By Alexander Cheema-Fox and Robin Greenwood

Using a uniquely deep proprietary dataset, we detail how global investors across regions and asset classes hedge their currency risk, stick to their hedges, and adjust their hedging targets over time.

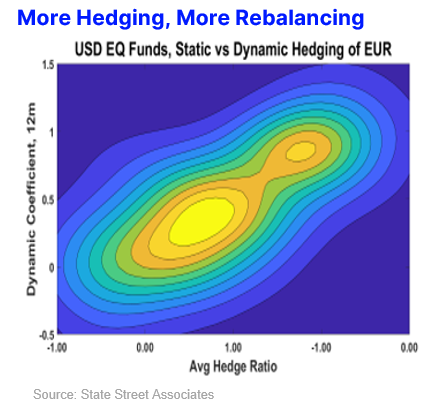

Currency risk is a key component of global investor returns, but different categories of investor approach these exposures differently. Using State Street’s proprietary custodial data, we have a uniquely precise view into how investors actually choose to hedge and how that varies over time, by asset class, and across different investor domiciles. We introduce a new quantity, the “dynamic hedge ratio,” to capture how investors adjust their hedge ratios and rebalance their currency risk over time. We find that US investors hedge less than others, that equity investors hedge less than fixed-income investors, and that investors tend to stick to target hedge ratios. Moreover, we find that average hedge ratios vary through time with currency, equity, and bond factors, yet exhibit a post GFC shift towards higher hedge ratios that cannot be explained by these factors.