By William Kinlaw, Mark Kritzman, Sébastien Page, and David Turkington.

Published in the Journal of Portfolio Management, August 2021.

Recipient of the Journal of Portfolio Management's 2021 Bernstein Fabozzi /Jacobs Levy Outstanding Article Award.

To account for asymmetric correlations, investors must measure them correctly. Many don’t.

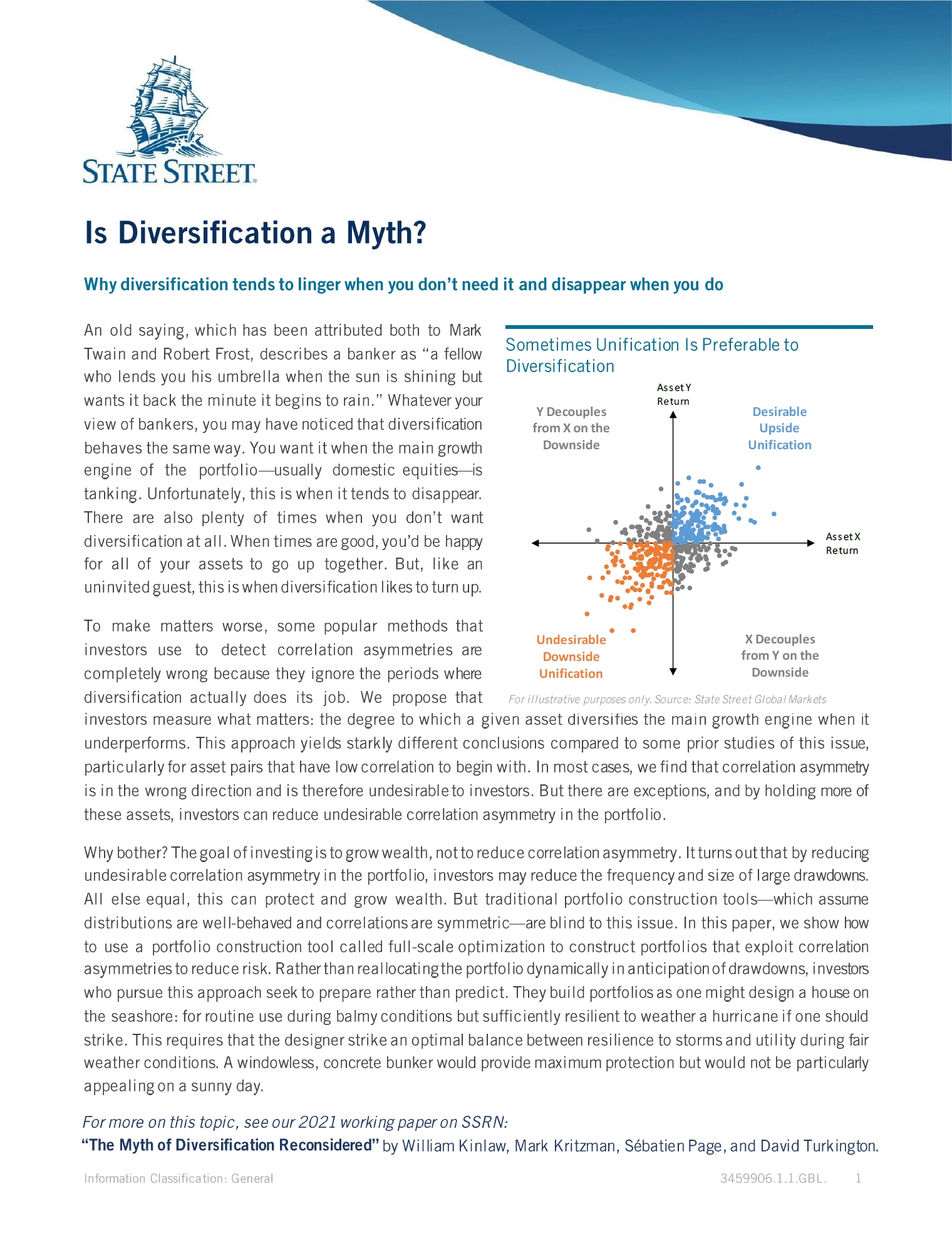

Diversification is one of the core principles of investing. Unfortunately, it tends to disappear when it is needed most and turn up again when it is unwanted. To make matters worse, many investors and researchers measure these correlation asymmetries incorrectly. The fundamental flaw in most prior studies is that they focus only on instances where two assets lose money together, ignoring the more important case when one rises to truly offset (or diversify) the other. We propose that investors measure correlations conditional on the main engine of portfolio growth – often equities. By doing so, investors can focus on downside protection that is genuinely helpful when the growth engine falters. We show how to use a technique called full-scale optimization to construct portfolios that exploit correlation asymmetries to reduce risk.