By Yimou Li and David Turkington

Is it better to focus on single-stock, industry or factor trends? And how does market risk and time horizon affect them? We use a unified framework to map out the distinct sources of momentum and reversal in the stock market.

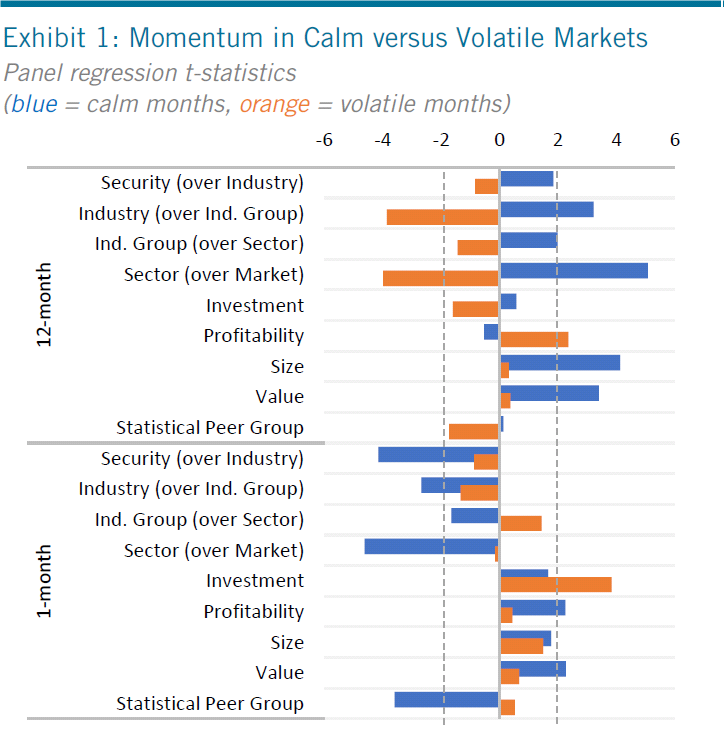

A variety of stock momentum and reversal effects have been documented in financial literature, but it’s hard to unify these often disparate findings. We disentangle the overlapping effects of momentum and reversal to show where the most durable relationships lie. We drill into industry, factor, and security-specific momentum in US equities, separating high versus low market volatility, ‘past winners’ versus ‘past losers’, and the periods before and after the global financial crisis. We find that many distinct sources of momentum and reversal coexist, short term reversal has intensified post-2010, winning sectors tend to crash more than winning factors, and more.

Get the summary here.