By David Turkington

Published in the Journal of Investment Management, First Quarter 2019.

Contrary to popular belief, levered small cap value stocks do not actually track private equity returns, but other factors such as sector exposure do.

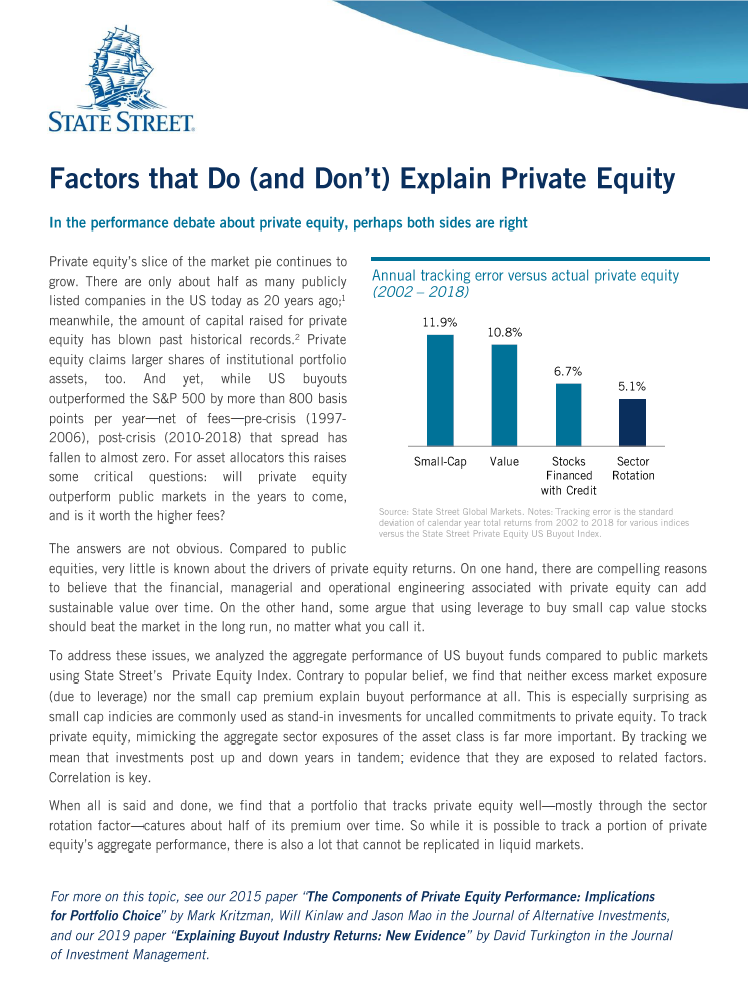

As an asset class, private equity buyouts have outperformed the S&P 500 historically, but people disagree on why. One explanation is skill in picking and managing companies; another is that private equity loads up on “factors” like small cap value which would have worked in the public market just as well. We use State Street’s Private Equity Index to look deeper into this question, and we find that even though levered small cap value stocks outpaced the S&P 500, they are basically uncorrelated to the yearly ups and downs of actual private equity returns. After dealing with the usual analytical pitfalls and challenges of illiquid asset returns, we find that the sector exposures of private equity explain about half of the performance advantage.