By David Turkington and Alireza Yazdani.

Published in the Financial Analysts Journal, March 2020.

Currencies tend to appreciate after their local equity market has done well, and a diversified strategy formed on this simple rule outperforms the traditional FX carry, value and momentum strategies.

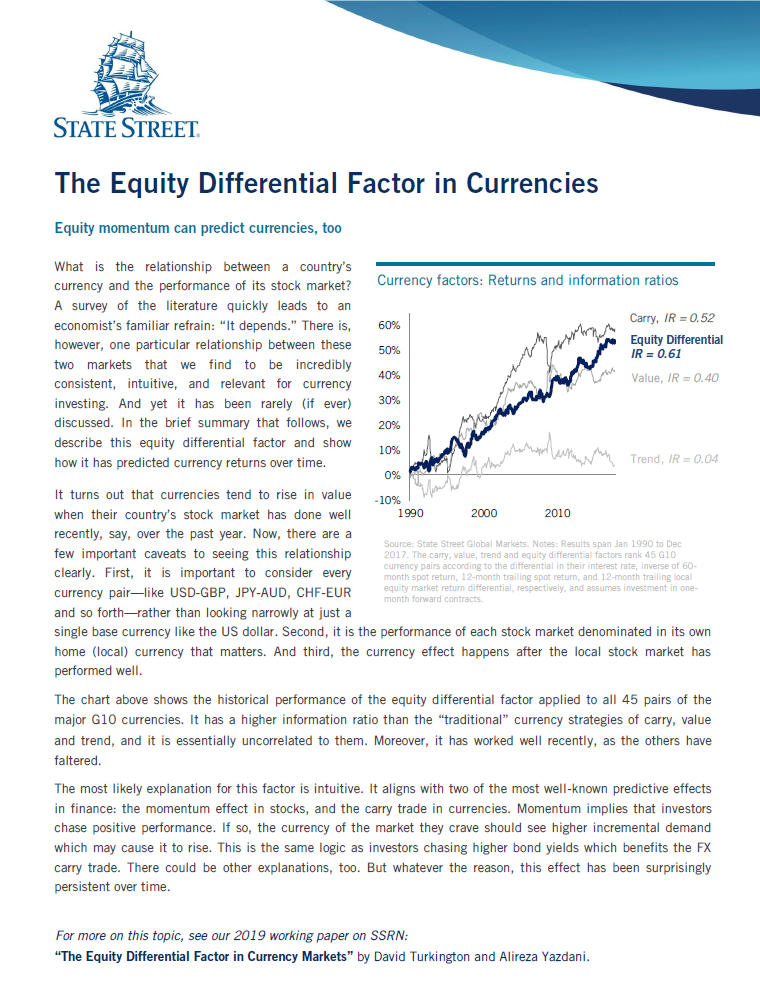

What is the relationship between a country’s currency and the performance of its stock market? Conventional wisdom suggests that only weak links exist between the two, but we find otherwise. It turns out that currencies tend to outperform after their local equity market has done well. A simple strategy of betting on major currencies with strong equity performance and against those with weak equity performance has been surprisingly effective. From 1990 to today, it has a higher risk-adjusted performance than other popular currency strategies, including carry, trend and value. In short, as investors predictably chase equity returns across borders, they bring currencies right along for the ride.

Get the summary here.