Corporate Resilience and Response to COVID-19

By Alex Cheema-Fox, Bridget R. LaPerla, George Serafeim, and Hui (Stacie) Wang.

Published in the Journal of Applied Corporate Finance, Spring 2021.

Not cheap talk. Companies' responses to ESG issues related to key stakeholders were systematically linked to stock performance during the COVID-19 market crash.

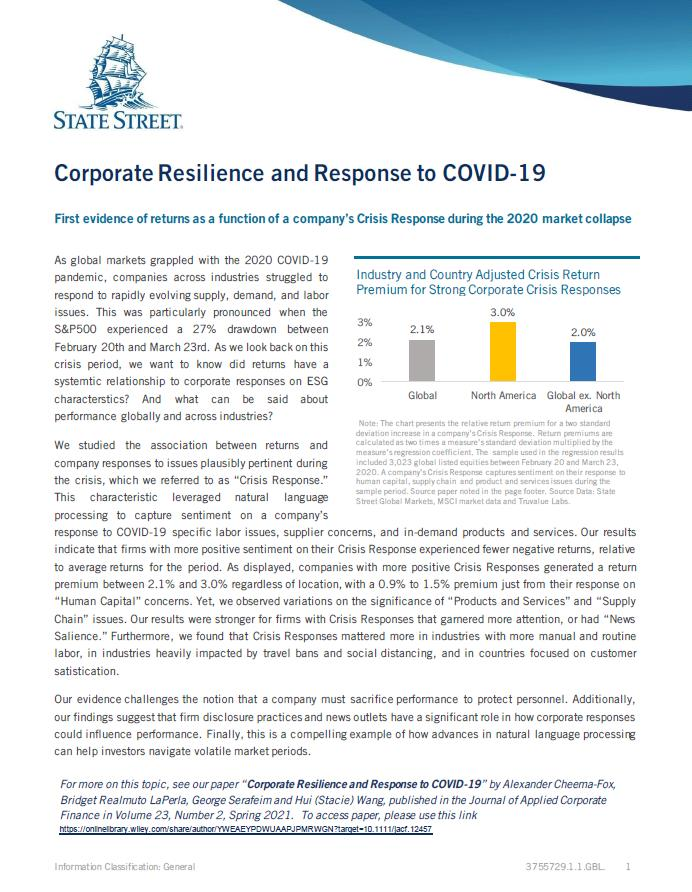

COVID-19 has forced companies to respond swiftly to the pandemic and highlight their resilience to investors. Exploring how their actions affect stock performance, we found that companies seen as protecting employees and securing their supply chain experienced higher institutional money flows and less negative returns, especially when those practices garnered significant public attention. Firms that most prominently re-purposed their operations to provide in-demand solutions to the crisis experienced a significant positive impact on returns. This evidence challenges the notion that shareholder and employee interests are in conflict. It also suggests that corporate disclosure and media coverage play a significant role in how corporate responses to crisis management decisions could influence investor behavior and impact stock performance.