Chart of the Week29 Nov 2024

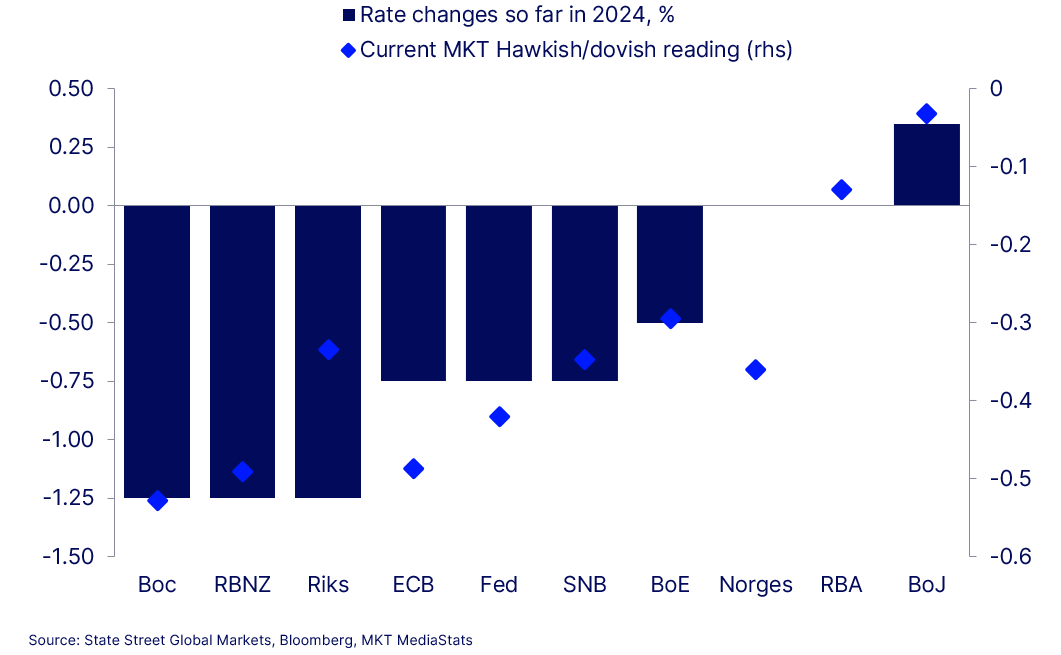

Central banks not for turning

The coming weeks sees nearly every major DM central bank hold its final policy meeting of the year. The message from our hawkish/dovish indicator is to expect more of the same. The BoC and the RBNZ continue to offer the most dovish messages, even after easing by 125bp so far in 2024. The market is split between a further 25bp or 50bp cut from the BoC. Judging by their tone, expect 50bp. The RBNZ is priced between 50 and 75bp, again the larger move looks possible. The BoE seems set to remain on hold, the ECB could surprise with a 50bp cut, but the BoJ may well deliver another tightening (the market is split almost 50/50). The Fed? In the middle; data dependent, I guess.