What’s New

Market Signals and Shifts: What to watch in 2026

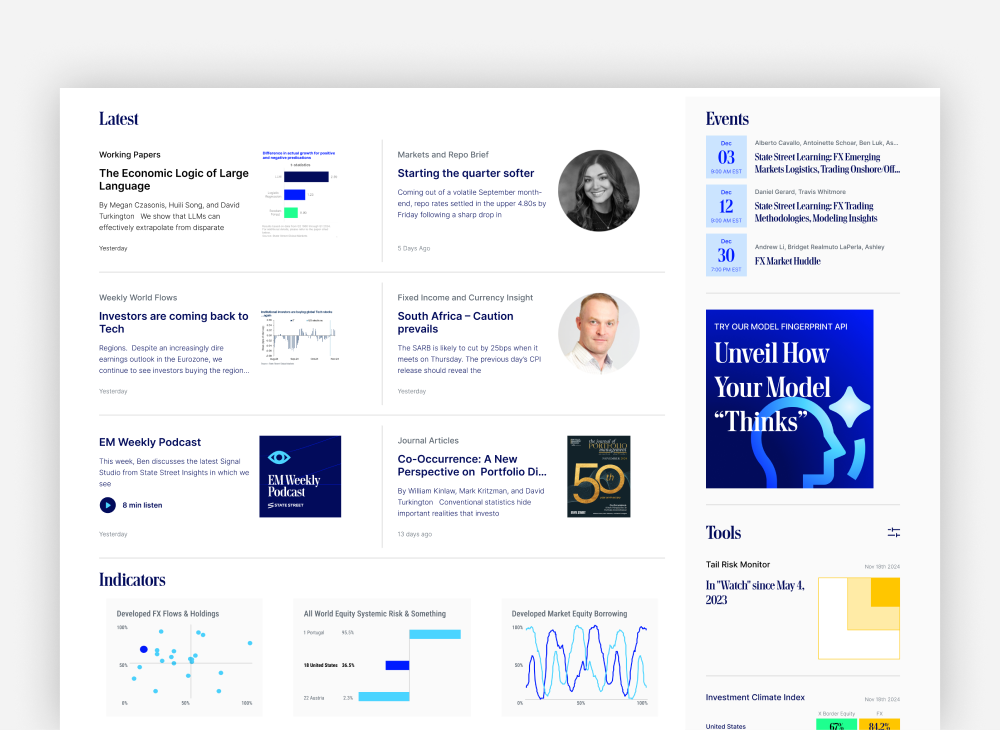

Our second annual State Street Markets outlook, Market signals and shifts: What to watch in 2026, examines the dominant forces shaping the year ahead through a lens that challenges consensus thinking.

Trading the Policy Whiplash

Market volatility continued to climb in February, with a landmark Supreme Court ruling on US tariffs last week upending US trade policy in an afternoon. Questions now circle as to whether last year's trade-induced USD weakness that was expected to continue into 2026 is now at risk of reversal. Meanwhile, the yen's tumble under Takaichi-nomics has resumed, equities and gold remain choppy and many long-dormant correlation relationships are starting to reassert themselves. Managing risk remains a constant ...

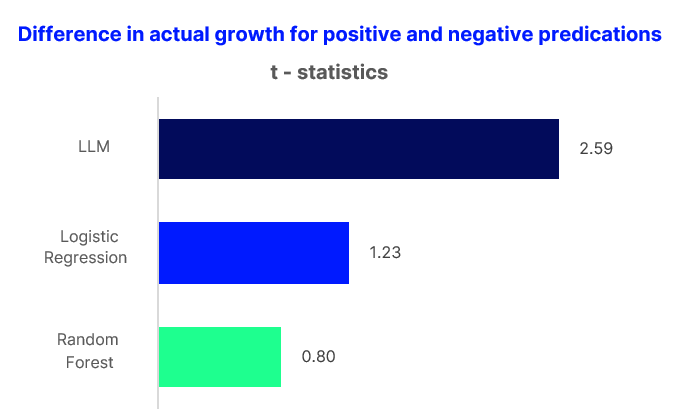

The Economic Logic of Large Language Models

We show that LLMs can effectively extrapolate from disparate domains of knowledge to reason through economic relationships, and that this may have advantages over narrower statistical models. Fundamentally, large language models (LLMs) and numerical models both learn patterns in training data. However, while traditional models rely on narrowly curated datasets, LLMs can extrapolate patterns across disparate domains of knowledge. In new research, we explore whether this ability is valuable for ...

What We Offer

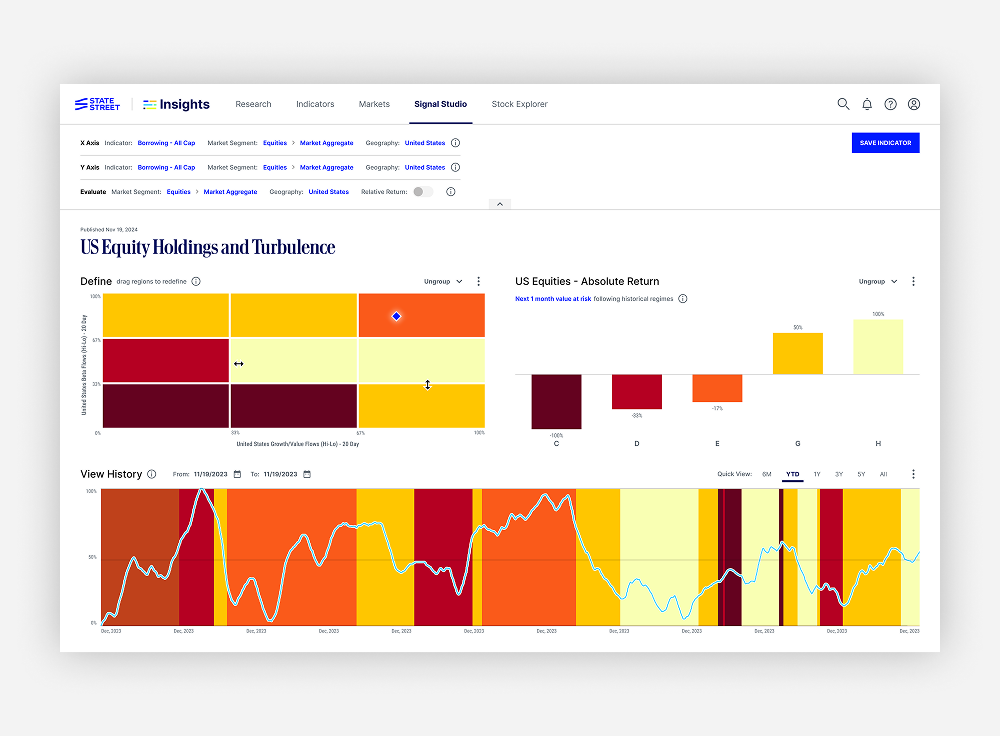

Anticipate market trends with distinctive, data-driven measures of aggregate flow and positioning, daily inflation, media sentiment, risk regimes, and more.

Unlock new investment angles with award-winning research from collaborations with our roster of 10+ academic partners on themes including Al, private markets, investment strategies, geopolitics, and beyond.1

Gain deeper vision on market turning points, risks, and opportunities with daily views and analysis on equity, fixed income, and currency markets.

Engage with the latest analysis, interactive charts, analytic tools, calculation APIs, and more with real-time tools on our Insights platform.

Partnerships

Academic Partners

Through our network of partnerships with renowned academics, we are constantly searching for the perfect blend of deep expertise and disruptive thinking that leads to valuable ideas.

Data Partners

Strategic partnerships extend our research vision with distinctive indicators of economic and market activity, providing a real-time pulse on emerging trends and uncovering patterns that others miss.

Connect

Discussions

Interactive dialog can take ideas to new levels. Let us know how we can work together to address current challenges, extend practical applications of research, and help create new value for your team.

Events

From our flagship Research Retreat seminars to topical webinars and educational series, we bring together impactful views from research experts, policymakers, investors, and beyond.

Learn more about what Insights can do for you

1. Peter L. Bernstein Award for Best Article in an Institutional Investor Journal in 2013; Bernstein-Fabozzi/Jacobs-Levy Award for Outstanding Article in the Journal of Portfolio Management in 2006, 2009, 2011, 2013 (2), 2014, 2015, 2016, 2021; Graham & Dodd Scroll Award for article in the Financial Analysts Journal in 2002 and 2010. Roger F. Murray First Prize for Research Presented at the Q Group Conference in 2012, 2021, 2023. Harry M. Markowitz Award for Best Paper in the Journal of Investment Management in 2022, 2023. Doriot Award for Best Private Equity Research Paper in 2022.