Chart of the Week18 Oct 2024

Not that unusual

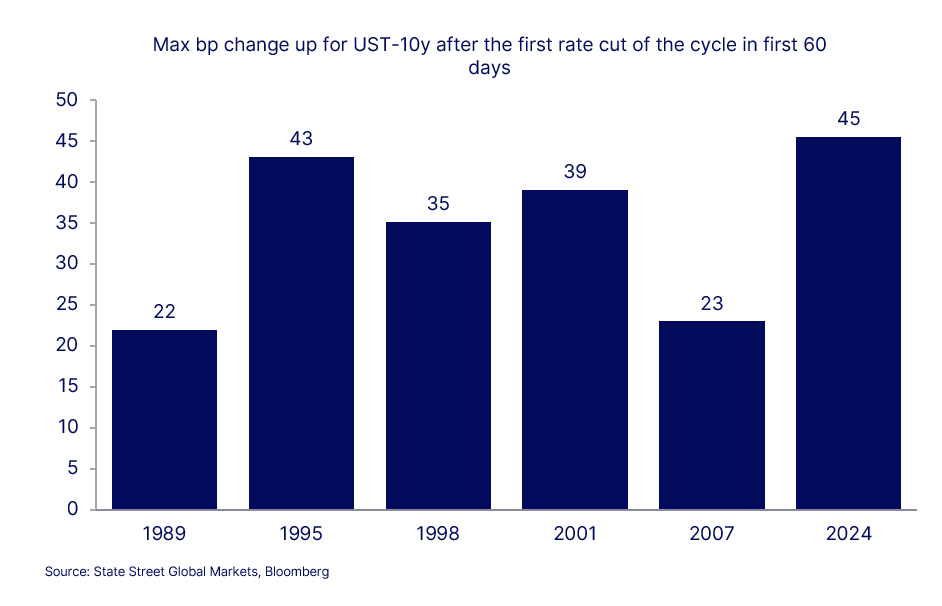

After the FOMC decided to cut rates by 50bps, US Treasury yields surged 45bps. In theory, if you cut off the upside tail for rates, it frightens investors at the longer end of the curve. Moreover, this comes on the back of stronger data from NFP and CPI, which has helped CESIUSD (economic surprises) surge 28 points after that rate cut, although, it has moderated slightly in recent days. In addition, yields seem to be tracking oil quite closely, which zoomed higher to $78.64 per barrel. Yields moving higher after the first rate cut in the cycle is not that unusual, even for those periods that eventually produced a recession. But the size of the move is highly consistent with the dominant soft-landing narrative.