By Josh Lerner, Jason Mao, Antionette Schoar, and Nan R. Zhang

Published in the Journal of Financial Economics, January 2022.

Contrary to common belief, returns in alternative vehicles in private equity increasingly depend on the match between GPs and LPs and both parties’ outside options.

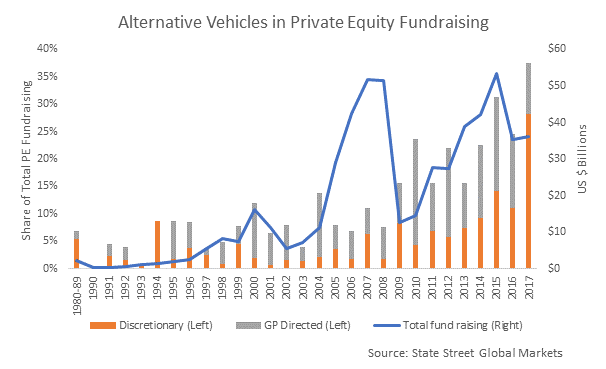

Using previously unexplored custodial data, we examine alternative investment vehicles (AVs) in private equity (PE) funds over the last four decades. By 2017, AVs reached 40% of all PE commitments. Average AV performance matches the PE market, but underperforms the main funds of the partnerships sponsoring the AVs. Limited partners (LPs) with better past performance invest in AVs with better average performance, even after conditioning on the general partners’ (GPs’) past records. This result is largely driven by preferential access of top LPs to top AVs. Returns in PE increasingly depend on the match between GPs and LPs and both parties’ outside options.