By Megan Czasonis, Ding Li, Grace (TianTian) Qiu, Huili Song, and David Turkington

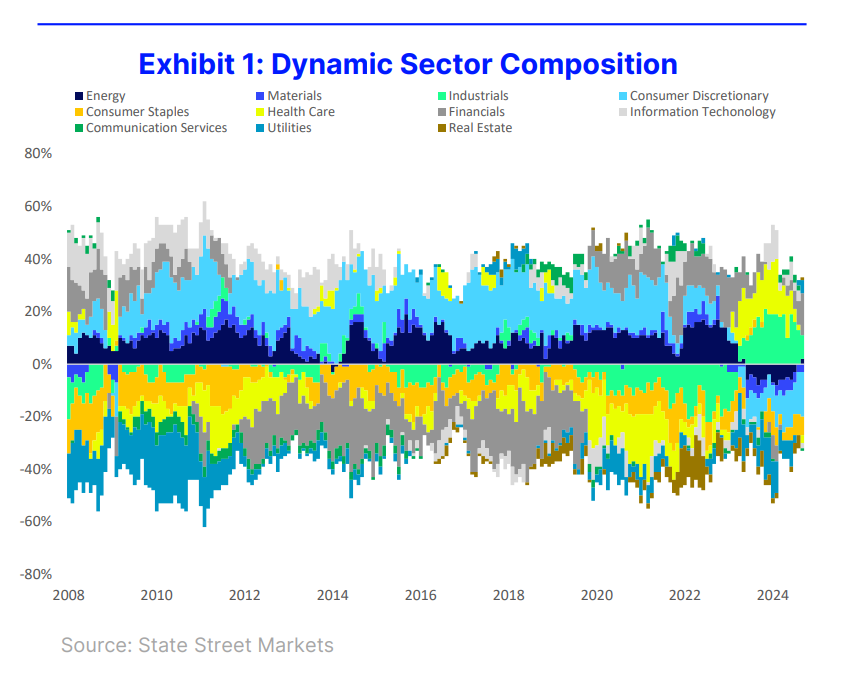

We present an adaptive method for constructing an inflation robustness equity factor which outperforms attribute- and sector-based strategies during 65 inflation events from 2008 to 2025.

We introduce a novel framework to identify which equities will prove robust and which will falter during episodes of inflationary stress. By analyzing firm-level attributes and comparing them to historical performance during inflation events, we construct stock-level inflation robustness scores that capture nonlinear, conditional relationships between stock characteristics and inflation sensitivity. Tested across 65 inflation events from 2008 to 2025, these scores reliably predict stock performance, with a long-short portfolio delivering 9.1% annualized outperformance during inflationary periods. The robustness factor outperforms traditional attribute- and sector-based strategies and remains statistically significant even after controlling for sector and factor exposures. This adaptive methodology enables investors to build inflation-hedged portfolios with greater precision than conventional equity benchmarks.