Chart of the Week09 Aug 2024

Volmageddon 2.0? Nope.

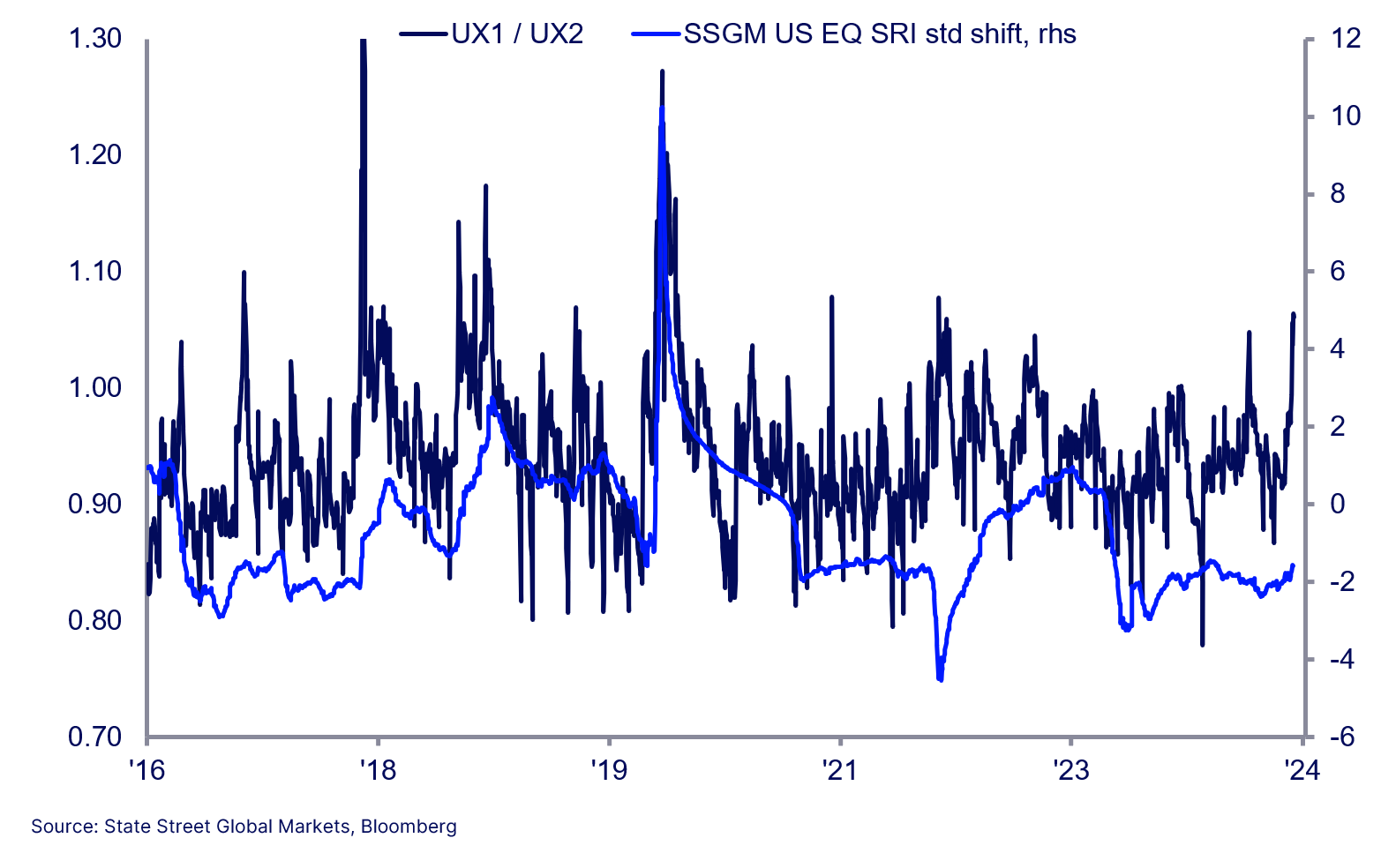

The VIX is an important risk barometer that gets a lot of the attention in times of market stress, but more than it probably deserves. It is subject to convexity, skew, and calendar effects, all of which were in play during a massive spike over the last week with risk markets in free fall. The ratio of values between the first two VIX futures contracts often proves a more stable guide for making historic comparisons. On this basis, this week’s price action registers as a garden-variety correction, not a 2018 Volmageddon event or anything close to LTCM, 9/11, GFC, COVID, or any other marquee risk-off episode you want to name. Our own Systemic Risk index underscores this point – it barely moved.