Decarbonization Factors

By Alex Cheema-Fox, Bridget Realmuto LaPerla, George Serafeim, David Turkington, and Hui (Stacie) Wang.

Published in the Journal of Impact and ESG Investing, August 2021.

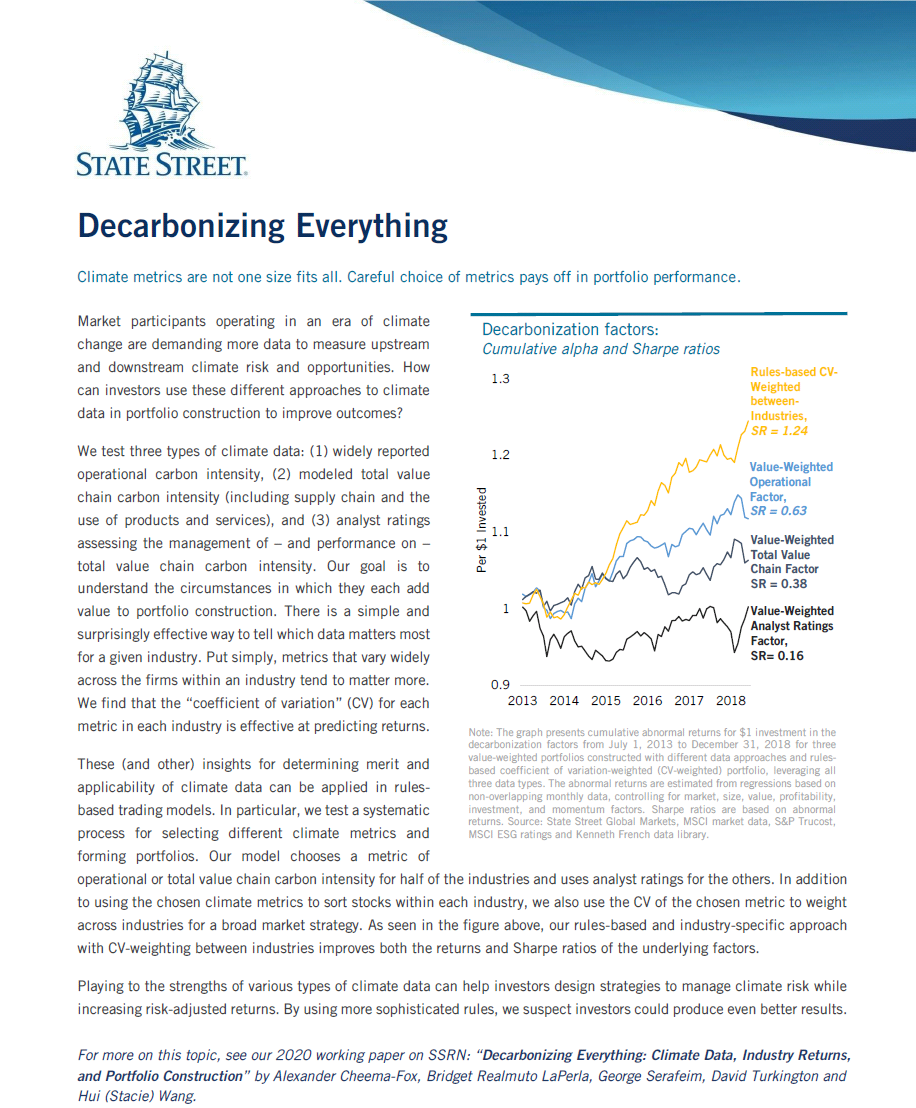

We directly study institutional flows into and out of decarbonization factors, and find that “going with the flows” on low-carbon strategies improves investor returns.

With growing concerns around climate change, the question arises, are institutional investors moving money into low carbon strategies? We measure how institutional-money, in aggregate, is flowing around this theme by constructing six low carbon strategies, which we call “decarbonization factors.” After controlling for a range of other traditional factors, we find that between 2009 and 2018 the decarbonization factors that maximized carbon reduction also delivered the highest alpha. Additionally, since not all factors perform well all the time, there is an attractive opportunity for investors to rotate across different strategies – implementing tilts at the sector, industry or firm level across multiple regions – to get continuous exposure to low carbon portfolios with more attractive return profiles.