKT

How Carbon Emissions Connect to Investing

George Serafeim, Harvard Business School (bio) | REPLAY AVAILABLE

Presenting a framework on how carbon emissions link to growth, risk, and valuation across different sectors of the economy.

Thursday, July 13th 2023 at 9:00am HKT

The Prospects For and Implications of Chinese Financial Liberalization

Dwyfor Evans and Yuting Shao (bio), State Street Macro Strategy | REPLAY AVAILABLE

Currency control has been a hallmark of Chinese economic policy. However, as economic development matures, the need to foster internal capital markets, policy orthodoxy and, ultimately, liberalize the capital account amid the broader prospects for renminbi internationalization becomes more pressing. We take a close look at monetary policy and interest rate liberalization over the years, including the growth of the offshore market that has enabled China to experiment with reforms. Its commitment and timing around further liberalization remains a matter of conjecture, beyond the limited scope of ‘Connect’ programs tied to Hong Kong. As China’s economic and political influence expands, how will Chinese authorities balance their competing priorities, such as: gaining access to international markets, implementing monetary policy reforms and maintaining institutional stability? Meanwhile, how should institutional investors position themselves in Chinese asset markets and navigate through the economic and financial risks that ensue?

Thursday, July 20th 2023 at 9:00am HKT

Relevance-Based Prediction

Mark Kritzman, MIT Sloan School of Management (bio) | REPLAY AVAILABLE

This presentation describes a new mathematical system for predicting future outcomes based on a statistical concept called relevance, which gives a mathematically precise and theoretically justified measure of the importance of an observation to a prediction. It also describes fit, which measures a specific prediction’s reliability, thereby offering guidance about how committed one should be to its predictions. And it shows how fit identifies the uniquely optimal combination of observations and predictive variables for each individual prediction task. This new relevance-based prediction system addresses complexities that are beyond the capacity of conventional prediction models, but in a way that is more transparent, more flexible, and less arbitrary than widely used machine learning algorithms.

Thursday, July 27th 2023 at 9:00am HKT

Narrative Economics in Practice

Gideon Ozik, MKT MediaStats (bio) | REPLAY AVAILABLE

Empirical measures of narratives can help investors quantify attention to stories and in turn, enhance portfolio returns. The summer session will discuss how media-derived measures of narratives can explain market-wide moves and how investors may use such measures to assess portfolio exposures to (otherwise) intangible risks.

We will examine specific applications of narrative economics to improve portfolio and risk management processes using a variety of narratives including inflation, escalation of nuclear tensions and civil unrest. We will then discuss how narrative-conscious strategies may improve stress scenario analysis and asset allocation. Finally, we will review methods by which investors may gain or hedge financial exposure to emerging themes by constructing portfolios of narrative-sensitive assets.

Thursday, August 3rd 2023 at 9:00am HKT

An Overview of Private Markets Investing

Josh Lerner, Harvard Business School (bio) | REPLAY AVAILABLE

After a historic boom leading into 2022, the private market now sits at an inflection point. Uncertainty is high, making investors' job of navigating the current private market landscape difficult. In this lecture, Harvard Business School professor Josh Lerner will discuss the major factors to consider when investing in today's market conditions. Professor Lerner will give insight on the drivers of the historic private equity (PE) boom, current trends that are impacting the direction of the market, and secular shifts that will influence the long-term outlook of PE. The content will draw from a combination of academic research, industry data, and expert insights to provide a 360-degree view of the market landscape. From this lecture, investors will develop a backdrop for positioning themselves for success amidst present and future market dynamics.

Thursday, August 10th 2023 at 9:00am HKT

Defining and Measuring Inflation

Alberto Cavallo, Harvard Business School (bio) | REPLAY AVAILABLE

As the global economy reemerges from the global COVID-19 pandemic and central banks raise interest rates to contain prices, inflation risk looms large in the minds of investors. In this session, Alberto Cavallo — the Edgerley Family Professor at Harvard Business School, co-founder of PriceStats, and member of the Technical Advisory Committee of the U.S. Bureau of Labor Statistics (BLS) — will discuss the fundamentals of how inflation is measured, what drives it, and how to think about the risk to investors in 2023.

Thursday, August 17th 2023 at 9:00am HKT

How Behavioral Biases Impact Markets

Alex Cheema-Fox, State Street Associates (bio) | REPLAY AVAILABLE

Sophisticated investors have long recognized that market participants are not always 100 percent rational and that behavioral biases and trends can influence markets. It is essential that investors learn to recognize these patterns — both in themselves and the markets at large — as well as how to measure and account for them when managing portfolios. In this session, Alex Cheema-Fox, Head of Investor Behavior Research at State Street Associates — reviews key principles of behavioral finance with a practical focus on implications for investment management.

Thursday, August 24th 2023 at 9:00am HKT

Central Banking Strategies and Challenges

Robin Greenwood, Harvard Business School (bio) | REPLAY AVAILABLE

In an increasingly interconnected world, it is impossible to succeed as an investor without a firm grasp on economic fundamentals and policy levers. In this session, Robin Greenwood — the George Gund Professor of Finance — will review the fundamental tenets of central banking with a focus on the main questions global investors should be thinking about in 2023.

Thursday, August 31st 2023 at 9:00am HKT

Currency Hedging and Currency Factors

David Turkington and Megan Czasonis, State Street Associates (bio) | REPLAY AVAILABLE

When investors seek returns in foreign markets, they inevitably gain exposure to currency risk. Efficiently managing this risk and turning it into an opportunity to enhance performance requires a well-defined currency process. In this presentation, Megan Czasonis (Head of Portfolio Management Research at State Street Associates) and David Turkington (Head of State Street Associates) will discuss how to approach currency hedging, first from the perspective of managing risk, and second from the perspective of generating active returns. In doing so, they’ll discuss how to balance the risk and diversification properties of foreign currencies, show how factors — both traditional and new — can explain currency moves, and identify which factors have worked well lately and which have broken down.

2023 State Street Summer Sessions Webinar Series

This summer we reviewed the fundamentals of finance and investing! Even the most sophisticated investors can benefit from an occasional tune-up. For our third annual State Street Summer Sessions, our team of academic and industry experts went back to basics, covering the core principles of modern investing.

Connecting theory to practice, our Global Markets research experts and academic partners covered topics such as inflation, liquidity, private markets, and much more. Replay videos are starting to get added, so check back here for updates!

CPE credit is offered for those who are CFA charterholders. You can earn 1 hour of credit for attending an hour long Summer Session. To qualify, you must attend the webinar in its entirety, answer the three polling questions throughout the webinar, and submit the Credit Request Form. Please reach out to Insights@StateStreet.com to request your form. We will also send out the form after the webinar. You must specify which session you are requesting credit for.

To view our APAC Region Foundations of Investing Seminar Series, click here.

Thursday June 15, 2023

11 a.m. EST

How Carbon Emissions Connect to Investing

George Serafeim, Harvard Business School (bio) | REPLAY AVAILABLE

Presenting a framework on how carbon emissions link to growth, risk, and valuation across different sectors of the economy.

Tuesday June 20, 2023

9 a.m. EST

Understanding Market Liquidity

Ronnie Sadka, Boston College Carroll School of Management (bio) | REPLAY AVAILABLE

Despite having been a key determinant of asset prices for decades, liquidity is still a difficult concept to define and properly understand. In this session, we shall review the theoretical economic underpinnings of market liquidity, and discuss its multi-faceted role in determining market prices and investment strategies. Alternative measures will be introduced as well as practical applications. Further attention will be devoted to the impact of recent market trends, such as retail trading and social media on market liquidity.

Thursday June 22, 2023

10 a.m. EST

How Behavioral Biases Impact Markets

Alex Cheema-Fox, State Street Associates (bio) | REPLAY AVAILABLE

Sophisticated investors have long recognized that market participants are not always 100 percent rational and that behavioral biases and trends can influence markets. It is essential that investors learn to recognize these patterns — both in themselves and the markets at large — as well as how to measure and account for them when managing portfolios. In this session, Alex Cheema-Fox, Head of Investor Behavior Research at State Street Associates — reviews key principles of behavioral finance with a practical focus on implications for investment management.

Thursday June 29, 2023

9 a.m. EST

An Overview of Private Markets Investing

Josh Lerner, Harvard Business School (bio) | REPLAY AVAILABLE

After a historic boom leading into 2022, the private market now sits at an inflection point. Uncertainty is high, making investors' job of navigating the current private market landscape difficult. In this lecture, Harvard Business School professor Josh Lerner will discuss the major factors to consider when investing in today's market conditions. Professor Lerner will give insight on the drivers of the historic private equity (PE) boom, current trends that are impacting the direction of the market, and secular shifts that will influence the long-term outlook of PE. The content will draw from a combination of academic research, industry data, and expert insights to provide a 360-degree view of the market landscape. From this lecture, investors will develop a backdrop for positioning themselves for success amidst present and future market dynamics.

Tuesday July 11, 2023

11 a.m. EST

The Limits of Diversification

Will Kinlaw, State Street Associates (bio) | REPLAY AVAILABLE

To diversify is one of the fundamental tenets of investing. Yet what seems straightforward in theory is complex in practice. Correlations can be asymmetric and unstable through time. Moreover, correlations measured over shorter intervals do not necessarily extrapolate to longer intervals. This presentation will synthesize more than 10 years of published research into these questions, analyze the challenge from a new perspective, and propose actionable solutions to help investors construct more resilient portfolios.

Thursday July 13, 2023

9 a.m. EST

The Prospects For and Implications of Chinese Financial Liberalization

Dwyfor Evans and Yuting Shao (bio), State Street Macro Strategy | REPLAY AVAILABLE

Currency control has been a hallmark of Chinese economic policy. However, as economic development matures, the need to foster internal capital markets, policy orthodoxy and, ultimately, liberalize the capital account amid the broader prospects for renminbi internationalization becomes more pressing. We take a close look at monetary policy and interest rate liberalization over the years, including the growth of the offshore market that has enabled China to experiment with reforms. Its commitment and timing around further liberalization remains a matter of conjecture, beyond the limited scope of ‘Connect’ programs tied to Hong Kong. As China’s economic and political influence expands, how will Chinese authorities balance their competing priorities, such as: gaining access to international markets, implementing monetary policy reforms and maintaining institutional stability? Meanwhile, how should institutional investors position themselves in Chinese asset markets and navigate through the economic and financial risks that ensue?

Tuesday July 18, 2023

9 a.m. EST

Introduction to Exchange Rates, Overshoots in Theory and in Practice

Michael Metcalfe, State Street Macro Strategy (bio) | REPLAY AVAILABLE

Exchange rates are fundamentally crucial for inflation, growth and international portfolios, as well as the cost of your summer vacation. Yet even though they are one of the deepest and most liquid financial markets, they remain one of the hardest to value and (sometimes) to understand. While theory suggests that exchange rates should calibrate around interest rate differentials or equalizing the prices of internationally tradeable goods or a broader set of equilibriums that produce internal and external balances in an economy. In practice, exchange rates are able to deviate substantially from such theoretical constructs as they jump between different macro drivers. With reference to ongoing correction of the US dollar’s overshoot that is being seen in 2023, we offer a guide as to how currency investment processes aim to cope with such an unruly asset class.

Thursday July 20, 2023

10 a.m. EST

Relevance-Based Prediction

Mark Kritzman, MIT Sloan School of Management (bio) | REPLAY AVAILABLE

This presentation describes a new mathematical system for predicting future outcomes based on a statistical concept called relevance, which gives a mathematically precise and theoretically justified measure of the importance of an observation to a prediction. It also describes fit, which measures a specific prediction’s reliability, thereby offering guidance about how committed one should be to its predictions. And it shows how fit identifies the uniquely optimal combination of observations and predictive variables for each individual prediction task. This new relevance-based prediction system addresses complexities that are beyond the capacity of conventional prediction models, but in a way that is more transparent, more flexible, and less arbitrary than widely used machine learning algorithms.

Tuesday July 25, 2023

11 a.m. EST

Introduction to FX Options

Tim Graf, State Street Macro Strategy (bio) | REPLAY AVAILABLE

Derivative markets are one of the many drivers of spot markets for foreign currencies, but their effects are often underappreciated. In this session, Tim Graf provides a brief overview of FX option basics and focus on how flows related to option hedging can drive currency movements.

Thursday July 27, 2023

9 a.m. EST

Narrative Economics in Practice

Gideon Ozik, MKT MediaStats (bio) | REPLAY AVAILABLE

Empirical measures of narratives can help investors quantify attention to stories and in turn, enhance portfolio returns. The summer session will discuss how media-derived measures of narratives can explain market-wide moves and how investors may use such measures to assess portfolio exposures to (otherwise) intangible risks.

We will examine specific applications of narrative economics to improve portfolio and risk management processes using a variety of narratives including inflation, escalation of nuclear tensions and civil unrest. We will then discuss how narrative-conscious strategies may improve stress scenario analysis and asset allocation. Finally, we will review methods by which investors may gain or hedge financial exposure to emerging themes by constructing portfolios of narrative-sensitive assets.

Tuesday August 8, 2023

9 a.m. EST

DeFi: Important Lessons and the Path Ahead

Antoinette Schoar, MIT Sloan School of Management (bio) | REPLAY AVAILABLE

The fast-growing decentralized finance (DeFi) system aims to build a new financial architecture that does not rely on traditional intermediaries and reduces rents in the financial sector, but recent events have shown that it also generates formidable challenges for market participants and regulators. This talk discusses the mechanics behind DeFi and lays out potential risks and benefits of this new architecture using forensic analysis from the Terra Luna crash.

Thursday August 10, 2023

10 a.m. EST

Defining and Measuring Inflation

Alberto Cavallo, Harvard Business School (bio) | REPLAY AVAILABLE

As the global economy reemerges from the global COVID-19 pandemic and central banks raise interest rates to contain prices, inflation risk looms large in the minds of investors. In this session, Alberto Cavallo — the Edgerley Family Professor at Harvard Business School, co-founder of PriceStats, and member of the Technical Advisory Committee of the U.S. Bureau of Labor Statistics (BLS) — will discuss the fundamentals of how inflation is measured, what drives it, and how to think about the risk to investors in 2023.

Tuesday August 15, 2023

9 a.m. EST

Interpretable Machine Learning for Investing

Andrew Li, State Street Associates (bio) | REPLAY AVAILABLE

Machine learning brings exciting opportunities to investing as advanced models that process complex nonlinearity and interaction patterns are powerful for statistical predictions. Machine learning for investing also faces challenges that differ from other disciplines where machine learning has excelled. The most challenging aspect is the black box problem — the lack of trust and transparency in understanding the models. In this summer session we will discuss both the opportunities and challenges when it comes to applying machine learning to investing, and our solution that allows human users to understand how a machine learning model arrives at a prediction.

Tuesday August 22, 2023

11 a.m. EST

Currency Hedging and Currency Factors

David Turkington and Megan Czasonis, State Street Associates (bio) | REPLAY AVAILABLE

When investors seek returns in foreign markets, they inevitably gain exposure to currency risk. Efficiently managing this risk and turning it into an opportunity to enhance performance requires a well-defined currency process. In this presentation, Megan Czasonis (Head of Portfolio Management Research at State Street Associates) and David Turkington (Head of State Street Associates) will discuss how to approach currency hedging, first from the perspective of managing risk, and second from the perspective of generating active returns. In doing so, they’ll discuss how to balance the risk and diversification properties of foreign currencies, show how factors — both traditional and new — can explain currency moves, and identify which factors have worked well lately and which have broken down.

Thursday, August 24, 2023

11 a.m. EST

Central Banking Strategies and Challenges

Robin Greenwood, Harvard Business School (bio) | REPLAY AVAILABLE

In an increasingly interconnected world, it is impossible to succeed as an investor without a firm grasp on economic fundamentals and policy levers. In this session, Robin Greenwood — the George Gund Professor of Finance — will review the fundamental tenets of central banking with a focus on the main questions global investors should be thinking about in 2023.

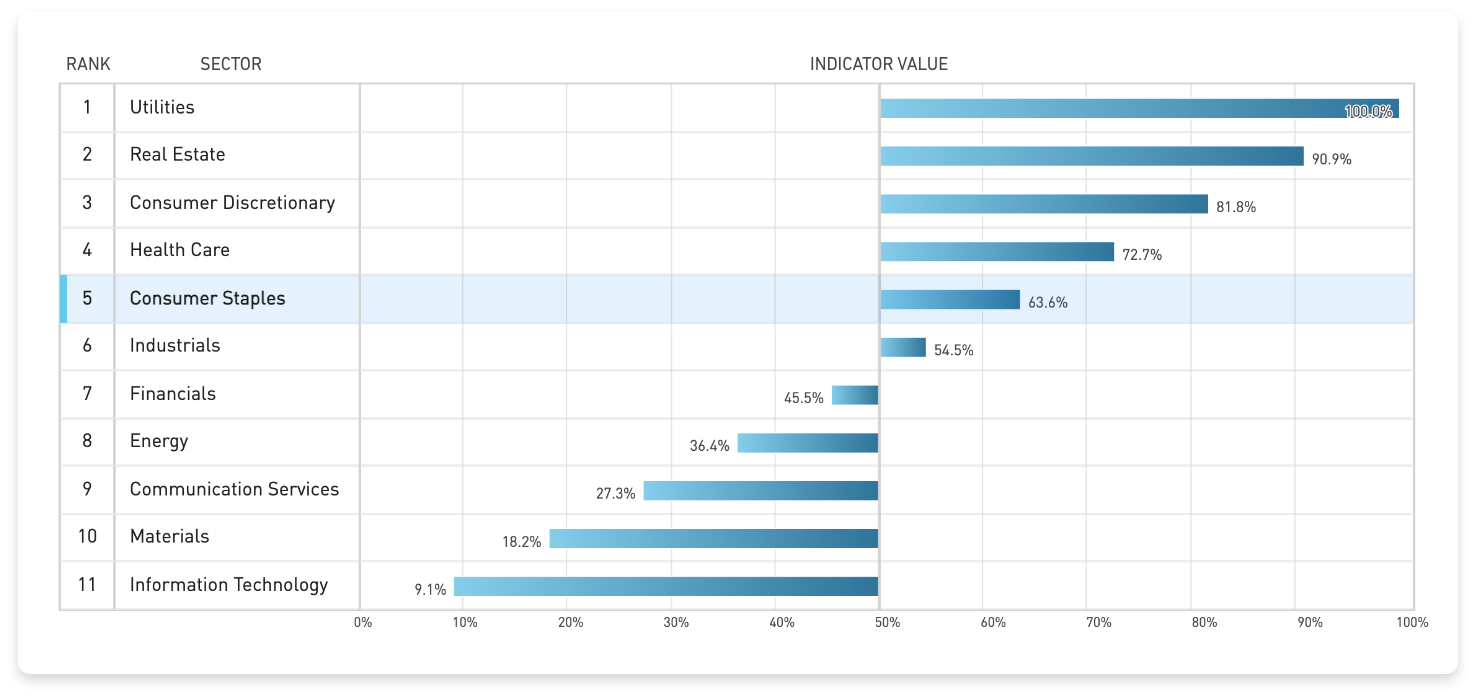

We define equity markets and sectors to be “frothy” when the probability of a future drawdown in prices is high. Using simple panel regressions, we analyze data across 80 countries and 400 country-sectors to identify and evaluate which factors--including issuance, volatility, the price path, and flow-based factors-- are most predictive of future sector-level drawdowns. We translate our predictive model into indicators for sector- and market-level froth.

Time to review the fundamentals of finance and investing! Even the most sophisticated investors can benefit from an occasional tune up. Watch replays from the 2022 State Street Summer Sessions webinar series, where our team of academic and industry experts went back to basics and covered the core principles of modern investing. Connecting theory to practice, our presenters put trends like inflation, cryptocurrencies and ESG investing into context.

How Media Narratives Drive Markets

Ronnie Sadka, Boston College Carroll School of Management | WATCH NOW

Investors' trading activity can be driven by their awareness of relevant narratives discussed in the marketplace. Quantifying such narratives can assist in understanding market price dynamics. In this session, Ronnie Sadka - the senior associate dean for faculty, chairperson and professor of Finance, and the Haub Family Professor at the Carroll School of Management, Boston College - reviewed the basics of behavioral finance and explained how investors should think about these principles in the modern era with a focus on the link between viral narratives and asset prices.

Introduction to Central Banking

Robin Greenwood, Harvard Business School | WATCH NOW

In an increasingly interconnected world, it is impossible to succeed as an investor without a firm grasp on economic fundamentals and policy levers. In this session, Robin Greenwood - the George Gund Professor of Finance - reviewed the fundamental tenets of central banking with a focus on the main questions global investors should be thinking about in 2022.

Introduction to FX Options

Tim Graf, State Street Macro Strategy | WATCH NOW

Derivative markets are one of the many drivers of spot markets for foreign currencies, but their effects are often underappreciated. In this session, Tim Graf provided a brief overview of FX option basics and focus on how flows related to option hedging can drive currency movements.

ESG Fundamentals

George Serafeim, Harvard Business School | WATCH NOW

While ESG investing has grown significantly in recent years, several phenomena raise questions about our ability to define the field of ESG investing. Difficulty to estimate its market size, derive consistent ratings of ESG performance, frequent accusations of ‘cheap talk’ by managers, and recent regulatory actions in both EU and US are signs of the challenge to define the field. In this session, George Serafeim - the Charles M. Williams Professor of Business Administration at Harvard Business School and academic partner at State Street Associates presented a conceptual framework clarifying the meaning of ESG investing by defining its objective, which sets a clear expectation about the outcomes from its application and its key characteristics. As a result, the framework enables investors to have a set of common premises as a basis for discussion, ask the right questions, and limit areas of judgement and unwanted discretion. For asset owners, the framework provides a guide for the evaluation and selection of asset managers and what outcomes to expect from the different approaches to ESG investing. For asset managers, the framework provides clarity about the actions needed to establish credibility in the market and how to create a shared understanding inside the organization about what the organization is trying to achieve.

Portfolio Construction: The Building Blocks of Optimal Diversification

Mark Kritzman, MIT Sloan School of Management and Will Kinlaw, State Street Associates | WATCH NOW

Most investors recognize the importance of portfolio diversification, but few are certain how to achieve it. Some academics and practitioners advocate simple heuristics, such as spreading bets equally, or in proportion to risk. But such basic approaches may leave money on the table. In this session, Mark Kritzman (State Street Associates Founding Partner and CEO of Windham Capital Management) and Will Kinlaw (head of Global Markets Research at State Street) – both coauthors of the book “Asset Allocation: From Theory to Practice and Beyond” – explored the tools and techniques necessary to implement more sophisticated diversification, quantified the benefits from these approaches, and discussed common pitfalls and guidance for achieving the most useful results.

Introduction to Investor Behavior

Alex Cheema-Fox, State Street Associates | WATCH NOW

Sophisticated investors have long recognized that market participants are not always 100 percent rational and that behavioral biases and trends can influence markets. It is essential that investors learn to recognize these patterns - both in themselves and the markets at large - as well as how to measure and account for them when managing portfolios. In this session, Alex Cheema-Fox Head of Flow and Positioning Research at State Street Associates - reviewed key principles of behavioral finance with a practical focus on implications for investment management.

Statistical Prediction: Empirical Methods Grounded in Theory

Mark Kritzman, MIT Sloan School of Management and David Turkington, State Street Associates | WATCH NOW

Classical statistics originated centuries ago, mainly for purposes of gambling and astronomical navigation. Today we are challenged to predict outcomes of more complex systems, such as social behavior. Machine learning can aid in these tasks, but suffers from many challenges of its own. In this session, Mark Kritzman (State Street Associates Founding Partner and CEO of Windham Capital Management) and David Turkington (head of State Street Associates) – both coauthors of a new book “Prediction Revisited: The Importance of Observation” – revealed the building blocks of data-driven prediction from a fresh perspective whereby data represents “experiences” rather than variables, starting with the information theory foundation for linear regression and building to more sophisticated nonlinear and conditional enhancements to predictive modeling.

Measuring and Managing Portfolio Risk

Megan Czasonis, State Street Associates | WATCH NOW

Investing always entails risk, and it must be managed. But risk is a multidimensional concept which makes it challenging to measure, and even more challenging to control. In this session, Megan Czasonis – co-author of “Prediction Revisited: The Importance of Observation” and head of Portfolio Management Research at State Street Associates, discussed the benefits and limitations to a wide range of statistical risk measures, from conventional notions of volatility and value-at-risk to the more intricate measurement of losses that may occur for different time scales and path dependencies. Further extensions include risk attribution for multiple assets in a portfolio and conducting regime-specific stress tests.

Introduction to Private Markets

Josh Lerner, Harvard Business School | WATCH NOW

Private markets have grown dramatically in recent years as investors have sought the higher returns and diversification these assets can introduce to portfolios. These potential benefits also come with a range of complexities. In this course, Josh Lerner - the Jacob H. Schiff Professor of Investment Banking at Harvard Business School, where he established and teaches doctoral courses on entrepreneurship, teaches in the Owners-Presidents-Managers Program, and leads executive courses on private equity - reviewed the core attributes of private markets and what investors need to know today. Josh is an academic partner at State Street Associates, as well as the author of multiple books including “Patient Capital” and “The Money of Invention”.

Making Sense of Machine Learning

Andrew Yimou Li, State Street Associates | WATCH NOW

Machine learning presents some tough questions when applied to investing. What do you do when a model, which has always worked well in the past, all of a sudden predicts something that seems crazy, but you don’t know why? Is it insane… or genius? And how would you explain your decision to your own clients or investors? Machines have a lot to say, if we can figure out how to listen. Andrew Li, Quantitative Researcher at State Street Associates, discussed key principles of machine learning, model interpretability frameworks, and how machines and humans can help each other improve.

Introduction to Blockchain and Cryptocurrencies

Antoinette Schoar, MIT Sloan School of Management | WATCH NOW

As the financial sector adjusts to the far-reaching implications of the blockchain revolution and debates the long-term viability of cryptocurrencies, investors need to understand the fundamental concepts that underpin digital assets. In this session, Antoinette Schoar - the Stewart C. Meyers-Horn Family Professor of Finance at the MIT Sloan School of Management - covered the basics of blockchain, cryptocurrencies, and digital assets with a focus on how they could change financial markets and the risks and limitations that investors need to understand.

Introduction to Inflation

Alberto Cavallo, Harvard Business School | WATCH NOW

As the global economy re-emerges from the global Covid-19 pandemic and central banks around the world continue to hold interest rates near historic lows, inflation risk looms large in the minds of investors. In this session, Alberto Cavallo - the Edgerley Family Associate Professor at Harvard Business School, co-founder of PriceStats, and member of the Technical Advisory Committee of the U.S. Bureau of Labor Statistics (BLS) - discussed the fundamentals of how inflation is measured, what drives it, and how to think about the risk to investors in 2022.

Introduction to exchange rates, overshoots in theory and in practice

Michael Metcalfe, State Street Macro Strategy | WATCH NOW

Exchange rates are fundamentally crucial for inflation, growth and international portfolios, as well as the cost of your summer vacation. Yet even though they are one of the deepest and most liquid financial markets, they remain one of the hardest to value and (sometimes) to understand. While theory suggests that exchange rates should calibrate around interest rate differentials or equalizing the prices of internationally tradeable goods or a broader set of equilibriums that produce internal and external balances in an economy. In practice, exchange rates are able to deviate substantially from such theoretical constructs as they jump between different macro drivers. With reference to the US dollar overshoot that is currently underway in 2022, we offer a guide as to how currency investment processes aim to cope with such an unruly asset class.

Pushing the Informational Edge: Accessing Alternative Data

Gideon Ozik, MKT MediaStats and Rajeev Bhargava, State Street Associates | WATCH NOW

In an increasingly challenging environment of alpha capture, investors are looking beyond traditional data sources as a means to achieve a competitive edge. Digitization and advancements of technology have enabled the collection of previously unmeasurable information, leading to a proliferation of available data sources pertaining to the macro economy and individual firms. While the increased availability of data affords considerable opportunity for economists, investors, and traders it also comes with complexities that need to be understood and addressed. In this session, Rajeev Bhargava, Head of Investment Indicator Research at State Street Associates and Gideon Ozik, founding partner at MKT Mediastats provided an overview of the various sources of alternative data currently available, reviewing the benefits, current academic research, as well as some of the inherent challenges these sources of information yield.

By Alexander Cheema-Fox and George Serafeim

Despite strong energy sector performance over the past year, best-in-industry decarbonization and climate solutions investments have exhibited strong returns.

Our goal is to bridge the worlds of financial theory and practice with innovative research for asset managers and owners. We focus on two fundamental drivers of performance to help State Street's clients exceed their performance goals and manage risk.

Our extensive indicator suites provide investors with powerful and practical market intelligence.

We partner with renowned academics to develop impactful new ideas for portfolio construction, risk management, and investment strategies.