By Megan Czasonis, Mark Kritzman, Baykan Pamir, and David Turkington.

Published in the Journal of Portfolio Management, March 2020.

We show how to compute data-driven probabilities for future economic scenarios, adding quantitative rigor to scenario analysis while preserving its intuitive appeal.

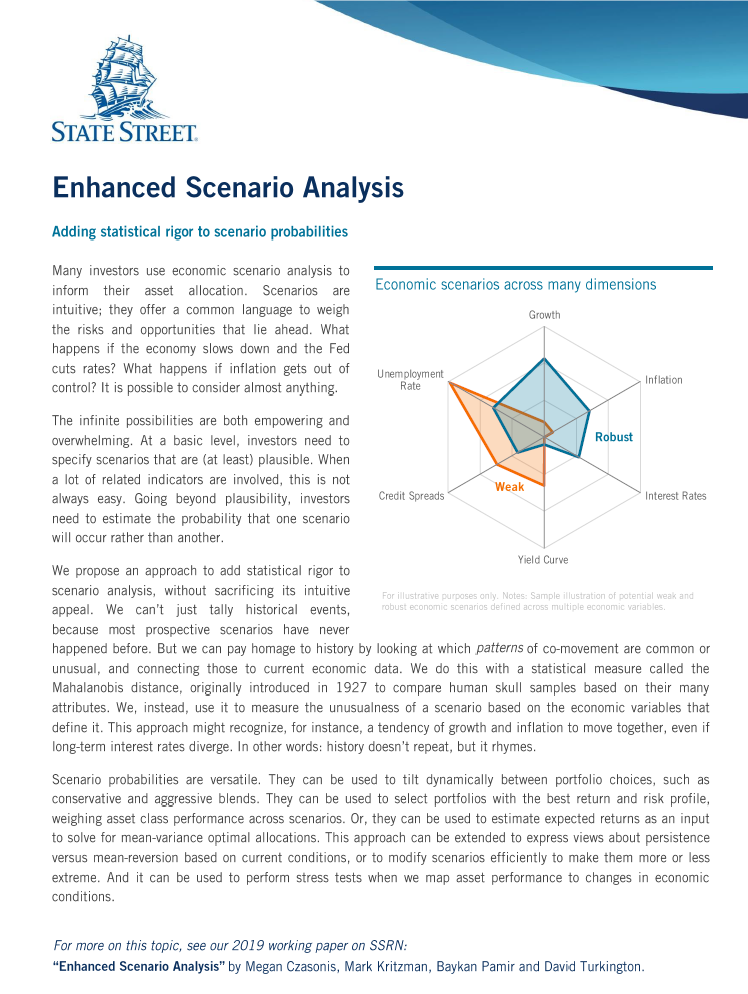

Many investors use economic scenario analysis as an intuitive way to inform their asset allocation. With scenario analysis you can model almost anything – but this flexibility is as much a blessing as a curse. How do you know what scenarios are reasonable, and which are more likely to occur? To address this challenge, we introduce a way to add statistical rigor to scenario analysis, without sacrificing its intuitive appeal. Using patterns of economic variables throughout history, we show how to come up with informed probabilities for future scenarios. These probabilities can then be used to tilt allocations dynamically, or solve for “optimal” allocations balancing return and risk – all using the convenient language of economic forecasts.

Get the summary here.