Chart of the Week15 Nov 2024

A heightened trade war brings EM pain

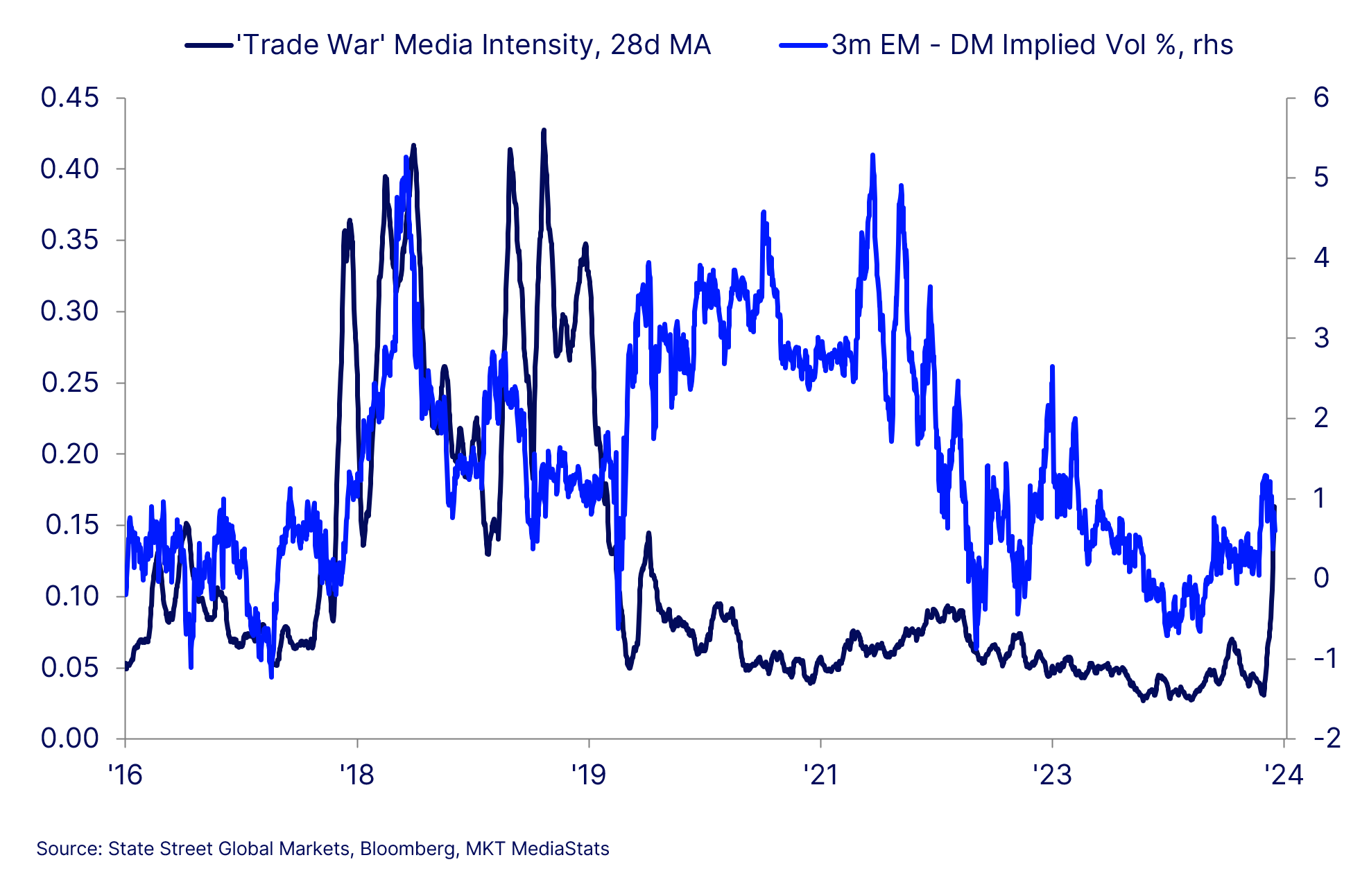

While currencies such as the MXN and CNY have already repriced to reflect the potential for onerous US tariffs, the pain can get worse. Our MediaStats intensity measures for the ‘Trade War’ narrative in FX articles show it rising only in recent weeks, but still far from highs seen during Trump’s first term, when tariffs were first applied, and the North American Free Trade Agreement (NAFTA) was renegotiated. That period coincided with significant risk premia for emerging market FX, built in via a much higher implied volatility relative to developed markets. That repricing has only just begun. What has already been a tough period for EM currencies could become one for assets soon enough.