By Alexander Cheema-Fox, Megan Czasonis, Piyush Kontu and George Serafeim

We analyse the transformative impact of life insurance platform integration on the business models, financial profiles, and market valuations of prominent alternative asset managers (AAMs).

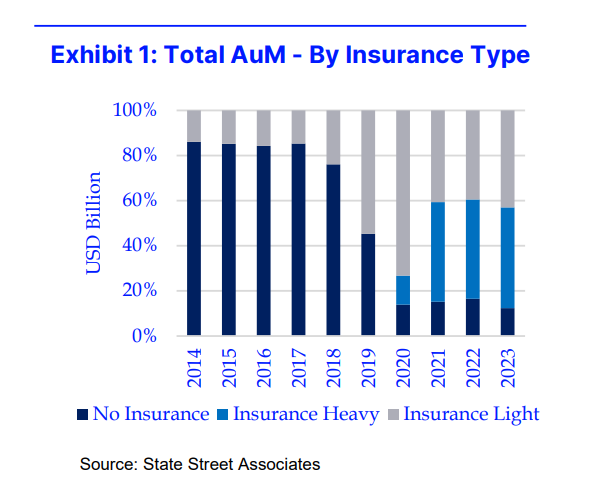

Relying on episodic fundraising through closed-end funds has long defined the growth and operating model of alternative asset managers (AAMs). Many firms have depended on periodic capital commitments from institutional investors, which, while effective for scaling private equity and credit strategies, expose managers to cyclical fundraising pressures, limited product scope, and volatile earnings. In our recent paper, we examine the industry’s shift as leading AAMs integrate insurance platforms, finding that insurance-backed capital transforms funding from episodic to permanent, enabling accelerated AUM growth and greater revenue stability. However, this structural change introduces new complexities - such as regulatory burdens and lower valuation multiples - while fundamentally altering the risk and return profile of these firms. We further analyze how the composition of capital, revenue mix, and market perceptions have evolved, offering insights for investors navigating the rapidly changing landscape of private markets.