- Macro Strategy Team

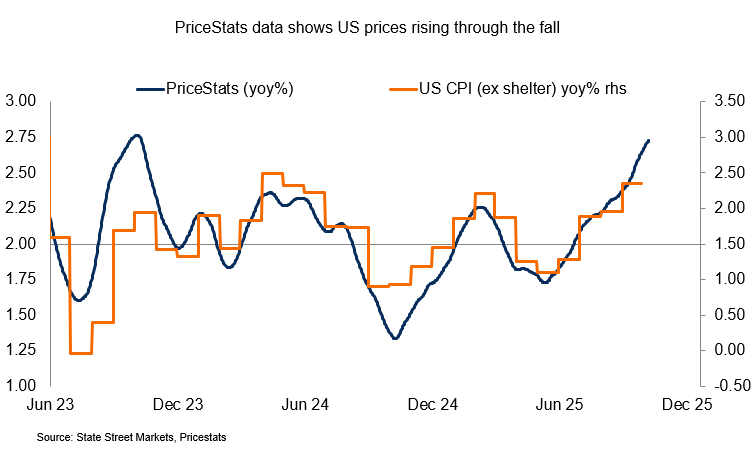

US inflation remained firm in September, though not alarming. A 0.24 percent increase is notable for September, as it is typically a month of modest price gains. This rise pushed PriceStats’ annual inflation to its highest level this year. Much of the unusual seasonal inflation strength came from household equipment and furniture prices, which include a higher share of imported goods than other sectors. According to PriceStats, the annual inflation rate in this segment has now risen above five percent for the first time since January 2023. The pressure from core goods on inflation has continued.

Outside of this sector, there were also firm readings in both food and transportation prices, but price pressures in apparel and electronics were closer to their norms for the month. Meanwhile, healthcare products registered a modest decline. Together, this suggests that while there are pockets of stronger inflationary pressures, the breadth of price increases remains narrow, suggesting that retailers are still somewhat uncertain about the resilience of consumer demand.

Given that monthly changes in the PriceStats series show a correlation with the US Bureau of Labor Statistics (BLS) inflation measures in excess of 80 percent over the past five years, this data should serve as a reliable guide for policy makers, consumers and financial market participants if official data is not released.

For now, PriceStats data suggests the uptrend aligns with the Fed’s and forecasters' projections for higher inflation into year-end. But this still requires careful monitoring for signs of acceleration as we move into the seasonal discounting season. If the current trend in inflation does not show its normal softening ahead of the US holidays, it could once again challenge hopes for further interest rate cuts.