- Macro Strategy Team

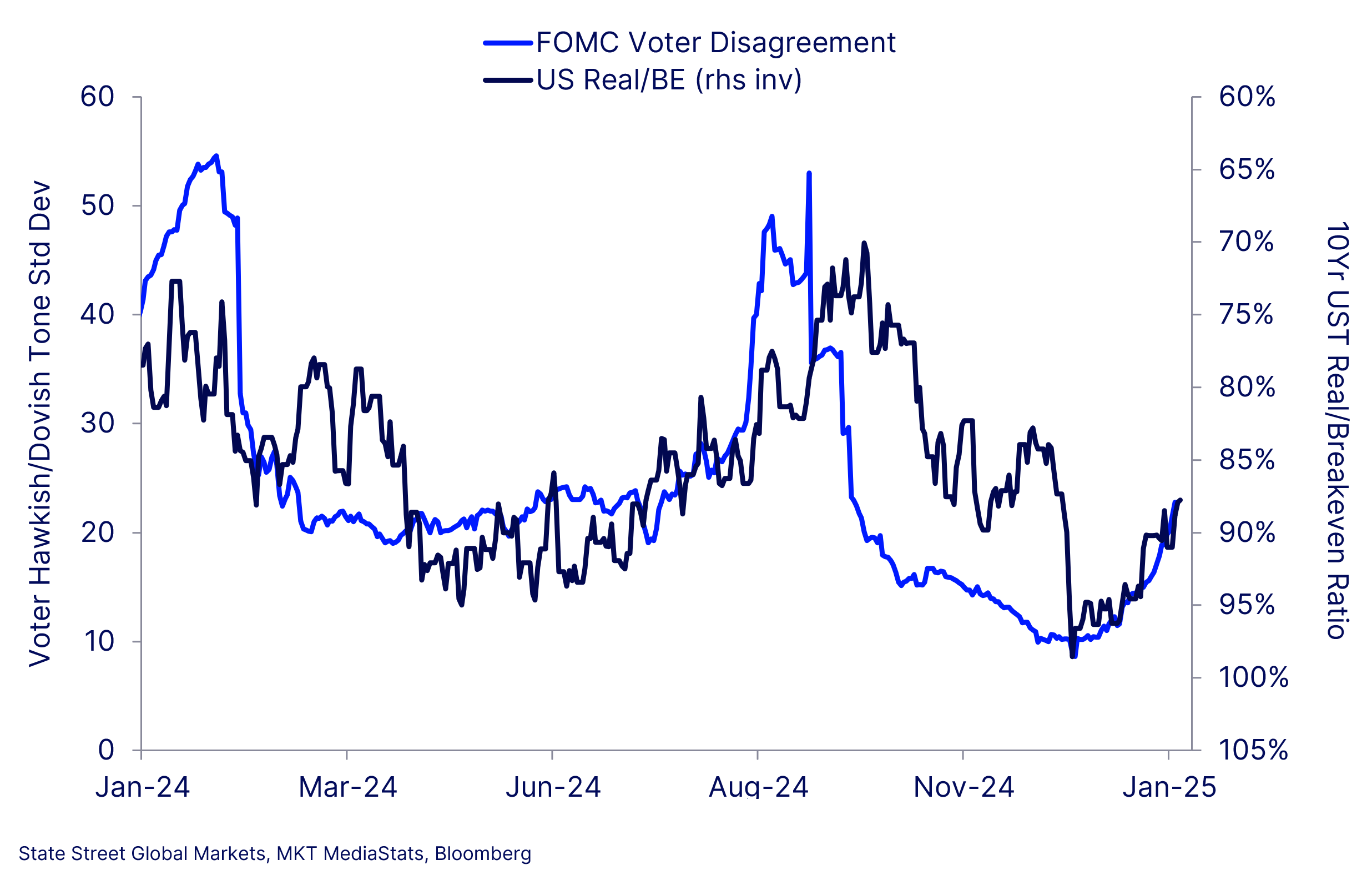

We'd expect breakevens to edge lower as real rates rise as investors trust that the higher yields they’re pricing in will help alleviate inflation pressures. However, a decline in the ratio of US reals relative to BEs is telling of a broken transmission function between the market’s policy expectations and inflation outlook. This faltering response function has coincided with a pickup in disagreement among FOMC voters as measured by the standard deviation in net hawkish/dovish media tone among voting members. The relationship suggests that greater inconsistency in policymakers' messaging has cast doubts on whether Fed policy will prove sufficient to tame inflation.

Author Bios

Macro Strategy Team

The Macro Strategy team provides cross-asset research and market intelligence across developed and emerging economies. Their expertise in FX, equities, and fixed income is complemented by proprietary indicators on investor behavior, inflation, and sentiment—turning complex data into actionable insights that help clients anticipate risks and capture opportunities.

1. Peter L. Bernstein Award for Best Article in an Institutional Investor Journal in 2013; Bernstein-Fabozzi/Jacobs-Levy Award for Outstanding Article in the Journal of Portfolio Management in 2006, 2009, 2011, 2013 (2), 2014, 2015, 2016, 2021; Graham & Dodd Scroll Award for article in the Financial Analysts Journal in 2002 and 2010. Roger F. Murray First Prize for Research Presented at the Q Group Conference in 2012, 2021, 2023. Harry M. Markowitz Award for Best Paper in the Journal of Investment Management in 2022, 2023. Doriot Award for Best Private Equity Research Paper in 2022.