Chart of the Week04 Apr 2025

How risk averse are investor allocations?

Going into April long-term investors had made some way to reducing and rotating the risk in their allocations to risk assets.

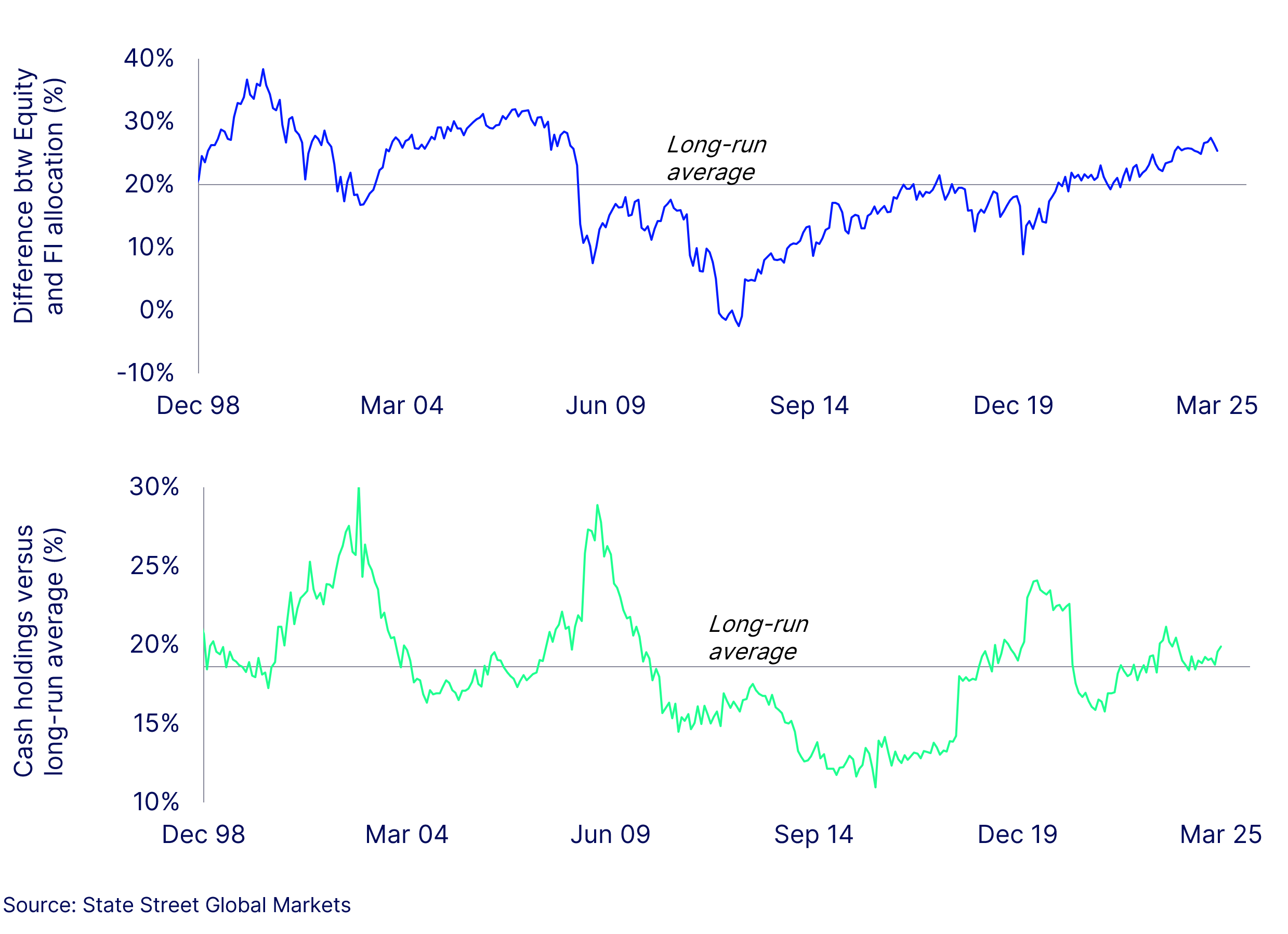

The spread of holdings of equities over bonds peaked at a post-GFC high in January at 27%. It had fallen to 25% by the end of March, but this is still well above the long-term average of 20%.

In a similar vein investors’ allocation to cash has risen smartly this year, but at just under 20% remains only 1% above its long-term average and well below crisis highs.

In short, investors allocations remain ill prepared for market turbulence.