Chart of the Week17 Feb 2023

The Cost of Financial Repression

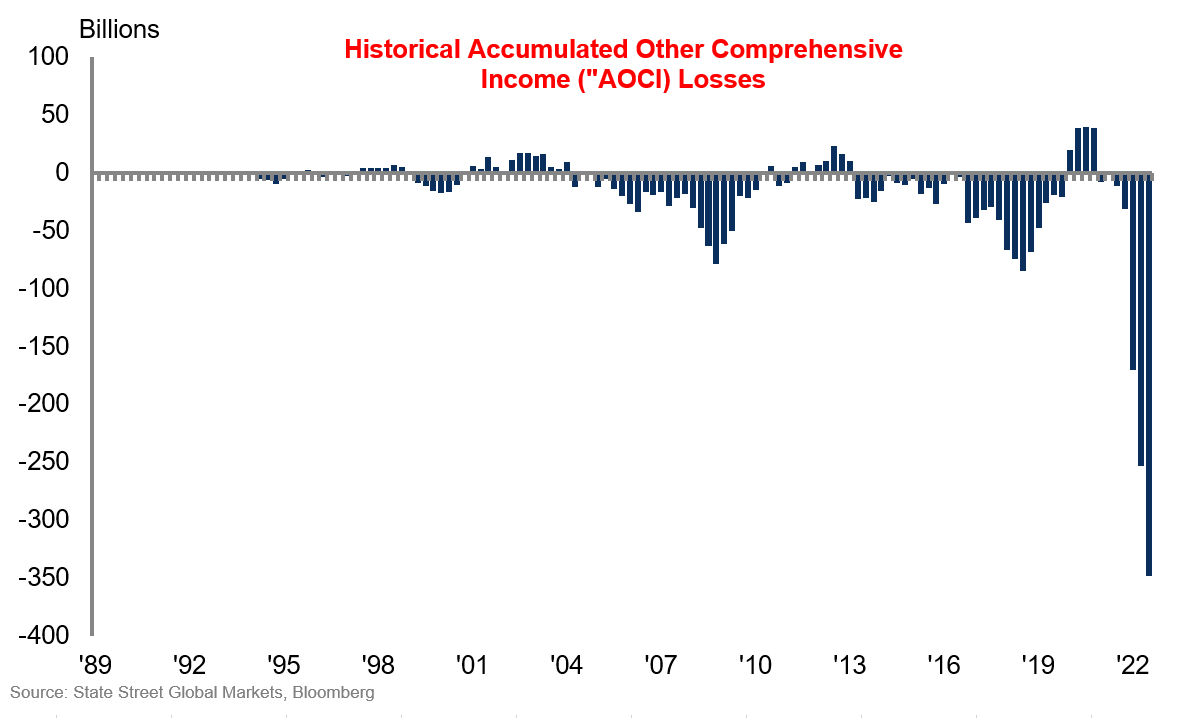

Guess what happens when regulations forced banks to hold Treasuries and then the prices of those Treasuries collapse as they did in 2022? These show up as “AOCI” unrealized losses. This drives down tangible book values with implications for Tier 1 capital. Martin Gruenberg (FDIC) says “right now, our banks have strong liquidity, so they shouldn’t have to dispose of those assets…but as the market evolves and banks may have to dispose of those assets, there are substantial unrealized losses that could impact our institutions.” Note banks have three categories for the securities they hold: Trading, Held to Maturity, and Available for Sale.