By Megan Czasonis, Mark Kritzman, and David Turkington.

Published in the Journal of Portfolio Management, February 2021.

We propose a more reliable way to predict the stock-bond correlation, focusing on relevant economic variables during relevant periods in history.

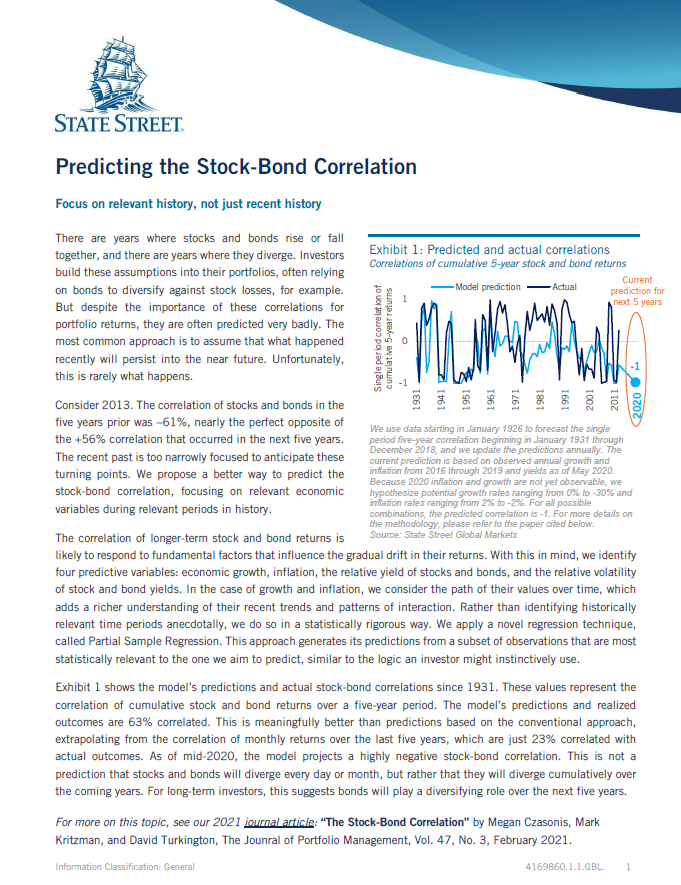

Despite its importance for portfolio returns, the stock-bond correlation is often predicted in an unreliable way. The most common approach is to assume that what happened recently will persist into the near future, though this is rarely what happens. We propose a novel approach for predicting the stock-bond correlation that relies on fundamental factors and censors historical observations according to their relevance to today. We show that these innovations improve the reliability of forecasting the stock-bond correlation compared to the conventional approach. Moreover, as of mid-2020, the models predicts that stocks and bonds will diverge cumulatively over the next five years, suggesting that bonds will play a diversifying role in the years to come.