August 28, 2025

What to Watch

Complimentary CONTENT

Exceptions to US exceptionalism

By: Michael Metcalfe

Summary

By Michael Metcalfe, Head of Macro Strategy

Entering 2025,

we pinpointed several critical fault lines and promising updrafts for financial

markets. The year has been a rollercoaster, and it's no surprise that both

challenges and opportunities have emerged, leaving us with an outlook that's equally

optimistic and cautious.

The key questions we posed at the start of

the year remain as relevant as ever. And just as we did in our mid-April

update, we revisit those questions here, leveraging the latest readings of State

Street’s investor behavior metrics. In the process, we explore the topic of “United

States exceptionalism.” Will it continue to dominate market consensus, or are

we on the brink of a significant rebalancing?

Investors remain overweight equities

By Michael

Metcalfe, Head of Macro Strategy

Allocations are back to peak optimism.

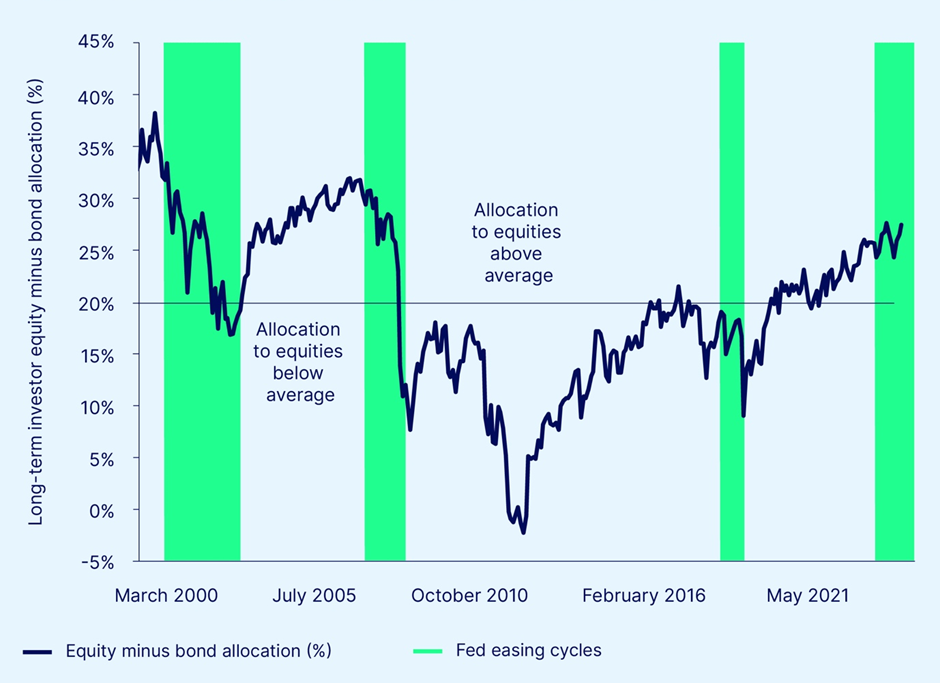

Investors entered 2025 with a high allocation in equities relative to bonds.

Over the past 25 years, the average allocation to equities has been around 20

percent above the allocation to fixed income, in line with a 60/40 portfolio

approach. In January, it peaked at 7.5 percent above this long-run average, reaching

a 15-year high.

While this overweight more than halved

during the turbulent three months that followed, investors never really gave up

on equities. This sentiment was reinforced by the rapid rebuild of the equity

overweight, nearly reaching its January high by the end of July. This brings us

back to the question we asked at the beginning of the year: Will the earnings

and economic outlook justify such a risk-seeking allocation to equities?

Federal Reserve easing cycles usually coincide

with a double-digit reallocation out of equities back to bonds. Once again,

this cycle is proving to be different. Optimists will point to the rapid

rebound in equity sentiment after its first quarter slip as another

demonstration of the resilience of equity fundamentals. However, this also

means that vulnerabilities to the outlook have returned. As seen in Figure 1, asset

manager allocations to equities are stretched once again to levels seen only in

the run-ups to August 2000 and July 2007, which are troubling precedents even

if this time is different.

Figure 1:

Asset manager equity versus bond allocations

Source: State Street Markets

US equities and US tech remain exceptional

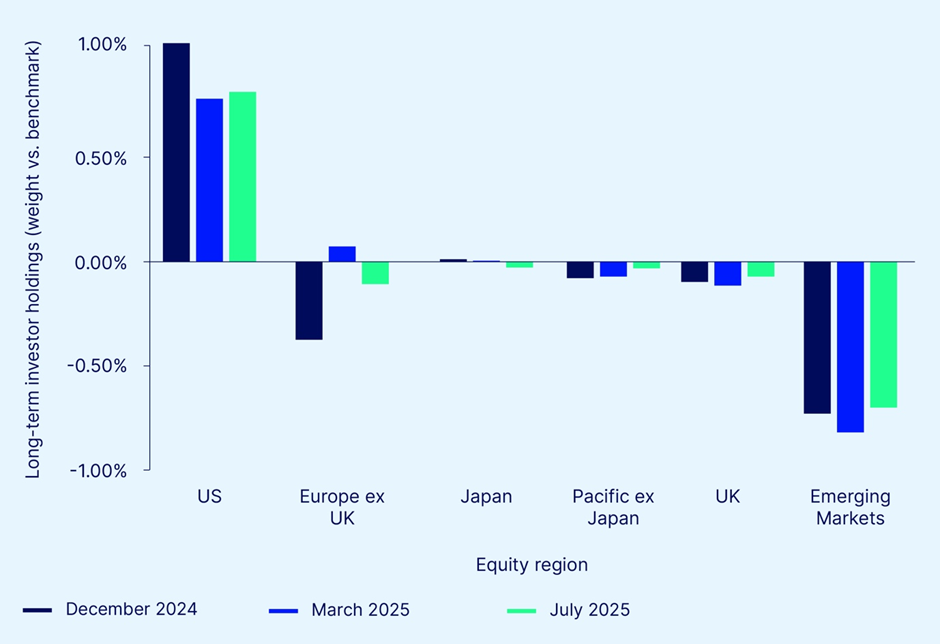

The answer to the question we posed at the

start of the year, “Will the US remain exceptional?” is a definitive yes! Investors

are overweight equities as discussed above, but within equities, the only

overweight across regions is still the US.

By the end of March, investor holdings of

US stocks above benchmark weight had been reduced by around one fifth, and

there was a flirtation with above-benchmark holdings in European stocks. But

this proved brief: By July, holdings in US equities had begun to rise again

modestly.

US holdings are still lower than they were

at the beginning of the year, and so underweights in Europe, the United Kingdom

and emerging markets are also all a little smaller. So one could argue that the

US, from an equity viewpoint, is a little less exceptional than it was in

December, but only marginally so, as shown in Figure 2. The fact that US

equities remain the only region where investors are willing to retain a

significant overweight, in spite of all the geopolitical and policy

uncertainties in 2025, highlights the resilience of this view.

As State Street Markets’ head of Equity

Research, Marija Veitmane argued back in January, it is a view supported by

robust relative earnings growth, and this was once again borne out by a strong second-quarter

earnings season, especially in tech. US equity exceptionalism remains a

well-earned narrative.

Figure 2: Investors' equity allocations across regions: A little less US centric, but still US centric

Source: State Street Markets

Trouble ahead for Treasuries

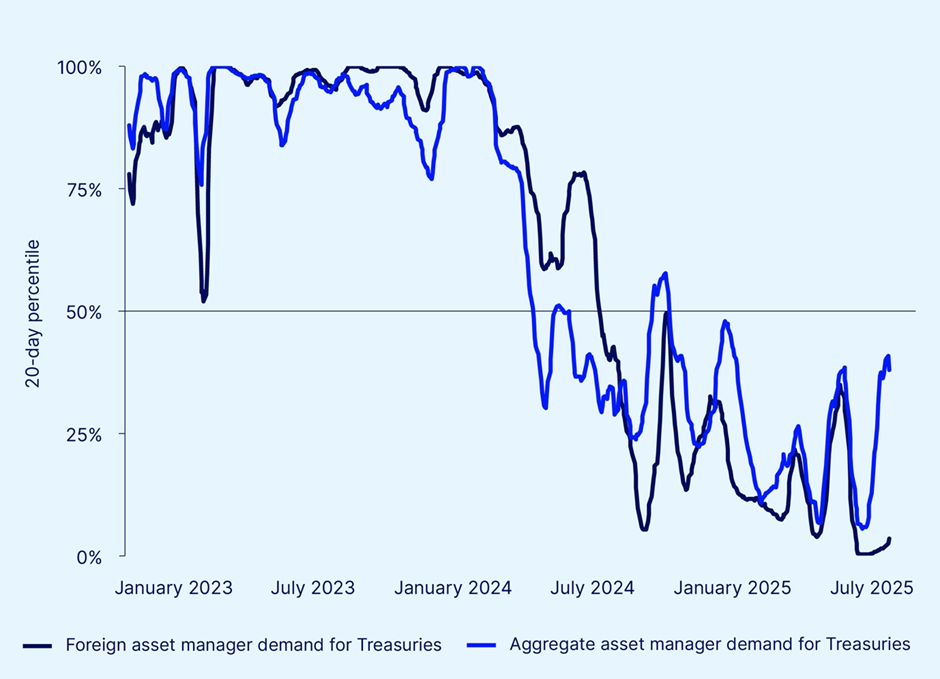

While investor sentiment toward US equities

has been robust, the same cannot be said for US Treasuries. After a volatile

first four months, 10-year yields have been stuck around 4.3 percent. Despite

reduced US growth expectations, inflation expectations have risen due to

anticipated tariff impacts on consumer prices, which we can track using

PriceStats® data. The US budget bill has also locked in significant fiscal

stimulus and increased Treasury supply.

Against this mixed backdrop for Treasuries,

asset manager demand has been tepid, especially among international investors

and for longer-dated bonds. This trend isn't new; as shown in Figure 3, foreign

asset manager demand for Treasuries has been below average for a year.

Conversely, there's been a recovery in foreign demand for German and Japanese

government debt. This reinforces our earlier point: Demand for US equities is

exceptional and not mirrored by sovereign fixed-income investors.

Figure 3:

Asset manager demand for Treasuries

Source: State Street Markets

And questions remain around the US dollar

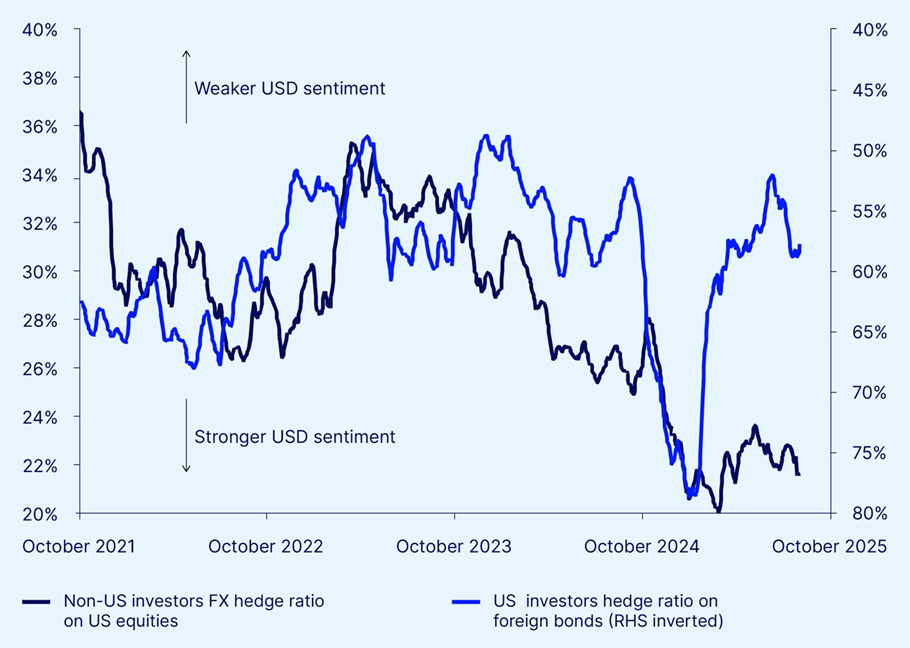

The question now is whether the US dollar

depreciation can go any further. The US dollar depreciated by almost 10 percent

in the first seven months of 2025, marking its worst start to a year in over

two decades. This move occurred despite interest rate differentials not

justifying such weakness. Our analysis points to two main factors: the rise in

policy uncertainty, which has sapped US dollar strength, and the dramatic

change in asset manager hedging activity over the past nine months.

On this latter point — and in contrast with

the behavior observed in the Treasury market — the change has been led by

US-based investors. For fixed-income managers based in the US, the fear of a

rapid US dollar appreciation following the US Presidential election manifested

itself in a surge in forward US dollar buying that took their hedge ratio on

their foreign bond holdings to a nearly

80 percent, a 25-year high.

This ratio peaked in mid-January and as the

feared US dollar overshoot failed to materialize, US managers sold their US

dollars forward rapidly to bring their hedge ratio back down below 60 percent,

where it has finally consolidated in July, close to its long-run average. This

part of the sentiment change would seem therefore to be done. Indeed, in July

we even saw some signs of recovery in domestic demand for the dollar.

However, not all investors have adjusted to

the US dollar’s weaker trend. Non-US investor hedge ratios on their US equity

holdings remain unusually low. This means that for all the exceptional foreign

buying of US equities in the past five years, there have been relatively fewer forward

sales of the US dollar to offset the currency risk.

This is largely understandable, as typically during

this period, the US dollar has offered a natural hedge to equities. Generally

when equities have declined, the US dollar has appreciated given its empirical

safe-haven status. But

this relationship has been challenged so far in 2025. The US dollar has depreciated alongside equity market

declines. This may alter the view that non-US investors should maintain such a

low hedge ratio on their US equity exposures, and is one area we are watching

closely in the second half of the year for a potential continuation of forward

US dollar sales from asset managers. So in contrast to US equities, it has been

the weakness of the US dollar — driven by the change in investor attitude

toward it — that has been exceptional

(see Figure 4).

Figure 4: Changing attitudes to the US dollar

Source: State Street Markets

Exceptions to US exceptionalism for the remainder of 2025 and beyond

After a highly uncertain eight months, US

equity dominance — particularly in tech — remains largely unchallenged.

Investor sentiment and fundamental metrics both support this view. US

exceptionalism is alive and well, but it's increasingly concentrated in US

equities. Alternatives in other regions or asset classes still lack the

fundamentals to mount a serious challenge.

The view through other asset classes is

much less sanguine. The lack of foreign demand for long-dated Treasuries

remains troubling, and investor hedging of the US dollar has shifted abruptly against

the currency for much of this year, even though interest rate differentials

have remained in its favor. Both behaviors point to a more cautious outlook as

the impact of economic and policy uncertainties in the US and elsewhere

continue to unfold.

Looking ahead to the remainder of 2025 —

with the US budget set, trade policy beginning to crystallize and the interest

rate path potentially clearing — policy uncertainty may start to decline. Media

focus on this topic has already begun to edge lower over the summer. This in

turn may help to alleviate investor concerns about Treasuries and the US

dollar. Domestic investor demand for both is already showing signs of recovery.

But it remains early days. The true

economic impact of policy changes will take some time to play out fully, even

in real-time data such as PriceStats. Against this backdrop, such high investor

allocations to equities implies a significant vulnerability to much weaker

economic news if it eventually comes.

Finally, if uncertainty does indeed subside in the

remainder of 2025, we will then begin to get answers to fundamental questions: Were

reassessments of the US dollar and Treasuries tactical blips in contrast with

the resilience of equity holdings? Or were they the beginning of a more

structural shift out of these US assets?

Disclaimer & Risk

Author Bios

Michael Metcalfe

Michael is Senior Managing Director and Head of Macro Strategy at State Street Markets

The information provided herein is not intended to suggest or recommend any investment or investment strategy, does not constitute investment advice, does not constitute investment research and is not a solicitation to buy or sell securities. It does not take into account any investor's particular investment objectives, strategies or tax status. Past performance is no guarantee of future results. For more information, please see the link for the marketing disclaimer for State Street Markets research, available in the “Legal Disclosure” section of our “Disclosures” page referenced in the footer below.