By Alexander Cheema-Fox, Edward S.Cuipa III, and Robin Greenwood

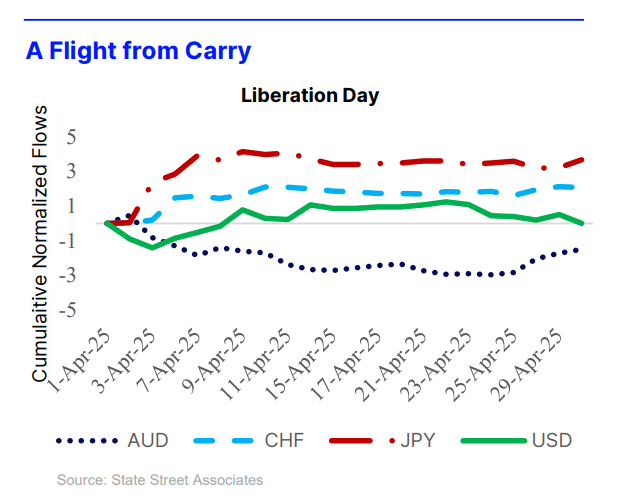

Institutional investor flows can help distinguish between flights to safety and flights from carry, revealing that the CHF, JPY, and USD play distinct roles depending on interest rate differentials and whether market stress is driven by macroeconomic uncertainty or funding pressure in currency markets.

We examine the roles of safe-haven and funding currencies during market stress by analyzing how institutional investors reallocate across currencies during crises. Using proprietary FX and local-currency sovereign bond flows from State Street, we show that while the CHF, JPY, and USD all act as safe havens, investor flows and currency behavior differ substantially across crises depending on interest rate differentials and whether the episode is driven by macroeconomic uncertainty or by a carry trade unwind. A panel regression framework, leveraging FX forward and sovereign bond flows, reveals that some crises, like the 2008 Global Financial Crisis and COVID-19, reflect true flights to safety, whereas others, such as the 2024 carry crash and Liberation Day, are characterized as flights from carry involving CHF and JPY inflows and muted or negative USD flows. These findings underscore the importance of distinguishing between safe-haven and carry dynamics in currency markets and suggest that institutional investor flows offer a powerful tool for classifying crisis episodes.