By Megan Czasonis, William Kinlaw, Mark Kritzman, and David Turkington.

Published in the Journal of Alternative Investments, Winter 2021.

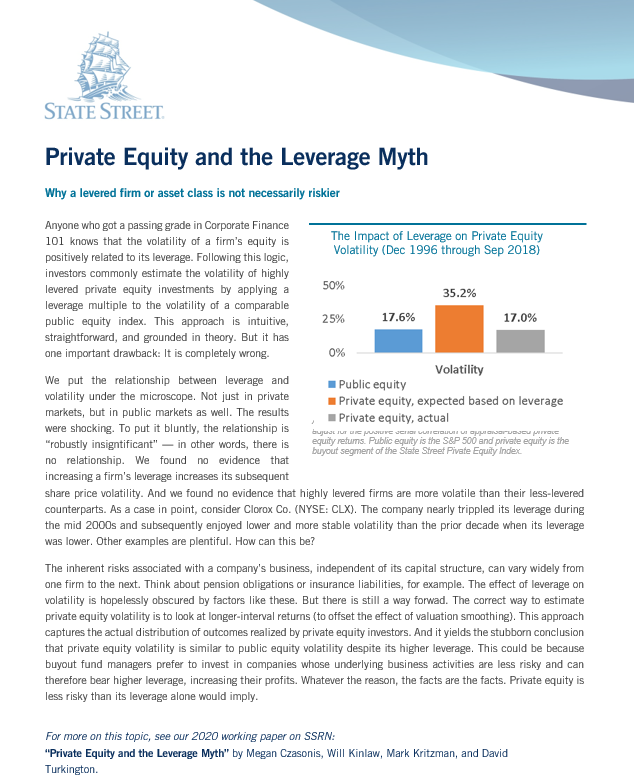

Conventional wisdom regarding the way leverage affects volatility is incorrectly leading private equity investors to dramatically overestimate risk.

A fundamental precept of corporate finance is that the volatility of a firm's equity is positively related to its leverage with one-to-one correspondence. Following this logic, investors commonly estimate the volatility of highly levered private equity investments by applying a leverage multiple to the volatility of a comparable public equity index. This approach is intuitive, straightforward, and grounded in theory. But it has one important drawback: It is completely wrong. In this paper, we present a comprehensive analysis of the relationship between leverage and volatility in public and private markets. We arrive at the stubborn conclusion that private equity funds (buyouts, in particular) have volatility that is similar to the public market despite their higher leverage.