April 11, 2025

What to Watch

Complimentary CONTENT

Market shifts have shifted, what’s next?

By: Michael Metcalfe

Summary

In our 2025

market outlook, we identified the pressing questions that would shape global

financial markets this year; would investors remain overweight equities, could

the US remain exceptional and was there trouble ahead for the US dollar to name

a few.

In just three months, the market’s conviction, as captured

in concentrated positions in risk and US assets, has quickly evaporated in the

face of policy and economic uncertainty. But as we move into the second quarter,

we return to our original questions and using State Street’s metrics of

investor behavior, assess whether the dramatic market adjustments mark a bottom

or are the start of a longer-term adjustment process.

Will investors remain overweight equities in 2025?

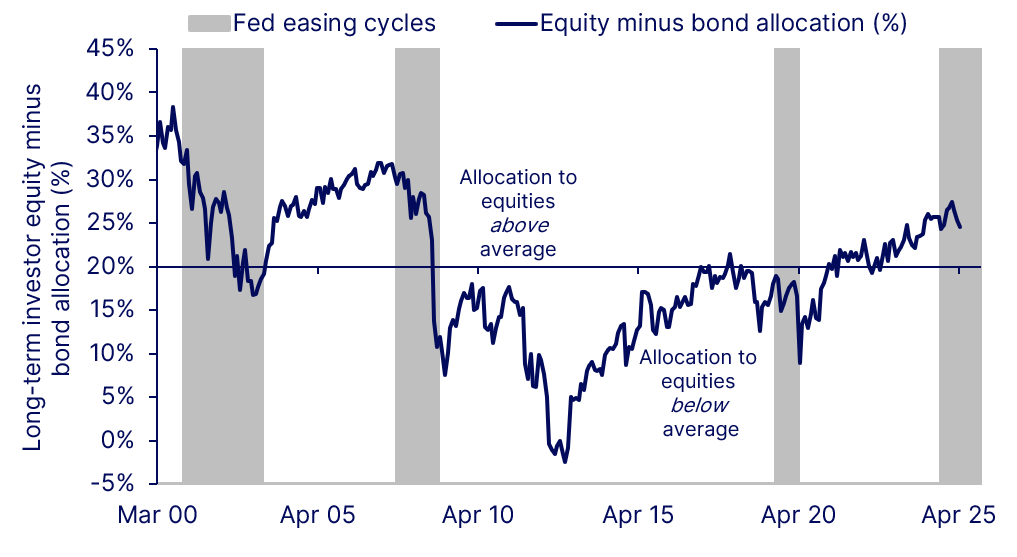

Investors came into 2025 with an extended overweight position

in equities. Over the past 25-years, the average allocation to equities has sat

around 20% above investors’ allocation to fixed income (in keeping with the

60/40 portfolio). In January, the equity allocation stood at 27% above fixed

income, a fifteen year high. As we noted in January, given allocations to

equities relative to bonds typically fall during Fed easing cycles, this overweight

position represented a potential vulnerability for asset markets. A

vulnerability that has been realized as policy and economic uncertainty has

risen sharply in the first quarter. In response, investors have rapidly reduced

their allocation to equities, but from historically high levels. And given the

sheer size of the overweight position in equities, the reduction through early

April has resulted in the allocation to equities relative to bonds falling from

27% to 25% (Figure 1). So asset managers still have some way to get back to a

benchmark allocation of equities should uncertainty and cyclical news get worse

from here.

Figure 1: Equity

vs. bond allocations, still elevated

Source: State Street Global Markets

2. Can the US remain exceptional?

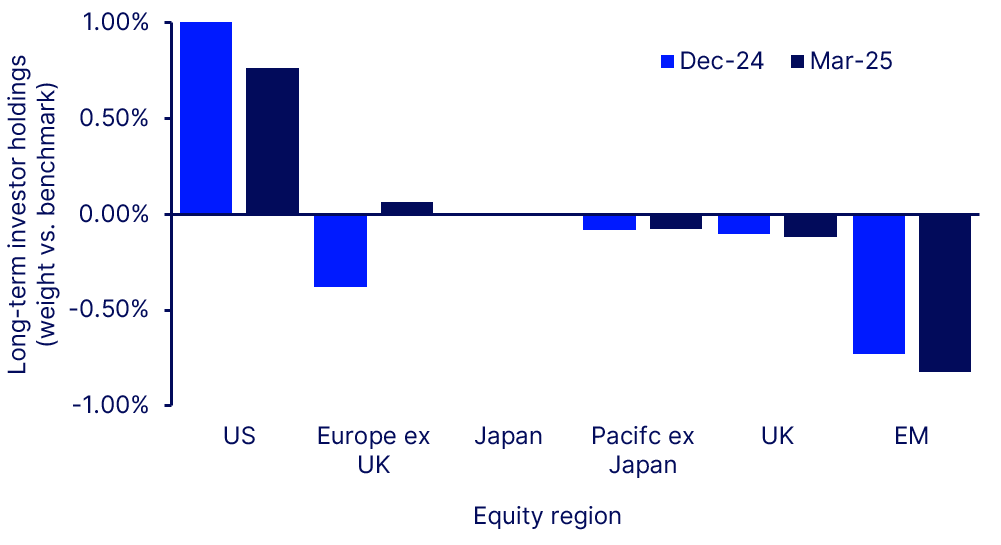

Asset managers began to reduce their significant overweight position

in US equities in the closing months of 2024, but still came into the year

broadly positioned for US exceptionalism. A view that has been challenged so

far in 2025. The overweight in US

equities has fallen by around a third and now stands at its lowest level in

three years (Figure 2). European equities have been the prime beneficiary of

this as investors eliminated their underweight in the region’s equities and

have begun to build an overweight. While this overweight in aggregate remains

modest, it is very uneven on a sector basis and our data suggests that by the

end of Q1 investors now have larger active overweight in European banks than

they do in US tech.

The bottom line is that investors are still positioned for

US outperformance, but their conviction in the idea is at a three year low. We

now await whether relative fundamentals will encourage investors to remain

overweight US or rebalance further in 2025 and begin to eliminate their still

substantial underweight in emerging market equities, which remains larger than

where it began the year.

Figure 2: Investors

equity allocations across regions, a little less US centric

Source: State Street Global Markets

3. Is there trouble ahead for Treasuries?

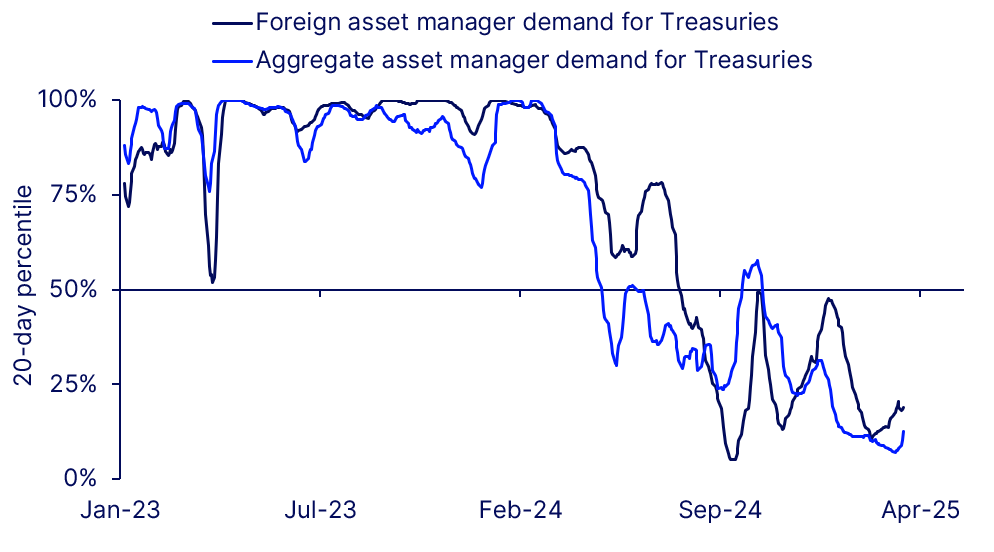

Asset manager demand for US Treasuries has been both a

source of hope and potential risk for some time. In December 2023, the

resiliency of asset manager demand for Treasuries was one our seven

surprises for 2024. In the end, that resiliency held for much of the year.

But asset manager demand for Treasuries and duration in particular ended the

year timidly and what was previously resilience now remains a potential risk

for 2025.

In aggregate and on a duration weighted basis, demand for

Treasuries has been in the bottom quartile of observations seen over the

past-five years for much of the first quarter. As of early April, reduced

growth expectations and the weakness in equity markets have not resulted in a

recovery in demand for Treasuries, particularly long-dated Treasuries. This

will prove an interesting test in Q2 and the remainder of the year as to

whether potential impediments to inflows into Treasuries, from concerns about

future inflation or future deficits, can be allayed or more fully offset by

weaker economic news. Here our real-time inflation data from PriceStats will,

at least, give us a timely read on how quickly (or not) actual tariffs or even

the looming threat of them is impacting price formation.

Figure 3: Asset

manager demand for Treasuries

Source: State Street Global Markets

4. Will the US dollar strength persist?

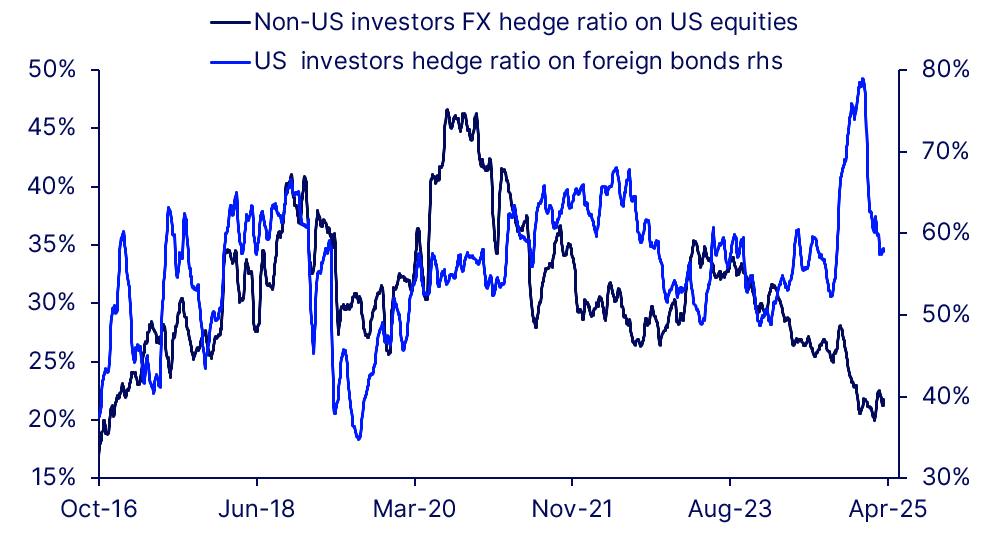

In a similar vein to US equities, asset managers began 2025

with a significant overweight in the US dollar. This overweight took many

different forms, but was best demonstrated in changes in observed hedging

activity of asset managers (Figure 4).

For fixed income managers based in the US, the fear of a

rapid USD appreciation following the US Presidential election manifested itself

in a surge in forward USD buying that took their hedge ratio on their foreign

bond holdings to a peak of near 80%, a 25-year high. This ratio peaked in

mid-January and as the feared US dollar overshoot failed to materialize, US

managers sold their US dollar forward rapidly to bring their hedge ratio back

down below 60% and close to its long-term average. This part of the US dollar

unwind would seem therefore to be done.

However, not all investors have adjusted to the

US dollar’s weaker trend. Non-US investor hedge ratios on their US equity

holdings remain unusually low. This means that for all the foreign buying of US

equities in the past five-years, there have been relatively more forward sales

of the US dollar to offset the currency risk. This is understandable as

typically during this period the US dollar has offered a natural hedge to

equities. Generally when equities have declined, the US dollar has appreciated

given its empirical safe-haven status. But this relationship has been

challenged so far in 2025.As investors

have reduced their US asset holdings, the US dollar has depreciated alongside

equity market declines. This may challenge the view that non-US investors

should maintain such a low hedge ratio on their US equity exposures and is one

area we will watch closely in Q2 for a potential continuation of forward US

dollar sales from asset managers.

Generally when equities have declined, the US dollar has appreciated given its empirical safe-haven status. But this relationship has been challenged so far in 2025. As investors have reduced their US asset holdings, the US dollar has depreciated alongside equity market declines. This may challenge the view that non-US investors should maintain such a low hedge ratio on their US equity exposures and is one area we will watch closely in Q2 for a potential continuation of forward US dollar sales from asset managers.

Figure

4: Changing

attitudes to the US dollar

Source: State Street Global Markets

Q2 and beyond

In response to the unprecedented uncertainty about policy

and the economic outlook, investors have reduced their exposures to risky

assets. But as of the first week in April, holdings of equities in aggregate

and US equities in particular remain above benchmarks and long-term historical

averages. To that end, they remain vulnerable to further position unwinds

should escalations in the trade war or recession risks grow in the coming

months. At the same time, we are watching carefully how asset manager demand

for Treasuries evolves in light of concerns surrounding fiscal deficits and

inflation expectations.

Finally, and in a departure from post COVID trends, asset

managers have also reduced their US dollar holdings, as they have reduced their

risk appetite. Having begun the year with a significant overweight in the

currency, asset managers begin Q2 with US dollar holdings close to neutral levels.

But we note that non-resident investors still have unusually low hedge ratios

on their US equity holdings, which may prompt further US dollar selling in Q2

if the usually reliable link between the US dollar and equity performance

continues to be questioned.

Disclaimer & Risk

Author Bios

Michael Metcalfe

Michael is Senior Managing Director and Head of Macro Strategy at State Street Markets

The information provided herein is not intended to suggest or recommend any investment or investment strategy, does not constitute investment advice, does not constitute investment research and is not a solicitation to buy or sell securities. It does not take into account any investor's particular investment objectives, strategies or tax status. Past performance is no guarantee of future results. For more information, please see the link for the marketing disclaimer for State Street Markets research, available in the “Legal Disclosure” section of our “Disclosures” page referenced in the footer below.